After several weeks of rumors during one of the largest wheat harvests in a decade, Russia’s prime minister Dmitry Medvedev announced on September 2, 2016 that the Russian government will essentially eliminate the year-and-a-half old wheat export tariff. As of September 15, 2016, the tariff will be lowered to zero.

In a year of already historic U.S. and world wheat production that has led to the lowest wheat prices in a decade, Russia’s considerable lowering of its barriers to wheat trade could lead to yet another downward jolt in the wheat markets. Consider the following:

- Russia is in the midst of one of its highest wheat production seasons in a decade.

- After Russia’s annexation of Crimea, Russian wheat farmers now have direct access to export facilities on the Black Sea.

- With poor 2015/16 production in France and other parts of the European Union, Russia is expected to overtake western Europe as the largest wheat exporter in the world.

With only these factors, Russian wheat exports are making a considerable impact on global wheat prices. It is reasonable, then, to expect that the significant tariff reduction—the tariff will be reduced to 0% from the most recent value of 50% of the wheat’s export value minus 6,500 rubles—would lead to a further lowering of the global wheat price.

But, that doesn’t seem to be the case. The futures prices for the three major wheat classes remained relatively unchanged by the news. Similarly, world wheat export prices have remained flat.

So what’s going on? Why aren’t we seeing a market response that would be anticipated with news that carries a potential influx of supply into the global wheat markets? There are several factors that are likely key to answering this question.

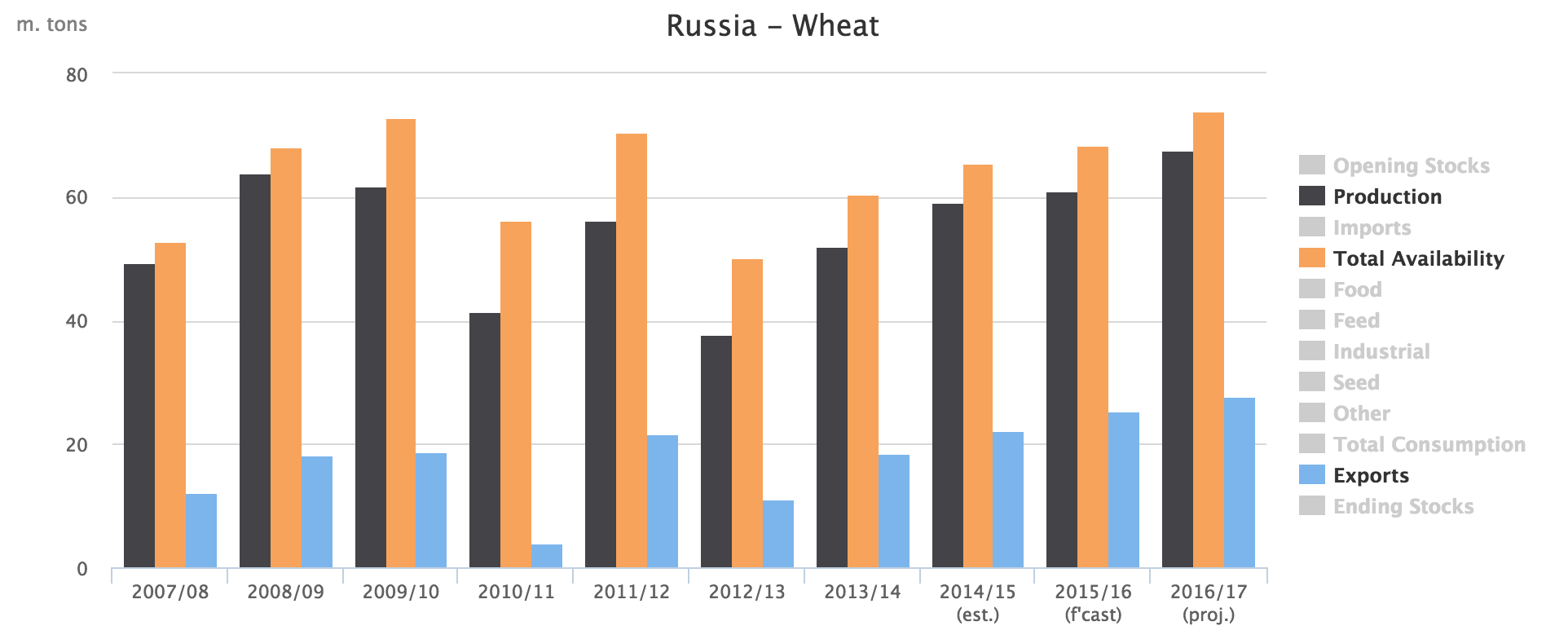

First, consider the chart below, which presents data from the International Grains Council about production, total availability, and export for Russia over the past decade.

Chart source: International Grains Council, Supply and Demand, Russia.

The data show that although the Russian wheat tariff was in place, Russian exports continued to increase fairly proportional to Russian production. Consequently, the tariff reduction is not likely to change Russia’s existing trade volumes and affect global prices.

Next, consider the exchange rate of the Russian ruble. The chart below shows the exchange rate between the ruble and the U.S. dollar over the past year.

Chart source: Indexmundi Exchange Rates.

(Photo by Stefano Merli is licensed under CC BY 4.0)