Key Issues:

- Despite May snow in Kansas, U.S. winter wheat yield forecasts remain steady at approximately 49 bushels per acre.

- U.S. winter wheat overall production is expected to decrease 25% from last year, but higher global production leads to record-high projected ending stocks.

- Uncertainty about wheat quality remains high as drought continues to be an issue in eastern Montana, most of North Dakota, and the Canadian Prairies.

- Brazilian imports are projected to reach near record-high levels, creating potential outlet for U.S. wheat.

- Hard red winter wheat harvest futures price: $4.40 / bushel

- Hard red spring wheat harvest futures price: $6.00 / bushel

Despite the unusual May winter conditions in Kansas last month, projected U.S. winter wheat yields (49 bushels per acre) remain around the five-year average of 47 bushels per acre, but well below last year’s 55 bushel per acre record high production. However, record decreases in winter wheat planted acreage places projected U.S. output at 1.25 billion bushels, down approximately 25% from last year.

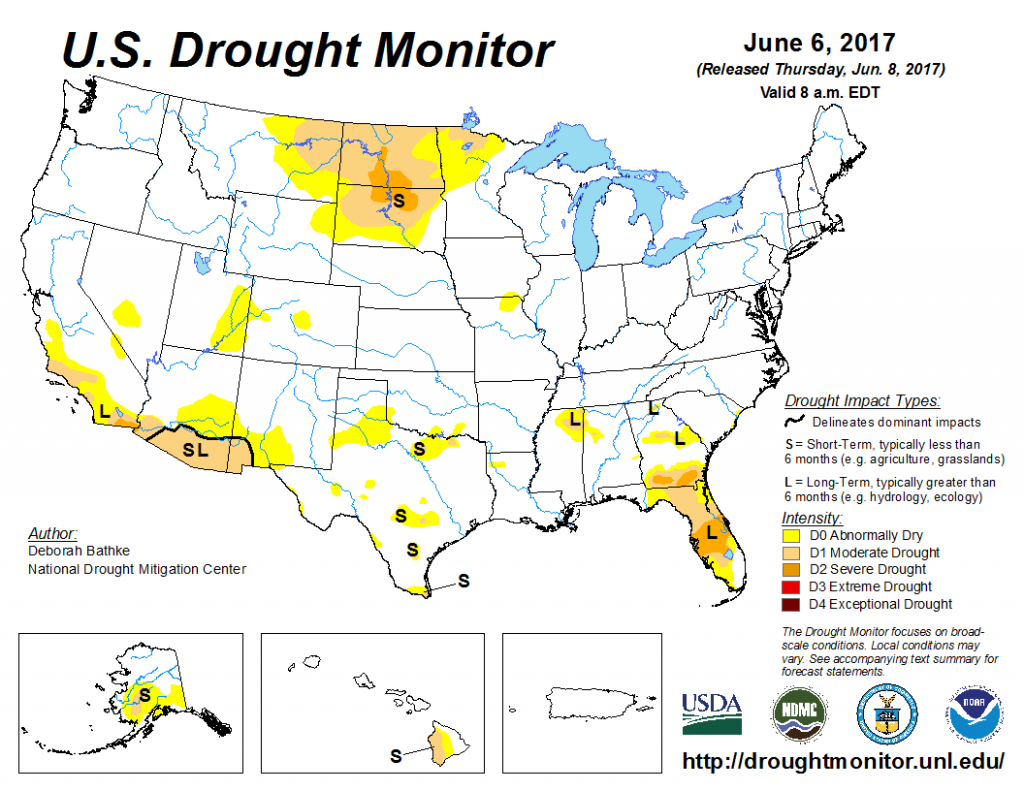

While overall production remains on par with the five-year average, quality concerns remain, heightening anxiety of another marketing year with a dearth of high-quality product. Many of the issues step from high temperatures and lack of precipitation in the primary spring wheat production regions: eastern Montana, western North Dakota, and the Canadian Prairies. The latest Drought Monitor report—represented by the map below—shows that these regions are at moderate to severe drought levels.

Figure: Drought Monitor Map for June 6, 2017

USDA wheat quality ratings (early-June Crop Progress report) also show that wheat rated in the top two categories—Excellent and Good—are below last year’s values for winter wheat, and well below last year’s and five-year average ratings for spring wheat.

| Montana | North Dakota | United States | |

| Winter Wheat | |||

| % Rated Excellent and Good, 2017 | 47% | — | 49% |

| % Rated Excellent and Good, 2016 | 65% | — | 62% |

| % Rated Excellent and Good, 5-year average | 59% | — | 44% |

| Spring Wheat | |||

| % Rated Excellent and Good, 2017 | 48% | 52% | 55% |

| % Rated Excellent and Good, 2016 | 74% | 84% | 79% |

| % Rated Excellent and Good, 5-year average | 61% | 80% | 72% |

Table: Crop Progress Report Ratings for Winter and Spring Wheat, Week 22 (early June)

In a bit of potential good news for U.S. wheat producers, Brazil is expected to import a nearly record-high amount of wheat next year, due to increased demand and significantly reduced domestic production. Low global wheat prices have led Brazilian farmers to switch land into other crops, leading to a projected 23% average decrease in wheat production. The Brazilian crop bureau, Conab, has increased their import forecast to 7.00 million tonnes (approximately 261 billion bushels).

Proximity between the United States and Brazil could provide advantages for U.S. producers to access these markets. Additionally, Brazil’s currency—the Real—has remained relatively steady in 2017 against the U.S. dollar, but has dropped by nearly 2.5% against the Russian Rubel. This could also help maintain U.S. producers’ competitiveness in global markets.

(Photo by malleefarmscapes is licensed under CC BY 4.0)