There are three wheat futures markets in the United States. Underlying each market is a specific type or class of wheat. The Chicago Mercantile Exchange lists both the Chicago Soft Red Winter (SRW) Wheat futures contract and Kansas City Hard Red Winter (HRW) Wheat futures contract. The Minneapolis Grain Exchange lists a Hard Red Spring (HRS) Wheat contract.

Wheat futures trading around the world

There are also wheat futures markets outside the United States. ICE Futures Canada in Winnipeg lists Milling Wheat and Durum Wheat contracts, though these contracts rarely trade and most Canadian farmers follow US price benchmarks. In China, the Zhengzhou Commodity Exchange trades a “strong gluten” wheat contract. The Borsa Italiana in Italy has a Durum Wheat contract and ICE Futures Europe in London trades feed wheat futures.

Perhaps the most important wheat futures contract outside the US is the Milling Wheat futures contract traded at the Euronext exchange in Paris. This market is sometimes known as the MATIF wheat contract after the acronym for its French name, the Marché à Terme International de France prior to the acquisition of the MATIF by Euronext.

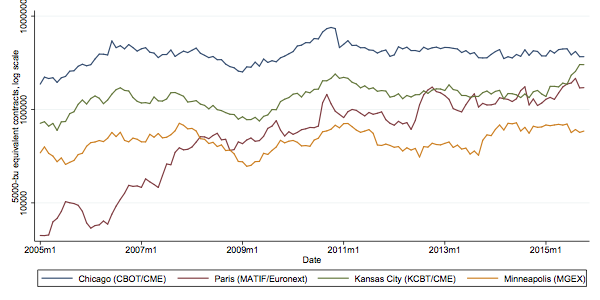

In terms of trading volume, or the number of contracts traded over a particular time period, Paris milling wheat futures have come to rival US exchanges. The figure above shows monthly trading volume for the three US wheat futures markets and the Paris market from 2005 to 2015. While the Chicago SRW futures clearly lead in terms of volume, the biggest change in volume has occurred in Paris. In 2005, Paris volume was less than 10% of Minneapolis, 2-3% of Kansas City, and less than 1% of Chicago. By 2015, Paris volume was significantly greater than Minneapolis and equal or slightly below Kansas City. (Volume is compared on the y-axis using a logarithmic scale to enable comparison of numbers that differ by orders of magnitude.)

Trading volume is connected to price discovery

Changes in trading volume are important because they may signal changes in price discovery, or the process by which information about the value of the commodity is incorporated into publicly observable prices. Futures market price discovery provides important and timely signals to growers, merchants, processors, and end-users about the value of a bushel of wheat. Market observers pay attention both to the absolute level of prices in each market, which signal how abundant wheat, and to the price differences or spreads between prices in each market, to get a sense of how scarce one type of wheat is relative to another.

The price discovery role is so important that US law governing derivatives trading codifies this purpose. It states that agricultural futures markets operate in the national interest to “provid(e) a means for managing and assuming price risks, discovering prices, or disseminating pricing information through trading in liquid, fair and financially secure trading facilities” (US Code Title 7, Ch. 1,Sec. 5).

To generate real price discovery, wheat futures markets must incorporate information about the value of wheat into prices in a timely manner and make this price information widely available. This information can include anything relevant to the value of the commodity, whether it is the effect of frost damage in Australia, rains in Argentina, grain inspections in Egypt, or feed demand here in the US. The market weighs the relative impacts of all these factors from minute-to-minute, or even second-to-second to arrive at the reported price.

Frequent transactions help to assure market observers that reported prices reflect the latest information. If trading in a futures market is infrequent, prices may grow “stale,” no longer reflecting the latest news about supply and demand. Traders in that market face the risk of large swings in the value their positions when prices do adjust or when traders try to exit the market. This is in part what traders mean when they say that markets with low trading volume are illiquid.

If trading volume in Paris is rising relative to US markets, Paris prices may be the first to reflect new information about world supply and demand conditions. One French wheat trader went as far as to say that “The market is not done in Chicago anymore. Prices of the European continent have taken the leadership of the world wheat market.”

Does the observed increase in trading volume for Paris Milling Wheat futures mean that wheat price discovery is shifting abroad? What does this mean for growers, merchants, and other market participants here in the US? I’ll have another post on this topic next week.

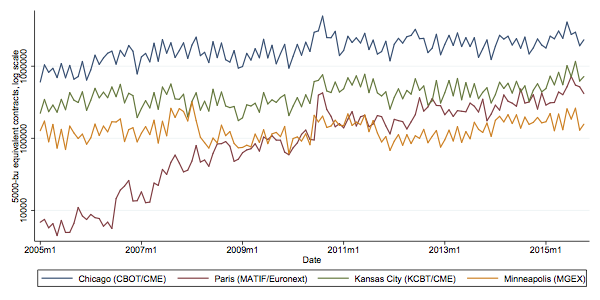

UPDATE: One interested reader suggested I compare futures market open interest across the four major wheat futures contracts rather than trading volume. Open interest measures the number of outstanding or open positions (long and short) in a futures market. It may be a better indicator of changes in price discovery as it indicates not just trading activity but the willingness of traders to take positions which may be based on information. The figure below plots open interest as of the first trading day of the month over the same 2005 to 2015 period as above. As with volume, open interest in Paris milling wheat futures has risen considerably and is similar in magnitude to open interest in Kansas City HRW wheat futures.