Key Points:

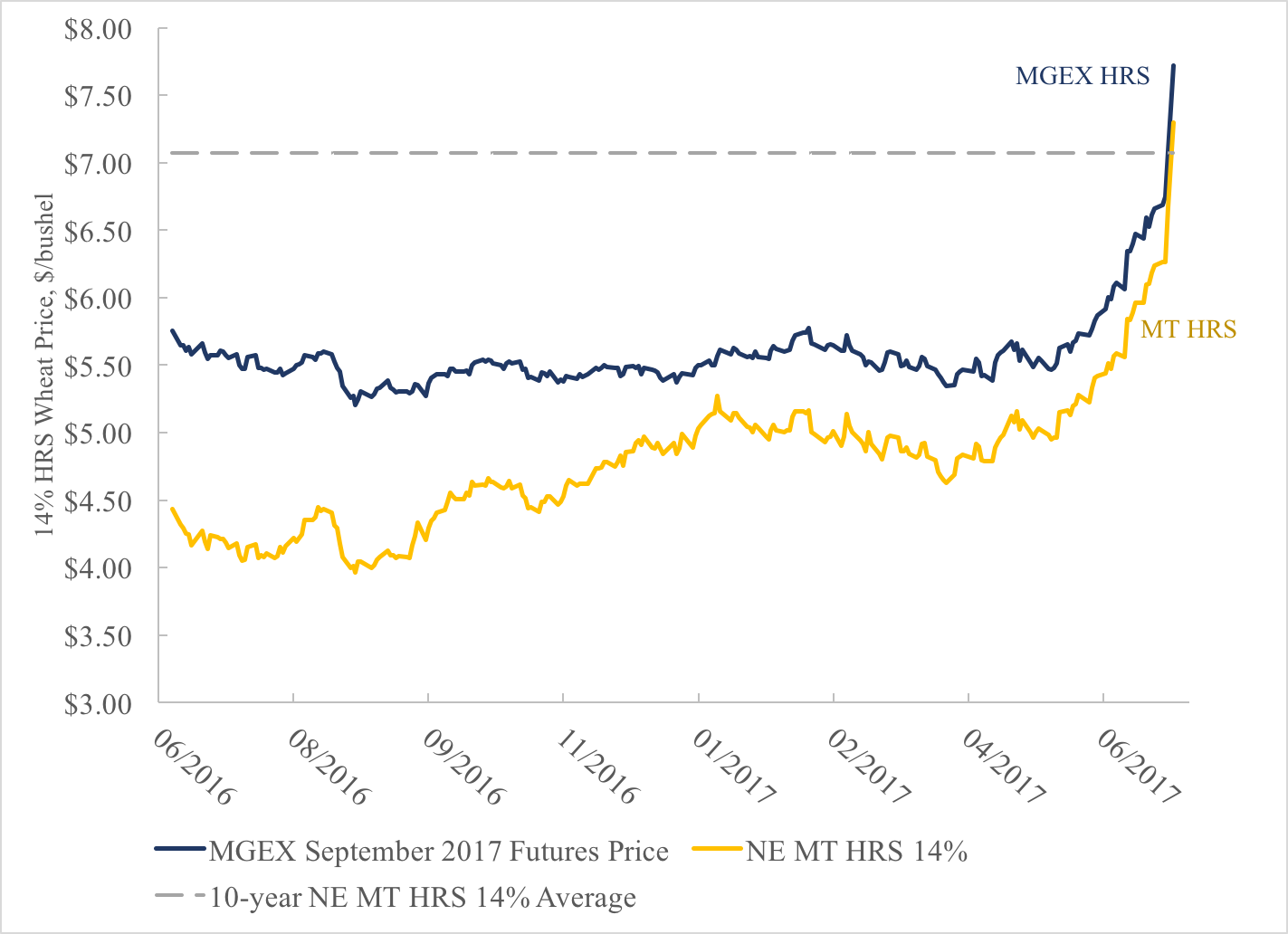

- September hard red spring wheat futures price is above $8.00/bu, nearing $1.00/bu above the 10-year average.

- Production conditions in Montana, North Dakota, and Canada continue to deteriorate and some producers are beginning to give up on their wheat crop.

- Protein premiums and discounts are likely to be high again this year, and potentially higher than last year as a result of a second straight year with low-protein wheat.

- Spring wheat exports have been higher than the five-year average, likely implying that high-quality wheat will be at an even larger deficit during the 2017/18 marketing year.

I did not expect things to look as bad as they did when I drove to northeastern Montana last week to talk with wheat and pulse producers participating in the 2017 Northeast Montana Pulse Plot Tour. The primary U.S. spring wheat production region has been in an increasingly severe drought since mid-May, and with triple-digit temperatures forecasted in the next ten days, there does not appear to be respite in sight.From conversations two weeks ago with several Extension professionals from North Dakota State University, I was shocked to learn that some farmers in north-central and northwest North Dakota have begun to hay their spring wheat because they see no chance for production condition improvements. The Drought Monitor map paints a clear picture of the deteriorating conditions in the past two months.

