Russia’s invasion of Ukraine has rocked the global energy market. Oil and gas prices were already soaring for a variety of reasons (as detailed in my recent post), but the sanctions against Russia–one of the world’s largest oil and gas producers–along with the general uncertainty and volatility caused by a major European war have sent prices to levels unseen in nearly a decade. Since we derive such a high share of energy from fossil fuels, and since energy is an input to all products and services to some degree, high oil and gas prices are closely linked to the sustained high levels of overall inflation that the US is experiencing. But in this post I want to focus on one particularly interesting relationship: that between oil and food prices.

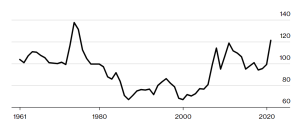

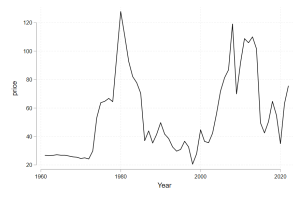

Figures 1 and 2 below show the Food and Agriculture Organization (FAO) real food price index (i.e. the average international price of a “basket” of common food items) and the real oil price from 1960-2022. As you can see, there is a remarkable correlation between the movements of oil and food prices, and today we are once again seeing a spike in the oil price accompanied by a similar one in food prices. Food is currently more expensive than at any time since the 1970s.

Figure 1: FAO Real Food Price Index

There are several reasons food prices are so influenced by oil. First and most obviously, oil is a direct input for running tractors and other farm equipment. Expensive oil also increases the cost of transporting goods to market, and agricultural goods often have to travel long distances over land, which is much more expensive than transport by sea.

Fossil fuels are important further back in the supply chain as well. Natural gas (the price of which tends to be tightly linked with oil) is a major component in the production of fertilizer. The manufacturing of pesticides is also extremely energy-intensive and in some cases uses petroleum products as an ingredient. So when considering the entire supply chain, food is one of the most fossil fuel-intensive sectors in the economy.

There are other more indirect links as well. The US has pursued multiple policies encouraging the production of ethanol from corn. In addition to generous ethanol subsidies, the US mandates the use of certain percentages of ethanol content in high-octane gasoline. These policies have substantially increased the demand for ethanol, and thus for corn. And when the oil price increases, it incentivizes increasing the share of biofuels in gasoline as a substitute. This increases the amount of corn (and other crops) grown for fuel rather than food, which puts upward pressure on food prices generally.

The tight correlation between energy and food prices is not due solely to energy markets driving food prices. Increases in global wealth and general global demand for goods cause both prices to rise at the same time. But it’s clear that those in the agribusiness sector and anyone else interested in understanding movements in food prices need to understand the oil and gas markets as well.