A few days ago, the USDA published a report, “

Spotlight on Guatemala as Trade Flourishes Under CAFTA-DR.” The report uses data from the

Global Agricultural Trade System of the USDA Foreign Agricultural Service to examine changes in the value of exports and imports of agricultural and food products among the United States and the six central American countries—Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, and Nicaragua—in the Central American Free Trade Agreement (CAFTA), which was passed in 2004.

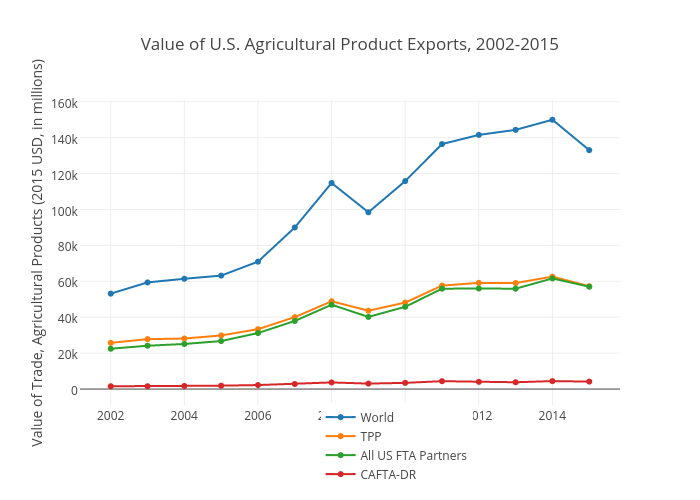

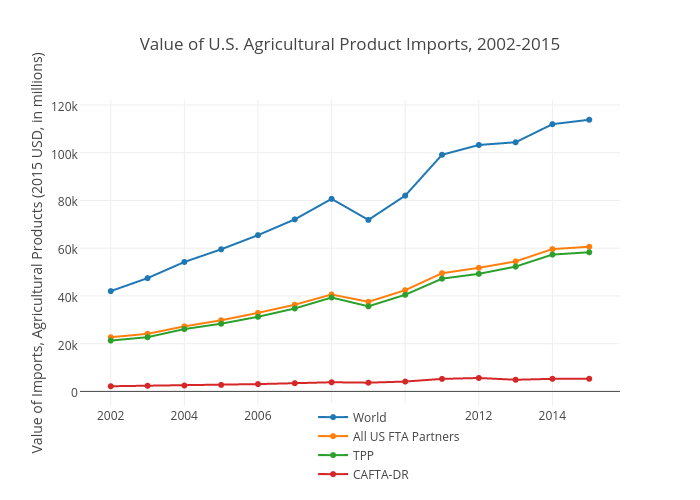

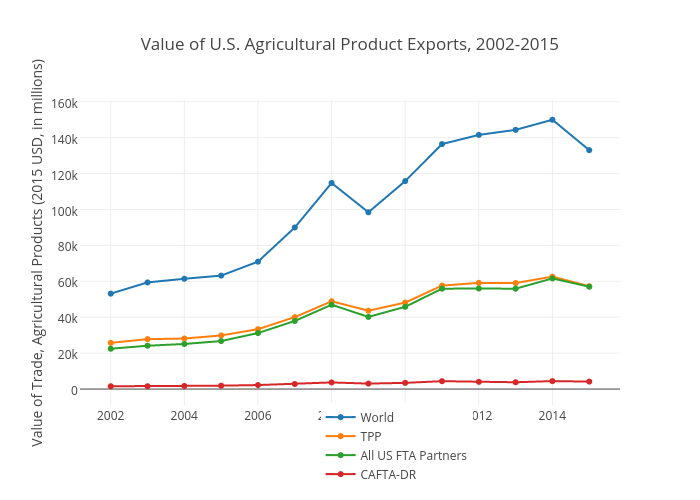

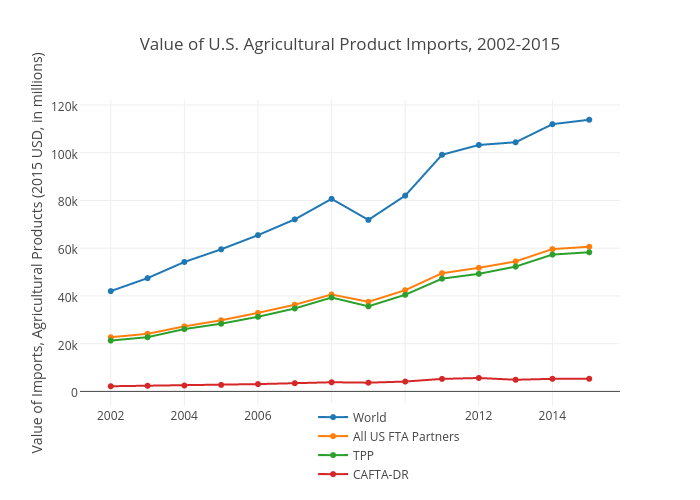

With the U.S. presidential elections upcoming in 10 weeks and much of the Democratic and Republican parties’ candidates platforms centered around changing the current structure Trans-Pacific Partnership (TPP) agreement, I wanted to compare the USDA’s reports conclusions about the CAFTA to what might be expected if the TPP agreement is adopted. I used the exact same data as the USDA report in order to ensure consistency between the two assessments.

First, I wanted to examine the general trends in U.S. exports and imports of agricultural products. I compared four categories:

- World: represents trade with all U.S. partners, regardless of whether the United States and partners have a free trade agreement.