Unsurprisingly, this has had major impacts on spring wheat markets. Since mid-May, hard red spring wheat futures prices have skyrocketed, as markets have become increasingly worried about the potential of another year with scarce spring wheat availability. Spot prices in most locations within the U.S. spring wheat growing region have followed, exceeding their 10-year average—a ten-year period during which wheat prices rose to historically-high levels.

Source: Futures prices are from Quandl and spot prices are from the USDA Agricultural Marketing Service.

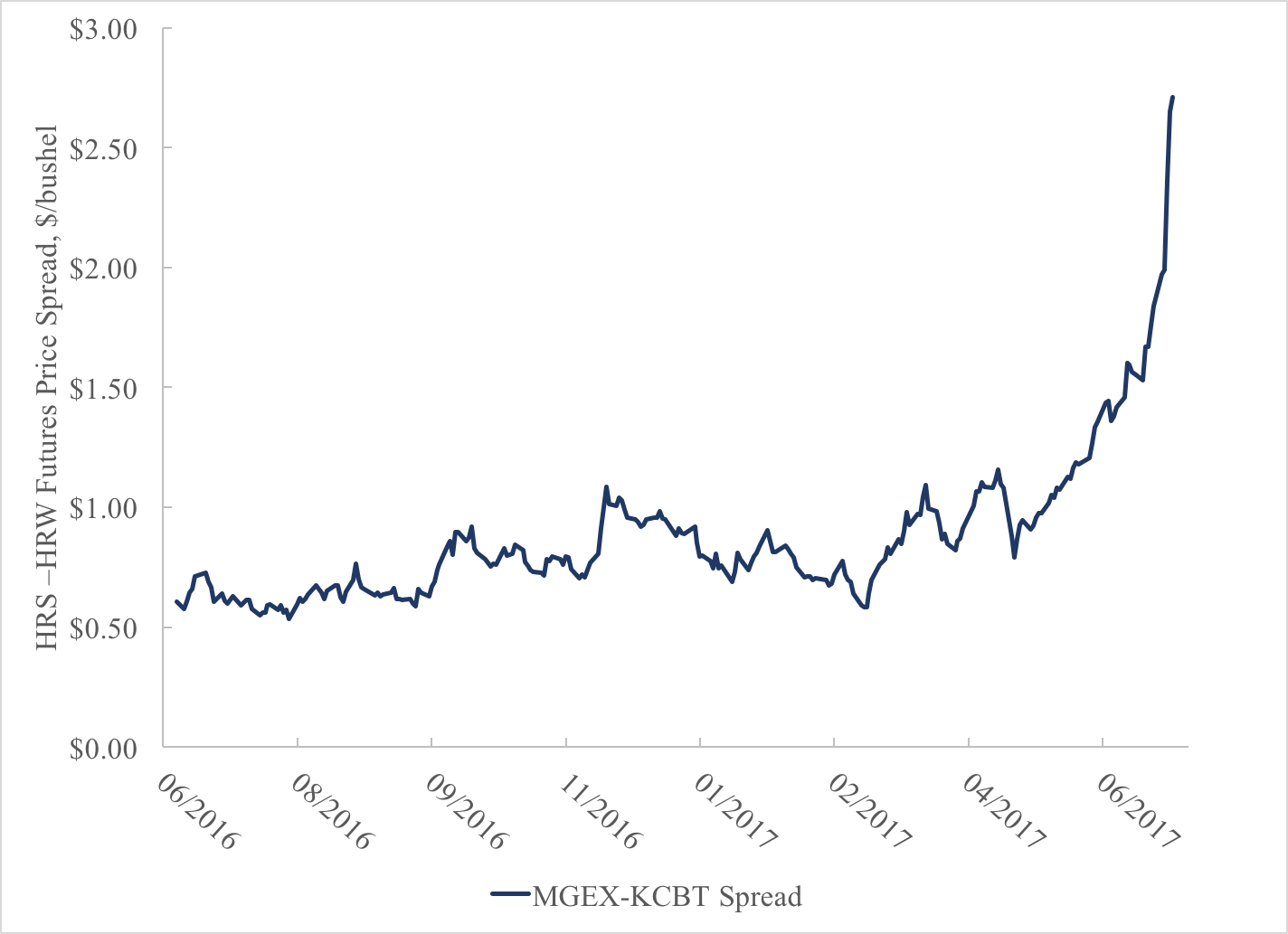

A natural question to ask is whether this market reaction is due to worries purely about not having enough wheat or about not having sufficient high-quality (high-protein) wheat. A measure that I like to use is the spread between prices of spring wheat and winter wheat futures contracts. With spring wheat typically having a higher protein content than winter wheat, an increasing price spread between these two commodities would be suggestive of quality deficits (alternatively, a constant spread and rising prices in both the spring and winter wheat markets would suggest worries about overall quantities).

