Stepping into an insurance agent’s office can be a duanting task when considering the number of choices one has to make regarding crop insurance. First, there is the decision of whether you need to purchase federally-funded multiple peril insurance, state hail insurance, or no insurance at all. Though, if you’re in an insurance agent’s office, chances are you have already decided to participate in some kind of insurance. Second, should you purchase insurance that is based on yield or revenue outcomes? What about the harvest price exclusion? Third, what coverage level, or deductible, should I purchase. Fourth, is it better to use basic, optional, or enterprise units. These are the four main choices one needs to make regarding crop insurance. To illustrate, I’d like to spend some time in this post going through each of these decisions in Montana.

To get started, below is a list of the top 10 insured crop in Montana in 2016, based on liability reported by the Risk Management Agency.

| Rank | Commodity | Liability (in $M) | Percent of Acres Insured |

| 1 | Wheat | 572.5 | 95% |

| 2 | Dry Peas | 172.8 | 91% |

| 3 | Barley | 101.2 | 74% |

| 4 | Whole Farm Revenue Protection | 64.0 | Unknown |

| 5 | Forage Production | 50.5 | 37% |

| 6 | Pasture Rangeland Forage | 30.7 | Unknown |

| 7 | Sugar Beets | 28.9 | 70% |

| 8 | Corn | 14.0 | 41% |

| 9 | Potatoes | 9.2 | 53% |

| 10 | Apiculture | 8.2 | Unknown |

In today’s post we will focus on the top 3 crops: Wheat, Dry Peas, and Barley. These crops are notable in Montana because their high levels of production and participation rates. Both Dry Peas and Wheat producers in Montana insure over 90% of all planted acres.

Insurance Plan Selection

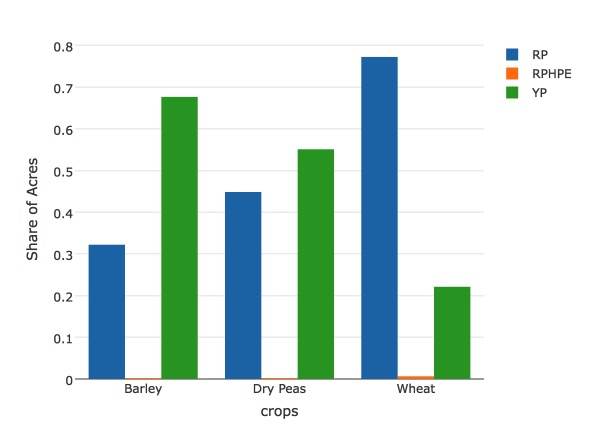

There are three main policies to select for most crops, which includes Revenue Protection (RP), Revenue Protection – Harvest Price Exclusion (RPHPE), and Yield Protection (YP). The main difference between YP and RPHPE is that the trigger for RPHPE is based on the product of national prices and individual yields, while YP only covers yield shortfalls. RP adds the harvest price provision on top of RPHPE, where the revenue guarantee can increase if the market price increases between planting and harvest. Prices for these policies are mostly based on the futures market, but can also be based on a formalized contract price. In the case of wheat, futures price fluctuations can lead to purchases of RP in order to protect against either adverse yields or price movements. When market contracts are used, then the price risk component becomes less of a concern, which leads to the usage of YP policies, as is more commonly the case with barley and dry peas. Below is a figure that shows the breakdown of each plan for Montana producers, by commodity. Nearly all areas are insured under RP or YP. While 77% of all wheat acres are insured under RP policies, Barley and Dry Pea acres are dominated by YP plans, with shares of 68% and 55%, respectively.

Coverage Level Selection

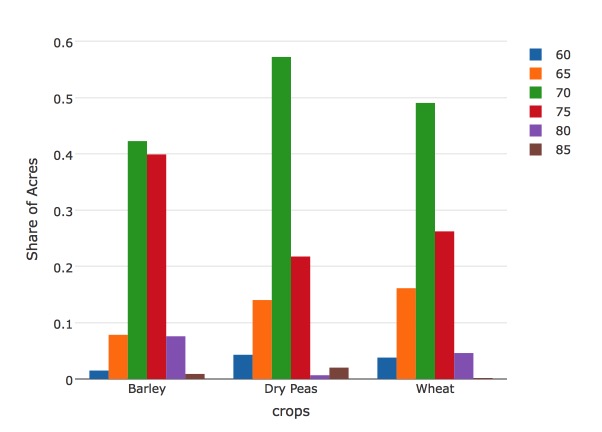

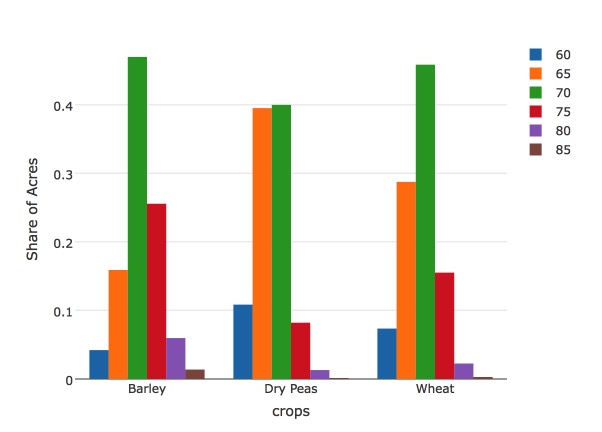

Selecting the right coverage level can be a more difficult task. Two basic guidelines include: (1) Purchase the coverage level that allows you to guarantee you can cover your variable costs; or (2) Purchase the coverage level that provides a guarantee that you and your banker are comfortable with. One more consideration is the negative relationship between coverage level and the subsidy rate. That being said, below are coverage levels that were purchased in Montana for the 2016 crop year. These figures show a clustering of selections around 70%-75% for RP policies and 65%-70% for YP policies.

Unit Selection

The final choice one must make is regarding unit designation. As shown below, the majority of acres in Montana are insured under optional unit designation. Optional unit policies are the most disaggregated level of insurance, followed by Basic and Enterprise units, respectively. As units become more disaggregated, the premiums increase since the likelihood of indemnity payouts increase. One additional consideration is the additional subsidy that is attached to enterprise units. When deciding between units, it is important to understand whether there are similarities across fields. If yield outcomes across fields tend to vary substantially, then optional units are a good choice. Alternatively, if yield outcomes tend to be highly correlated then a more aggregated level of units may be a more cost-effective risk management tool.

1 Comment

Pingback: Recapping the 2021 drought - AgEconMT