Before the Thanksgiving holiday, I wrote about the rise of wheat futures trading in Europe. Trading volume and open interest for the Euronext/MATIF milling wheat futures contract have grown substantially in the last decade. Both volume and open interest for Euronext/MATIF futures are comparable to the CME Kansas City Hard Red Winter Wheat contract and significantly greater than for MGEX Hard Red Spring Wheat. This shift has lead some traders to suggest that US futures markets have lost their leadership role in determining the world benchmark price of wheat. Combined with the declining export share for US wheat in world trade due to a strong dollar and acreage shifts to corn and soybeans, this paints a fairly dire picture for US wheat growers and merchants. One concern is that shifting center of world wheat price discovery away from the US may lead to greater basis risk for US wheat growers.

Does trading volume and open interest equal price discovery?

Before we write off the US wheat industry, let’s first remember that US wheat futures are still actively traded markets. There are thousands of transactions and many traders; there are currently 472 traders that exceed the CFTC open interest reporting threshold of 150 contracts in Chicago wheat futures and many more with positions smaller than the threshold.

An abundance of traders and transactions is thought to lead to better price discovery, the process by which information about the value of the commodity is incorporated into publicly observable prices. For example, when wheat traders learn that supply is likely to be smaller than expected due to a drought, flood, or some other weather event, they buy futures contracts to profit from the expected increase in price as wheat becomes more scarce. Every additional transaction in a market is an opportunity for someone with better information to profit and for their information to be known publicly though changes in price. Incidentally, many of the current issues with cattle futures stem from a lack of transactions and price discovery in cash cattle markets.

That said, there is no ironclad economic law that says more trades means prices will better the true or fundamental value of the underlying commodity. Not all trades are the result of a trader acting on new information. This means that more trades in Chicago than Paris may not necessarily mean that more price discovery occurs in the Chicago market; the market may indeed “not be done in Chicago anymore” as one trader has stated.

Measuring price discovery using high frequency price data

In the case of wheat, the presence of multiple futures markets allows us to dig into price discovery in a novel way. We can isolate common price changes across futures markets likely due to new information about wheat market fundamentals. Price changes based on fundamentals are ones that are not quickly reversed by subsequent trades. We can compare price changes in each market when such persistent price changes occur and determine which market moves first. The market that moves first is thought to be the one where price discovery occurs.

In a new working paper with my colleague Michael Adjemian at the USDA Economic Research Service, we seek to measure price discovery by estimating the proportion of price leadership in each market. Because prices in these markets move quickly, we analyze intraday prices, or the many prices reported throughout the trading day. This helps us determine which market moves first. Price changes from one day to another are largely the same across markets. When Chicago futures close higher than the previous day, futures markets in Kansas City, Minneapolis, and Paris very often close higher as well. Looking at price changes inside the day helps us see which market leads.

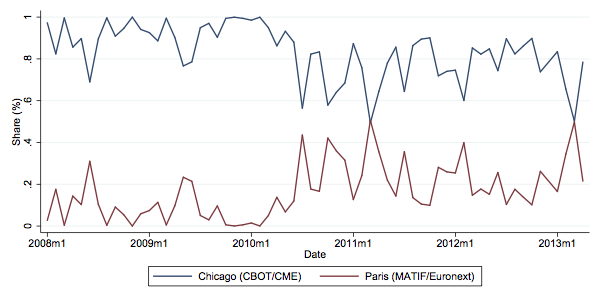

Comparing the leading US market, Chicago, to the Paris exchange, we find that Chicago wheat futures generally account for the majority of price discovery, but the price discovery share for Chicago declined in 2010. The figure below plots our main result, the monthly estimated share of information leadership occurring in the Chicago and Paris wheat futures markets between 2008 and 2013. On average, Chicago has a price discovery share of approximately 90% before July 2010 and 75% after July 2010. (Note that the share of one market is simply one minus the share of the other, since we limited statistically to comparing only two markets at a time.) Generally speaking, we find price discovery has become more diffuse and more variable across markets over time.

Why did world wheat price discovery change in 2010? While we can’t make causal claims at this point, the change in price discovery occurred coincidentally with a major supply shock in the former Soviet Union. Recall that there was a major drought in Russia in the summer of 2010, dramatically curtailing Russian wheat production and exports. On top of the drought, the Russian government implemented a wheat export ban on August 5 which further limited exports. This is suggestive evidence that the Paris market is quicker to incorporate news about supply shocks in Eastern Europe. To the extent that these shocks matter more for world wheat supply and demand going forward, Paris wheat futures are likely to generate a significant share of wheat price discovery.