The data in the figure below clearly indicate that there is significant worry about the availability of higher-protein wheat. Hovering around $0.75 per bushel spread between June 2016 and May 2017, the price spread shot up to over $2.50 per bushel in early-July. News about quality concerns in France and Spain are also contributing to the global high-quality wheat supply concerns.

Source: Futures prices are from Quandl.

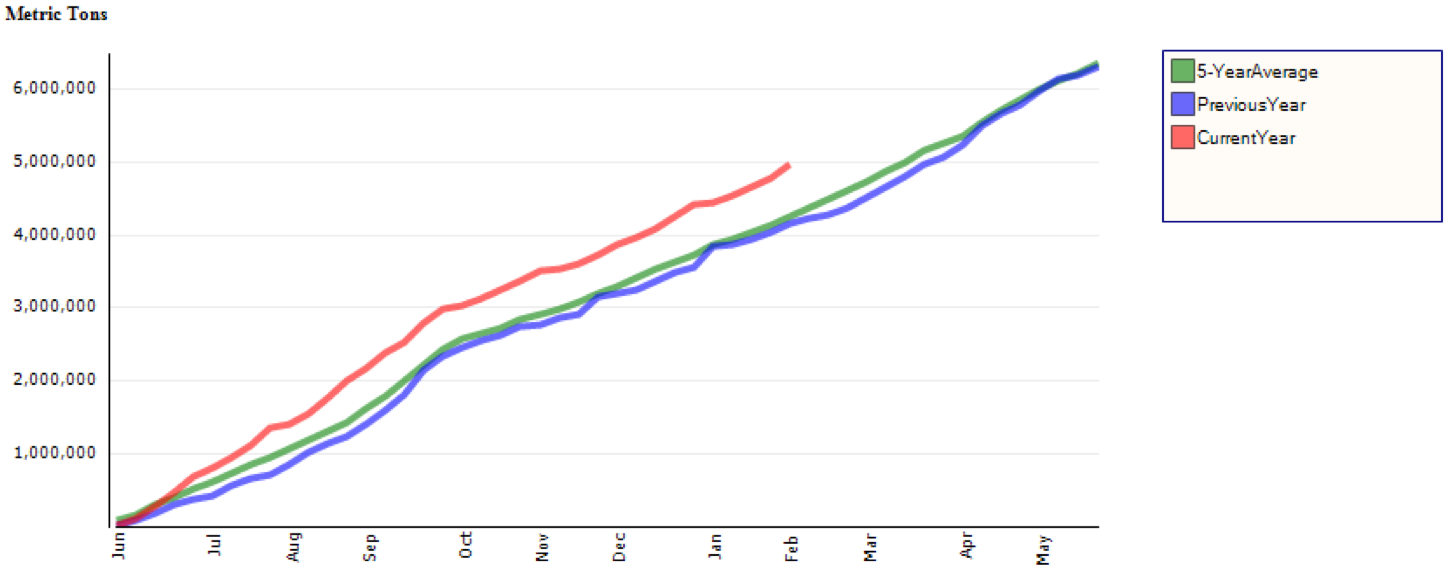

Without rapid improvements in production conditions, it is unlikely that these prices will return to their pre-May levels. But, while 2017 production conditions are bleak, perhaps producers have sufficient spring wheat inventories to take advantage of the high prices. While inventory data for spring wheat are not available (and using inventory data for all wheat classes would be misleading because of the record production year in 2016), an indirect measure is the quantity of U.S. hard red spring wheat exports.

The figure below shows that this year’s spring wheat exports have exceeded last year’s exports and their five-year average. The increased spring wheat exports reflect U.S. producers filling the voids created last year’s scant global production of high-quality wheat. But what this also implies is that spring wheat inventories are likely lower than usual, potentially reducing opportunities for producers to take advantage of the seemingly unstoppable spring wheat price increases.

Source: USDA Foreign Agricultural Service

Moving forward, three factors are likely to play important roles in determining whether the spring wheat price rally will continue:

- Any (even small) improvements in spring wheat production conditions are likely to slow or halt price increases. Keep an eye on World Agricultural Supply and Demand Estimate reports and weather conditions.

- Reports about average or above average quality levels for the 2017 hard red winter wheat crop could also limit spring wheat price increases.

- The willingness of producers to hold stored or new-crop spring wheat off the market in hopes of garnering a higher bid could contribute to additional price increases.

How have you dealt with this year’s wheat markets? What are your strategies for marketing your high-quality wheat? We would love to hear from you: leave a comment or send us a note.

(Photo by freeloosedirt is licensed under CC BY 4.0)