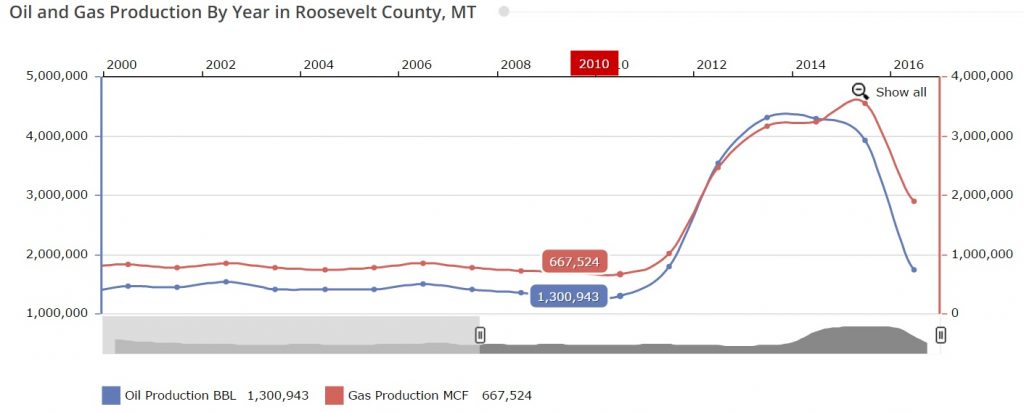

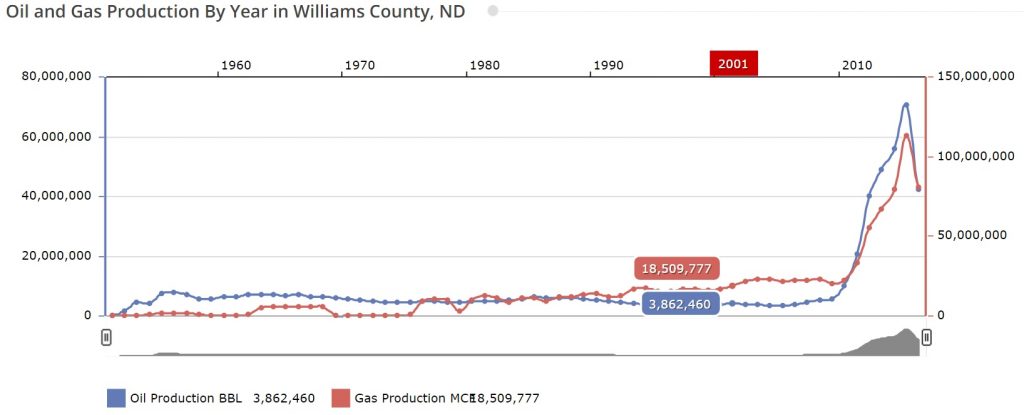

The 21st century has been a wild ride for the oil and gas market. After a long period of low and relatively stable oil prices, starting in 2003 things headed skyward (looking back at commentary around that time yields amusingly quaint references to the “important psychological threshold of $40 oil”). After a severe hiccup during the 2008 recession, prices resumed climbing to nearly $130 per barrel before an unexpected freefall over a six-month period in 2014, bottoming out at under $30 before currently settling at around $50. The crash has taken a heavy toll on the Montana hydrocarbon sector, as shown below in graphs from Drillingedge.com. The first shows production in Roosevelt county, the center of Montana shale production, and the second shows production in the nearby mega-boom county of Williams, North Dakota, where many Montana residents near the border are employed.

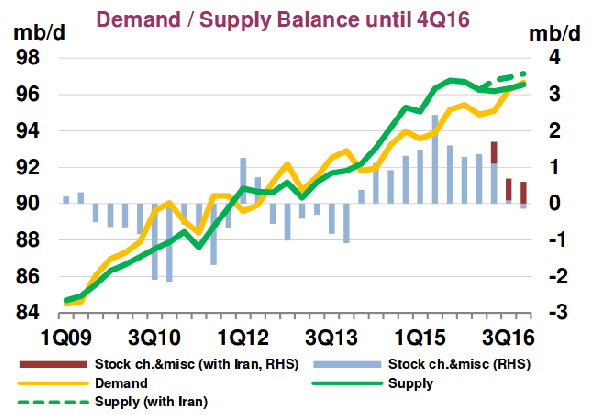

So what caused these wild price fluctuations, and what can we expect in the near/medium-term future? Both of these questions are unsettled, though there is some degree of conventional wisdom around the first, which is roughly the following: the rise of China and other emerging markets caused a surge in demand for oil that could not be matched by new production, which was becoming increasingly difficult to find (recall the now-dated commentary on “peak oil”). However, more recently the emerging markets started to stumble, Europe has remained mired in a post-recession funk, and the US shale revolution flooded the market with unforeseen gas and oil supply. These trends came to a head in 2014, when supply far outstripped demand, as shown in this chart from the International Energy Agency:

On the academic side, the most influential, though still contentious attempt to explain oil price movements is a 2011 paper by Lutz Kilian, which constructs a model that decomposes historic changes in price to changes in a measure of global demand for all industrial commodities, changes in oil-specific demand, and changes in oil supply. In line with conventional wisdom, he finds that the 2000s surge in prices was driven primarily by general global demand for goods. Perhaps more surprisingly, he finds that supply shocks have had virtually no impact on oil prices from 1975-2010, and a follow-up analysis yielded similar results for the 2014 crash, though some economists disagree with this analysis.

So what is the outlook for the oil market from here? Kilian’s work suggests that the best guide is global trends in overall economic activity and energy efficiency, but I would still caution against ignoring the supply side altogether. One interesting recent development is that OPEC, a cartel of 27 oil-producing countries, has announced an agreement to cut production in an attempt to juice the price. But many experts are skeptical about OPEC’s capacity to pull this off, since it has a much smaller share of world production than in its 1970s heyday and has traditionally had difficulty enforcing production quotas among all of its members.

Furthermore, the shale revolution may stymie OPEC’s efforts. Although production and employment are down, fracking companies in the United States are proving more resilient in the face of low prices than expected, and their smaller size and low drilling costs have made them extremely nimble. Rystad energy, a consulting firm, estimates that many wells become profitable with oil as low as $40/barrel. This means that as the oil price exceeds that amount, more frackers will begin production again, increasing supply and theoretically keeping a lid on prices. On the other hand, if prices fall well below $40, frackers will cut unprofitable production or go out of business, restricting supply and checking further price declines. Because of this flexibility, frackers are considered by some to have supplanted the lumbering OPEC as the world’s “swing producer”.

So there are good reasons to think that barring some major unforeseen shock, oil prices will remain fairly stable in the $40-$60 range for the foreseeable future. Don’t take it to the bank though-nobody saw the prolonged boom of the 2000s or the sudden crash of 2014 coming. In fact, trying to predict oil prices at all might be a fool’s game, given that a no-change forecast has historically outperformed forecasts based on oil futures markets.

(Photo by NPCA Photos is licensed under CC BY 4.0)