For the last three years, Anton Bekkerman and I have run a survey with the Montana Wheat and Barley Committee asking a bunch of wheat and barley variety questions and also, general ag economic questions. These questions are typically things I hear people talk about when I go out in the state—questions I get during talks, chats during breaks, etc.

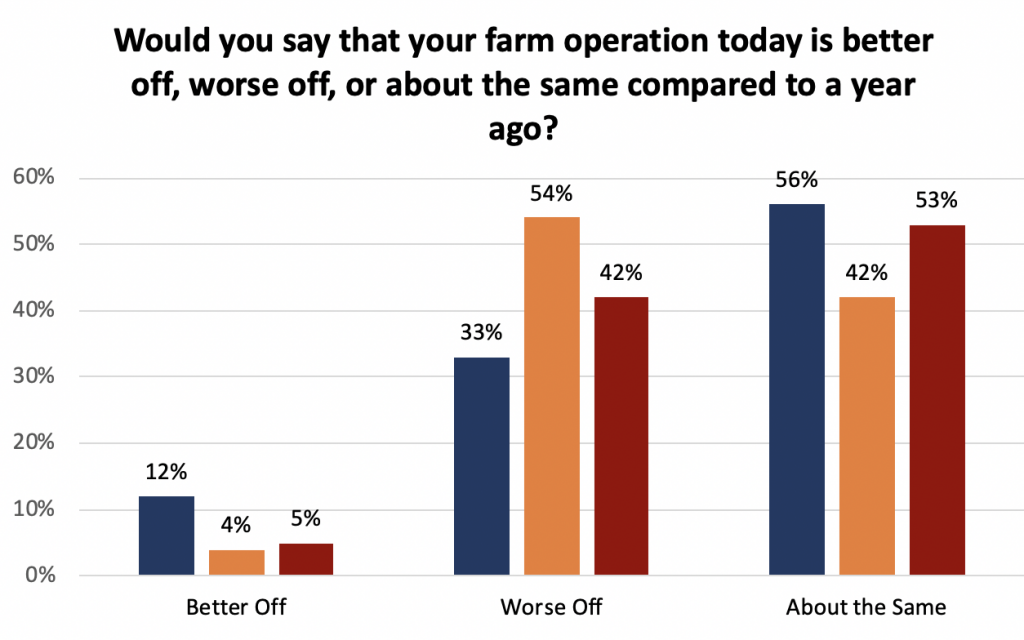

We’ve been running a couple questions that mirror some of those asked by the Purdue Ag Economy Barometer and I often find those the most interesting. This year, farmer sentiment both looking forward over the coming year (image above) and looking back over the last year (image below) is understandably not great.

Interestingly, outlook this year is slightly rosier in some ways than last, with a smaller percentage of producers reporting that they are worse off than last year. A smaller percentage also reports that they expect their financial situation to be worse in one year, as compared to the same survey last year. However, many reported some very challenging financial pictures last year so saying things haven’t gotten worse may not exactly be excellent.

There are a lot of things going on at the moment that haven’t helped agriculture. The trade war and the coronavirus pandemic are probably the main ones. (We’ll likely have a future post about trade and MFP payment questions we also asked in the survey.) But each producer has their own story that can include, among other things, small successes or compounding failures that make their own economic profile more complex. Teasing out some of these smaller trends is harder with our sample size (roughly 400) but this year we tried to do it in one way.

Thanks to a question a person asked during a meeting in Plentywood last winter, who asked if I knew how the “sentiment” responses varied by years experience in farming, we included a question about farming experience. Perhaps those who had farmed for longer periods of time and weathered previous economic downturns would have more perspective?

Overall, and unsurprisingly given farmer demographics, the vast majority (70%) of our respondents had a lot of experience (21 or more years) farming:

| Years experience in farming | |

| Less than 5 years | 5% |

| 5-10 years | 10% |

| 11-15 years | 7% |

| 16-20 years | 8% |

| 21+ years | 70% |

| Total (n=387) | 100% |

And there are differences in the summary statistics for different groups of farming experience levels. The next table shows Montana farmers’ sentiments about expected profitability in the next year, separated by years spent farming. The percentages reported each represent the percent of respondents by profitability sentiment, out of the total for each category of farming experience. Generally, farmers with less experience were more likely to think that profitability would remain the same than farmers with more experience, who were more likely to expect profits to fall in the coming year. We don’t actually know if farmers with more experience are better at predicting the future in this context. There are also so many fewer farmers at the lower experience levels that the comparison is a bit fraught. But I would say it’s not a positive trend.

| Years farming (N=374 answering both questions) | Better off | Worse off | About the same |

| Less than 5 years | 4 (22%) | 4 (22%) | 10 (56%) |

| 5-10 years | 4 (10%) | 17 (44%) | 18 (46%) |

| 11-15 years | 2 (7%) | 15 (52%) | 12 (41%) |

| 16-20 years | 5 (18%) | 13 (46%) | 10 (36%) |

| 21+ years | 38 (15%) | 126 (48%) | 96 (37%) |

Across all experience categories, farmers were most likely to state that their finances were currently about the same as they were one year ago. (Those numbers aren’t shown here.) We are just wrapping up our report for this year’s survey. If you’d like a copy, send me an email at kate.fuller@montana.edu.