- All US FTA Partners: represents trade with all U.S. partners who have a free trade agreement (FTA) with the United States.

- CAFTA-DR: represents trade with the six U.S. partners who are part of the CAFTA-DR.

- TPP: represents trade with countries who would be included in the TPP.

The figures below show the value of exports and imports for the United States between 2002 and 2015 (in million 2015 US dollars).

Chart notes: Data are from the USDA Foreign Agricultural Service and represent annual values in 2015 values.

Chart notes: Data are from the USDA Foreign Agricultural Service and represent annual values in 2015 values. Chart notes: Data are from the USDA Foreign Agricultural Service and represent annual values in 2015 values.

Chart notes: Data are from the USDA Foreign Agricultural Service and represent annual values in 2015 values.The figures show that across all regions, the value of exports and imports has increased. As the USDA report points out, there is an increase in the CAFTA-DR region. However, the charts indicate that the rate with which exports and imports have increased for these countries may have been lower than the increases in trade values across partners in other FTAs, countries that are part of the proposed TPP, and all countries regardless of their FTA status with the United States.

Additionally, we can use these figures to consider differences in the slope of the TPP category and the slope of the World category. Specifically, the slope of the World category is steeper (not shown) than the slope of the other two categories. This is perhaps suggestive that there may exist opportunities for additional value to be added by reducing the trade barriers that might currently exist.

In other words, consider this. Trade of agricultural products between the United States and all countries in the world (which includes countries with higher and lower trade barriers) has grown faster than the trade value between the U.S. and TPP countries. It is reasonable to consider, then, the fact that if trade barriers that currently exist between U.S. and TPP countries were lowered or removed, there could exist opportunities for growth in the rate of U.S. trade value growth for this region. Without further, more rigorous analysis, it is difficult to ascertain these opportunities quantitatively.

I also disaggregated the export trade data to look at several commodities that are particularly relevant for producers in the northern Great Plains region. The table below provides the value of U.S. exports and the percent growth in value between the pre-CAFTA period (2002-2004) and the current period (2013-2015).

| Product | Pre-CAFTA | Current | Percent change |

| CAFTA-DR Region | Wheat | $202.9 | $475.1 | 134% |

| Pulses | $9.4 | $34.0 | 262% |

| Sugars | $32.9 | $43.6 | 33% |

| Corn | $296.9 | $512.0 | 72% |

| Soybeans | $49.8 | $89.8 | 80% |

| Beef & Beef Products | $11.1 | $91.6 | 728% |

| Live Animals | $11.4 | $18.8 | 65% |

| All US FTA Partners | Wheat | $1,221.1 | $2,241.5 | 84% |

| Pulses | $75.9 | $224.4 | 196% |

| Sugars | $333.0 | $1,216.7 | 265% |

| Corn | $1,867.2 | $4,460.3 | 139% |

| Soybeans | $1,479.6 | $2,334.3 | 58% |

| Beef & Beef Products | $1,936.5 | $3,098.8 | 60% |

| Live Animals | $232.4 | $325.0 | 40% |

| TPP Region | Wheat | $1,053.3 | $2,120.8 | 101% |

| Pulses | $73.3 | $194.0 | 165% |

| Sugars | $337.3 | $1,221.2 | 262% |

| Corn | $2,664.7 | $4,788.1 | 80% |

| Soybeans | $1,983.1 | $3,213.9 | 62% |

| Beef & Beef Products | $2,399.3 | $3,658.3 | 52% |

| Live Animals | $282.3 | $332.5 | 18% |

| World | Wheat | $4,207.0 | $7,922.7 | 88% |

| Pulses | $235.3 | $748.0 | 218% |

| Sugars | $678.2 | $1,662.0 | 145% |

| Corn | $5,148.2 | $21,438.7 | 316% |

| Soybeans | $6,768.2 | $8,410.3 | 24% |

| Beef & Beef Products | $3,529.8 | $6,537.1 | 85% |

| Live Animals | $569.9 | $789.6 | 39% |

Tables notes: Data are from the USDA Foreign Agricultural Service and represent annual values in 2015 values. To ensure consistent comparisons, all regional trade values are compared to the three-year period average before CAFTA-DR; that is, 2002-2004. Current values represent the three-year period average 2013-2015. The three-year average is used to ensure that outliers do not substantially affect the percent change calculations. The pre-CAFTA calculation for beef products and live animals only uses years 2002 and 2003 to avoid the outlier associated with the BSE shock in 2004.

The table provides a more detailed comparison of growth outcomes and opportunities for potential growth. For example, the data indicate that exports of wheat, pulses, beef products, and live animals in the CAFTA-DR region grew faster than the export growth to all other countries and all countries in existing FTAs with the United States. However, growth in the values exports of sugar, corn, and soybeans was well below the overall trade growth in other regions.

Performing a similar comparison for countries in the TPP region, the largest growth opportunities appear to exist in the corn, beef product, and live animal sectors. The latter two categories are particularly relevant because the TPP includes significant reductions to barriers in export beef products to Japan, a historically major importer of U.S. beef.

So, while my version of the USDA’s analysis does provide some support for their conclusions, it also offers a more detailed perspective of where the CAFTA-DR may have been more and less successful. Moreover, it shows that the areas in which opportunities for agricultural producers could exist if the TPP is passed by the U.S. legislature.

(Photo by Glyn Lowe Photoworks. is licensed under CC BY 4.0)