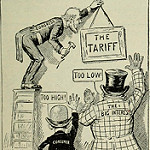

There has been recent discussion in the White house of using tariffs to achieve certain policy objectives. But what objectives can tariffs accomplish? What are the economic consequences? And are tariffs an efficient method of achieving government objectives?

Consider the impact of a per-unit import tariff in a country that purchases a relatively small share of the world’s supply. This country cannot influence prices in the world market, but it can use trade policies to raise domestic prices above world prices.

When the government imposes a tariff, the domestic price for the imported good rises above the world price. Consumers reduce their purchases of the good, and they are worse off because they pay a higher price and they consume less. Domestic producers are better off because they receive a higher price, and they increase their quantity of supply. The government collects revenues equal to the quantity of imports times the tariff. Nevertheless, increased producer profits and government revenues from the tariff are not large enough to offset the decrease in consumer welfare from increased prices.

If the government’s priority is to maximize total domestic welfare (consumer welfare plus producer profits plus tax revenues), then the tariff makes the country worse off. Does this mean that the government should never impose a tariff? The answer to that question depends on the government’s objectives. Let us consider a few policy objectives and alternative government measures:

- Suppose the government’s objective is to ensure that domestic production does not fall below a minimum threshold. The government could impose a tariff, or it could alternatively subsidize domestic production by giving the equivalent of the tariff to domestic producers for each unit of production. Unlike the tariff, the subsidy does not impact domestic consumption since it does not change the domestic price. The subsidy essentially transfers income from the consumer to the domestic producer, but the reduced consumer income is smaller than the decrease in consumer welfare that would result from a tariff. In fact, total domestic welfare is greater under the subsidy than it is under the tariff, even after accounting for the difference in tax revenues that the government would collect from a tariff. Consequently, the subsidy is preferred to the tariff.

- Suppose the government’s objective is to limit imports. Then a tariff is preferred to a subsidy. The tariff reduces consumer purchases by raising domestic prices while simultaneously increasing domestic production. A large subsidy would be required to increase domestic production to sufficiently reduce imports while holding consumption constant at the world price.

- Suppose the government’s objective is to raise tax revenues. A tariff would raise additional tax revenues, but at the expense of domestic consumers. Consumers would be better off paying equivalent taxes to the government so that they could keep prices lower.

Bottom line: Governments can achieve important policy objectives through tariffs, but tariffs are often a costly and inefficient method of reaching these objectives.