Last week, my colleague Anton Bekkerman discussed higher wheat protein premiums for this year’s crop. He noted how the glut of relatively low-protein, low-quality wheat in the United States, Russia, and elsewhere has caused the value of the Minneapolis Grain Exchange (MGEX) hard red spring wheat futures contract to strengthen relative to the lower protein Kansas City hard red winter wheat futures price.

Millers and bakers need higher protein hard red spring wheat to blend with lower protein wheats to meet the specifications required for their breads and other baked goods. Market signals help to coordinate this process by encouraging growers to delivery high protein and high quality wheat and store low protein and low quality. One signal comes from the differences in price across markets, as Anton showed.

Price signals about wheat protein in the futures carry

Another signal comes from price differences in each market across time. Recall my post from August 4 about the future market carry, or the difference in price for delivery at different dates. I discussed how the carry for hard red winter wheat has grown to discourage deliveries of lower protein winter wheat. We have seen the opposite in the spring wheat futures market, a signal that should encourage deliveries of spring wheat now coming off the combine in Montana, North Dakota, and Western Canada.

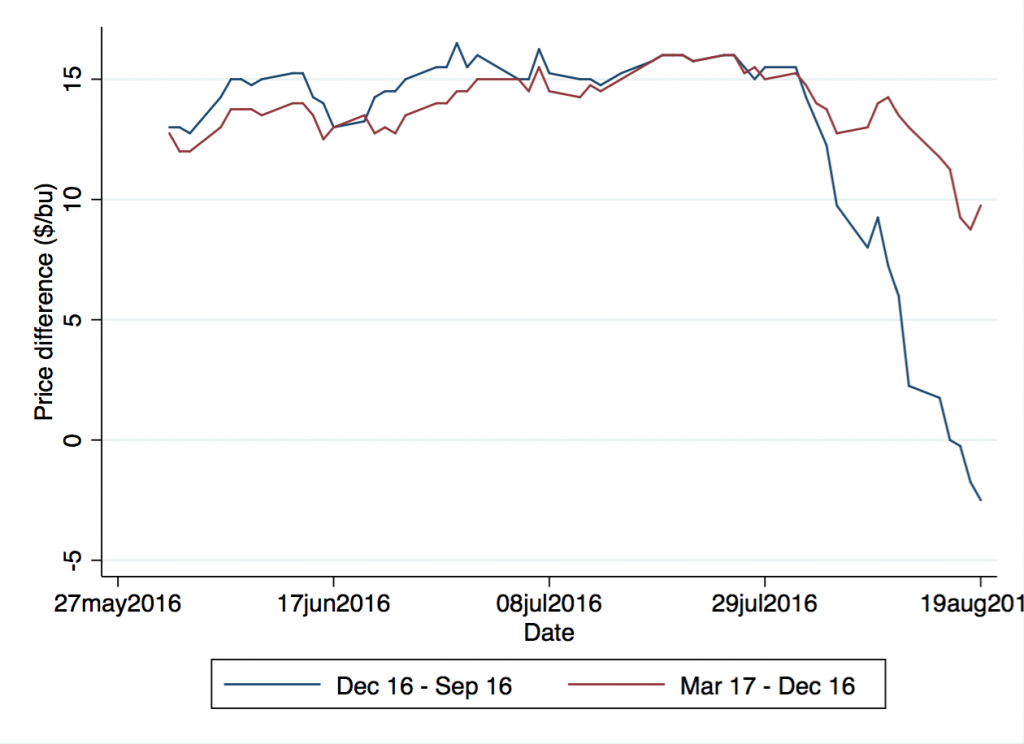

The figure below shows difference (or carry) between the MGEX December 2016 and September 2016 contracts and the difference between the March 2017 and December 2016 contracts. In June and July, we saw a difference between delivery months of approximately 15 cents per bushel. This equals a carrying charge of 5 cents per bushel per month, comparable to what we see currently in the winter wheat futures market.

Beginning in August, the spring wheat futures carry evaporated. Spreads between delivery months decreased. In the last few days, the December-September spread has gone negative. This negative carry is a strong signal for growers with high protein wheat: the market wants your wheat now, not later. The market will pay a higher price for that wheat now than it will in December or in March.

For growers with low protein wheat, this is a frustrating prospect. I am currently helping my dad and brother with their spring wheat harvest in Manitoba. (That’s my brother in picture above.) The first loads of wheat we hauled to the elevator had protein levels between 12.5 and 13 percent. The forward contracts my dad and brother have with their buyers specify protein levels of 13.5 percent. Protein levels below 13.5 percent mean discounts from the contracted price.

For those looking for a scapegoat for low wheat prices and discounts for low wheat quality, one can blame Russia, or Kansas, or some third party. Such explanations don’t change the signals the market is sending in the form of a large carrying charge for winter wheat and a low or negative carrying charge for spring wheat. High protein wheat is valued and should be delivered now. Low protein wheat will languish in grain bins and piles until it is needed.