Looking at the evidence

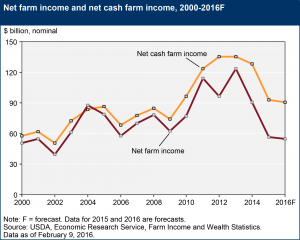

It’s easy to be overwhelmed by all of the negative headlines about ag markets this year. Grain prices are down, cattle prices have taken a nosedive, and John Deere just announced cuts to equipment output in response to weak demand. Here in Montana we are seeing drought over much of the state, and wildfires in parts of it. Last month, the USDA released projections for 2016 farm income that showed further declines from 2015.

The new diversification is…more diverse

Diversification has long been a recommendation of ag economists to smooth income and outlays from month to month and year to year. Producers with both livestock and crop operations have benefited from that advice in recent years, as high cattle prices have balanced out low crop prices. This year, however, things are obviously quite different. Diversification in risk management strategies might mean branching out in ways new and unfamiliar. One recent Des Moines Register article points to corn and soybean growers in Iowa growing horticultural crops—fruits and vegetables—as a way to add another component to their operations. (A Western Extension Committee survey suggests that horticultural crops are one of the few areas in which producers in the West are optimistic.) Experimenting with pulse production, malt barley, and other relatively new crops have also paid off for some producers this year.

Learning about new crop insurance products is another way to expand risk coverage. For example, NAP and Whole Farm Revenue Protection are new products that insure ag enterprises that were previously not possible, or difficult to insure. Spending time honing your budget and understanding costs and returns of equipment purchases, practices, and enterprises will not only help increase efficiency now, but in the years to come. Using futures and options is another important strategy. Learning about USDA-administered disaster assistance that in your area is another way—and I’ve been surprised to learn of producers not using disaster assistance, simply because they don’t know about it.

On the bright(er) side, Anton Bekkerman’s August 15th article points to several sources suggesting wheat prices will improve over the coming year—at least slightly, and Eric Belasco’s August 3 article suggests that the livestock market is beginning to see less volatility.

Each of these strategies entails trade-offs and won’t work for everyone. What works for you? What doesn’t?