With the ongoing saga regarding the China-US trade dispute, it’s easy to get consumed with the constant drama. While Montana does not currently export much to China [Prior to the trade dispute, China was the 7th largest destination for US wheat and purchased almost no U.S. beef], the loss of market access for Montana farmers and ranchers to China will have large repercussions and limit future growth in these industries.

On the heels of China reopening trade to US beef exports in June 2017, ranchers across Montana began considering the possibilities of what market access into the largest consumer market in the world would look like. As a result, I started to work on taking a class of agricultural business students to China to better understand this important market. In future posts, I will discuss that trip, which included 16 undergraduate students and 3 faculty members from the College of Agriculture. Anyway, while things have changed substantially since June 2017, the excitement of selling US products in China is still worth being excited about, particularly in Montana. In what follows, I will describe the main reasons why I see China is important to U.S. and, more importantly here, Montana agriculture.

First, the size of the consumer market in China is hard to ignore. In 2017, the population in China was 1.4 billion, which is over 3 times the population in the United States. Shanghai contains 22 million residents, which is far larger than any city in the U.S. and only outnumbered by two states (California and Texas). China has 5 cities, outside of Shanghai that are over 8 million people and larger than any city in the United States. This population concentration is important to note because big cities are where many American and other international brands are commonly found. Given these large population numbers, it is clear that even small degrees of market penetration could amount to major gains in agricultural export volumes.

Second, China does not possess a comparative advantage in many agricultural products, meaning they will be big importers under agricultural trade with lower trade barriers. There are some exceptions to this rule, but for the most part, farmers have small plots of land and do not take advantage of scale in the same way that other major agricultural production countries do. For example, the average farm size in China is just over 1 acre (Wu et al., 2018), while the average farm size in the US is about 257 acres (2017 Census of Agriculture). As an aside, one trend in Chinese agriculture is the use of aggregators and cooperatives in land management, which may help to provide some scale advantages (I plan to have future blogposts on this topic). Currently, most beef products are imported from Australia, but lower tariffs are needed to make US products competitive with Australian products. In other Asia-Pacific countries where the US and Australia compete, such as S. Korea and Japan, the US market share is competitive with Australia, in spite of the higher cost of transportation and production. On our trip to China, a grocery store manager in Chengdu said to me that before the trade dispute with China began, U.S. beef products struggled to sell due to their excessively high price (2-3 times higher than Australian cuts) and lack of effective marketing. Both of those obstacles could be overcome through a trade deal with China that included lower tariffs on beef, as well as a concerted marketing strategy for U.S. beef in China, as has been achieved in other countries, such as Japan.

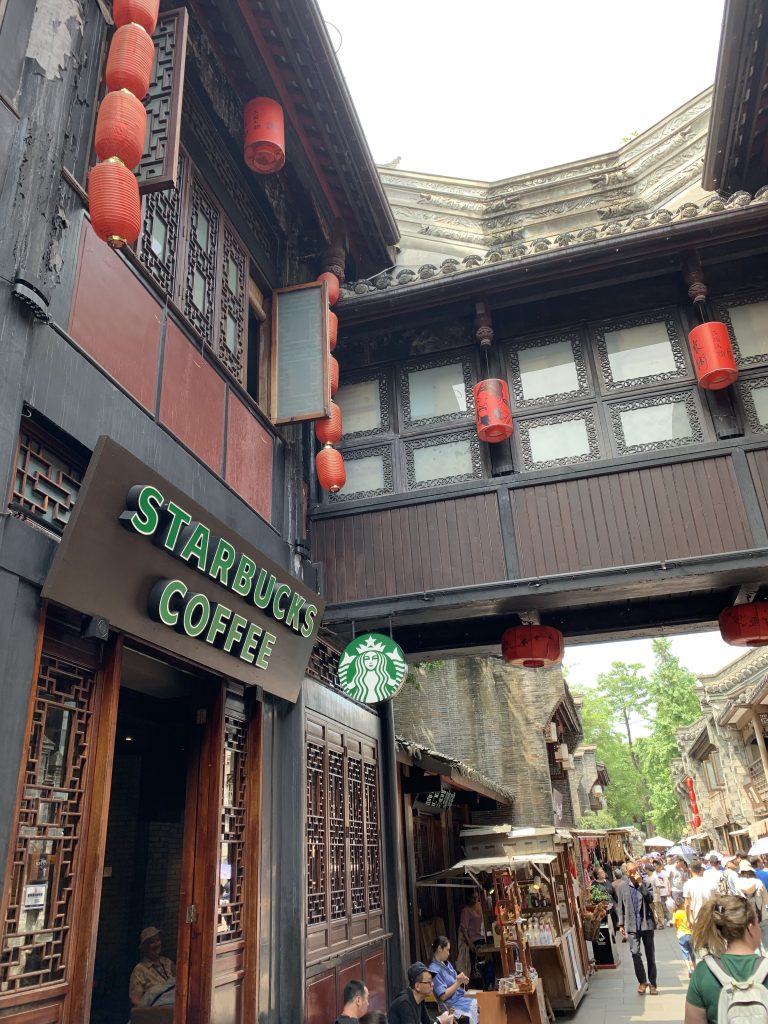

Third, American products are in high demand by younger middle-upper class Chinese. It is difficult to ignore the many American products that can be found throughout China, even under the current trade dispute. Whether it’s a store like Starbucks, McDonalds, KFC, or Shake Shack, or products found in a supermarket, it’s clear that many American brands are popular in China. I had a conversation with a young Chinese man who said he knew very little about how coffee was made and didn’t care for the taste, but still liked going to Starbucks and drinking coffee. He admitted that it was more a lifestyle purchase that the enjoyment of coffee. Given the growth in other Asia-Pacific countries, it is easy to imagine U.S. beef products being sold in China in supermarkets and restaurants in large cities, such as Shanghai.

In future posts, I will dig into our class trip to China to further discuss some of the important things that we learned about the Chinese agricultural system and consumer markets. Let me know if there is anything you’d like for me to focus on in future posts.