Several days ago, President Trump’s administration released a proposed budget, which included significant cuts to many government programs. Agricultural and food programs, too, did not escape rationed funding. And while the proposed budget has been quickly deemed “dead-on-arrival” by widespread and seemingly bipartisan declarations from lawmakers (a common outcome for presidential budget proposals during the past several administrations), it is also widely acknowledged that these proposals provide insights into the White House’s legislative priorities.

As discussions and negotiations for the 2018 Farm Bill quickly approach, the proposed budget could be one of the first signals of specific farm policy components that could be affected. For example, the budget includes a provision that would set a $40,000 limit to the amount of crop insurance subsidies that participating farmers could receive. Recently, Eric Belasco provided a brief analysis of how such a policy might impact U.S. producers and taxpayers. Another proposed change in President Trump’s budget is a stricter means-based eligibility limit for receiving payments from the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC).

The stated purpose of the ARC and PLC programs described by the USDA Farm Service Agency is to provide financial assistance to commodity crop producers during periods of market downturns and/or yield decreases. The ARC-County program is structured to provide assistance when county-area revenues drop below some trigger value and the PLC program makes payments when market year average prices fall below a reference price. Currently, there are two primary limitations for these program payments: (1) total payments are limited to $250,000 per household per year and (2) households with an adjusted gross income (AGI) above $900,000 are not eligible for payments. Trump’s budget proposes to reduce the AGI threshold from $900,000 to $500,000.

The new AGI threshold represents a fairly significant 45% reduction from the existing criterion. On the surface, this certainly appears as potentially having a major impact on restricting access to these safety net programs for a large proportion agricultural producers. But would this really be the case?

Data from the farm-level Agricultural Resource Management Survey (ARMS) help provide an initial understanding of the answer. Using the most recent 2015 information about farm-level ARC-County and PLC elections and payments as well as associated data describing household gross farm income and gross off-farm income (the sum of which provides a close approximation of household AGI), I consider the trade-off between potential budgetary savings of the proposed AGI threshold and the number of farms that could lose access to ARC and PLC payments.

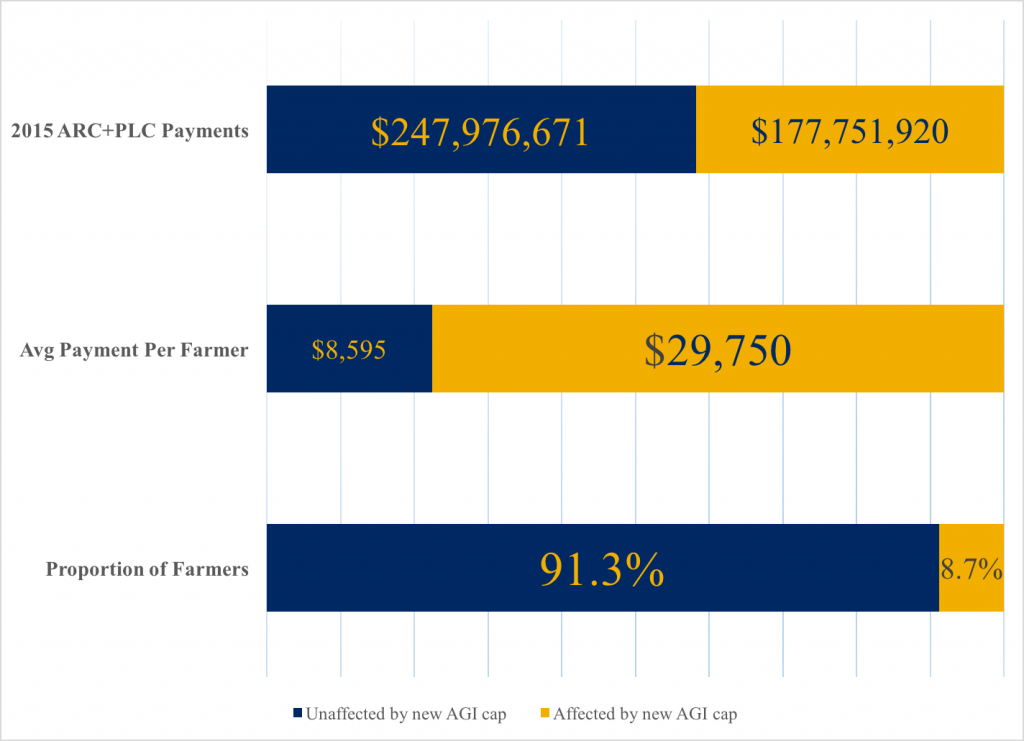

The figure below shows how farms would have fared if in 2015 the AGI threshold was lowered from a limit of $900,000 to $500,000. The blue bars represent farmers who would not have been affected, and yellow bars pertain to those who would have lost access to payments.

Figure: Impacts of Lowering the AGI Threshold for ARC/PLC Payments

First, the data show that the lower threshold would have resulted in a total savings of approximately $177 million. That represents approximately 42% of the total ARC and PLC payments made in 2015 to the sample of farms in the dataset. The large savings occur primarily because farmers affected the change would have received nearly $30,000 per household in ARC and PLC payments. This is nearly 3.5 times the payment received by farmers who would have been unaffected by the AGI threshold change.

However, what is the trade-off in terms of farms losing access to ARC and PLC payments? The data indicate that fewer than 1 in 10 farmers would be affected. Over 91% of U.S. farmers would still remain eligible to receive financial assistance through the ARC and PLC programs in periods of market downturns and unforeseen events that adversely impact crop yields.

Additional research and analysis is needed to understand the full range of dynamics and impacts of this and other proposed policies. However, since at least some portions of Trump’s proposed budget are likely to be seriously considered and potentially implemented, the outcomes presented above can certainly provide a baseline for further discussion.

(Photo by 401(K) 2013 is licensed under CC BY 4.0)