Bill Gates, co-founder of Microsoft, made recent headlines for being the largest owner of farmland in the United States. No, Mr. Gates has not decided to change career paths amid some sort of late-life crisis, rather he is part of a small, growing trend of institutional investment in farmland. Institutional investors can take a variety of forms, but many can be thought of as absentee landlords who own land for the financial gains that can be reaped from its long-term asset value and annual stream of rental income.

How important are absentee landlords in the grand scheme of the U.S. farm sector? A recent USDA-Economic Research Service report, by Siraj Bawa and Scott Callahan, takes a close look at this issue. There is no universal definition of exactly what makes landlords “absentee”, but they are defined by Bawa and Callahan as farmland owners not residing in close proximity to the land they own and lease out to a tenant farm operator. In agricultural statistics parlance, this makes absentee landlords a distinct subset of “non-operator” landlords, a category that also includes retired farmers who live in close proximity their land which they now rent out to someone else. As of 2014, non-operator landlords own 31% of all US farmland, more than three-quarters of which is owned by someone who lives within 100 miles of the land. This implies that approximately 7% of all U.S. farmland is owned by landlords located at least 100 miles away from their land, which is the most lenient definition of an absentee landlord adopted by Bawa and Callahan.

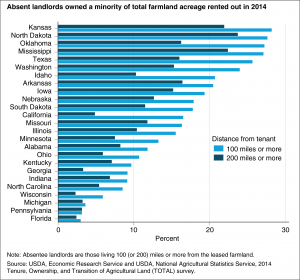

What types of geographic patterns emerge with respect to landlord absenteeism? North Dakota, the surveyed state most closely aligning with eastern Montana, has the highest degree of landlord absenteeism in the US. Specifically, the median distance between landlords and their land is over 100 miles in North Dakota. The high degree of absenteeism in North Dakota is likely partly driven by the Bakken shale formation, which was barely in the aftermath of its peak level of development when the report’s survey data was collected. Overall, there are eight states where at least 20 percent of the land owned by non-operators is associated with a landlord-tenant distance of at least 100 miles, many of them located in the Plains region (see figure). Perhaps it is not surprising that there is more distance between landlords and their land in less dense areas, but the authors also note that landlords tend to be closer to their land in the Midwest relative to other regions, including many coastal areas.

The report also finds a negative correlation between cash rents and the distance between landlords and their land. Todd Kuethe and I find a similar pattern in a 2018 unpublished conference paper on bargaining power in farmland rental contracts where we also control for various land, rental contract, and demographic characteristics. Although these estimates are merely descriptive and are not meant to imply a causal connection between landlord proximity and rental rates, they do suggest that farm operators renting from more absent landlords tend, on average, to pay a sub-market rate. Why might this be the case? Perhaps distant landlords are more interested in the long-term investment potential of the land, potentially for non-agricultural purposes, and are less plugged in to the ebbs and flows of the local rental market. It is also possible that these landowners inherited the land from a family member, but are no longer involved in the agricultural sector and thus have little appetite for undertaking annual negotiations with tenants to extract the highest rent possible.

All told, absentee landlords can have different motivations for why they own land, but, as a group, they still account for a small share of US farmland. Beyond splashy headlines involving tech tycoons, part of the reason why this group seems to have received increased attention of late has to do with the performance of the broader economy. Farmland, given its typical stream of steady positive returns, tends to see increased outside investment during economic downturns, such as the one brought on by the Covid-19 pandemic over the past year. Although it is easy to read too much into stock prices, heightened interest in farmland as an investment is reflected in the recent performance of two well-known publicly traded farmland real estate investment trusts, Gladstone Land Corp. and Farmland Partners Inc., which have both seen considerable increases in their share prices since the fall.

Betting on farmland may be attractive to some investors, but the dividends received from most major U.S. equities are generally taxed at a preferential rate compared to farmland rental income, which is taxed as ordinary income. As such, while institutional farmland investment may be having a moment, the tax advantages of other outlets tends to keep a natural ceiling on the total amount of farmland owned by outside investors. One major challenge in tracking this trend is the fact that non-operator landlords are not accounted for in most USDA data products, including the Census of Agriculture. The 2014 TOTAL survey on which the Bawa and Callahan report was based, for instance, was the first effort of its kind since 1999 and changes to the survey design over time precluded a direct assessment of trends in non-operator ownership. More frequent and consistent updating of the information in the TOTAL survey would go a long way towards improving our understanding of the types of landowners involved in the US farm sector.