For my first post on ageconmt.com over a year ago, I opined on which factors tend to drive oil prices up or down and what the future of the oil market might hold. An abundance of caution and humility are always necessary when projecting oil prices, but at the time I thought we were likely to see a period of relative stability. American fracking companies were thought to have supplanted OPEC as the world’s swing producer, as these firms were much smaller and more flexible than the traditional oil powers but still had come to make up a large enough share of the energy industry to exert market power. If prices fell enough, many fracking companies would go out of business or at least hold back on drilling, putting a floor underneath global prices. Conversely, if prices rose they would resume drilling and ease the upward pressure.

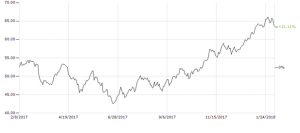

So how has the stable prices forecast turned out? For a while it was looking pretty good! Oil prices mostly gently fluctuated within a $45-$55 range from mid-2016 to late-2017, but in the last few months they have experienced a mini-surge to around $65. Oil price activity for the last year is shown below:

What is behind the recent uptick? One thing to note is that back in November of 2016 OPEC announced an agreement to cut production in an effort to goose the price. This was an interesting reversal from its conscious decision to let prices continue to crater in 2014 and 2015, ostensibly in an effort to put American fracking companies out of business. The strategy was only a partial success at best, as the frackers proved more resilient and flexible than anticipated. The production cut in 2016 may have been a tacit acknowledgement that fracking competition was here to stay.

OPEC’s announcement did initially bump up the price, but this was short-lived, and it seemed like a victory for those (like yours truly) arguing that OPEC’s influence had waned. But the recent rally has reopened the question. One likely reason for the increase is that this last November OPEC agreed to extend the cut through the end of 2018, easing fears that rising tensions between Saudi Arabia and Iran would scuttle the deal.

But there are other factors in play as well. The ongoing collapse of Venezuela (actually the country with the most proven oil reserves in the world) has caused drastic declines in its oil production. On the demand side, the global economy, particularly the advanced economies that make up the vast majority of oil demand, is as healthy as it has been since the Great Recession. As detailed in my previous oil price post linked above, some research suggests that prices are almost exclusively driven by global demand.

Whatever the cause, the oil price rally has indeed caused fracking production stateside to perk up. Rig counts in early 2018 are up sharply from one year ago. Productivity per rig is also growing significantly as fracking technology continues to improve. US crude production is projected to set an all-time high in 2018.

This mini-boom is being felt in the Bakken shale play in North Dakota, and it could again be felt in Northeastern Montana, which is within commuting distance to the most productive parts of the Bakken and grew at a breakneck pace during the original boom. Recent research by economists at Dartmouth University estimates that gains in employment and income resulting from fracking production extend to 100 miles within the production location.

With the usual caveat that predicting oil prices is probably a fool’s errand, it seems likely that prices will maintain the recent uptick as long as the global economy remains healthy, while fracking companies will provide a check on any major swings in either direction. Watch this space for commentary on any major developments.