Recent posts by Kate and Joe have provided information on growth in organic acreage and decisions regarding organic certification. With these topics in mind, an important consideration for any growing industry includes the ability of its producers to manage risk. Over the last 20 years, federal crop insurance has become the dominant risk management and farm safety net policy. More recently, the Risk Management Agency (RMA) has substantially increased the number of organic products covered (from 4 in 2011 to 79 in 2018) and the use of Whole Farm Revenue Protection (from $1.1B in liability in 2015 to $2.5B in liability in 2018). This post will focus on the areas of growth and opportunity for these crop insurance products meeting the needs of organic and diversified producers.

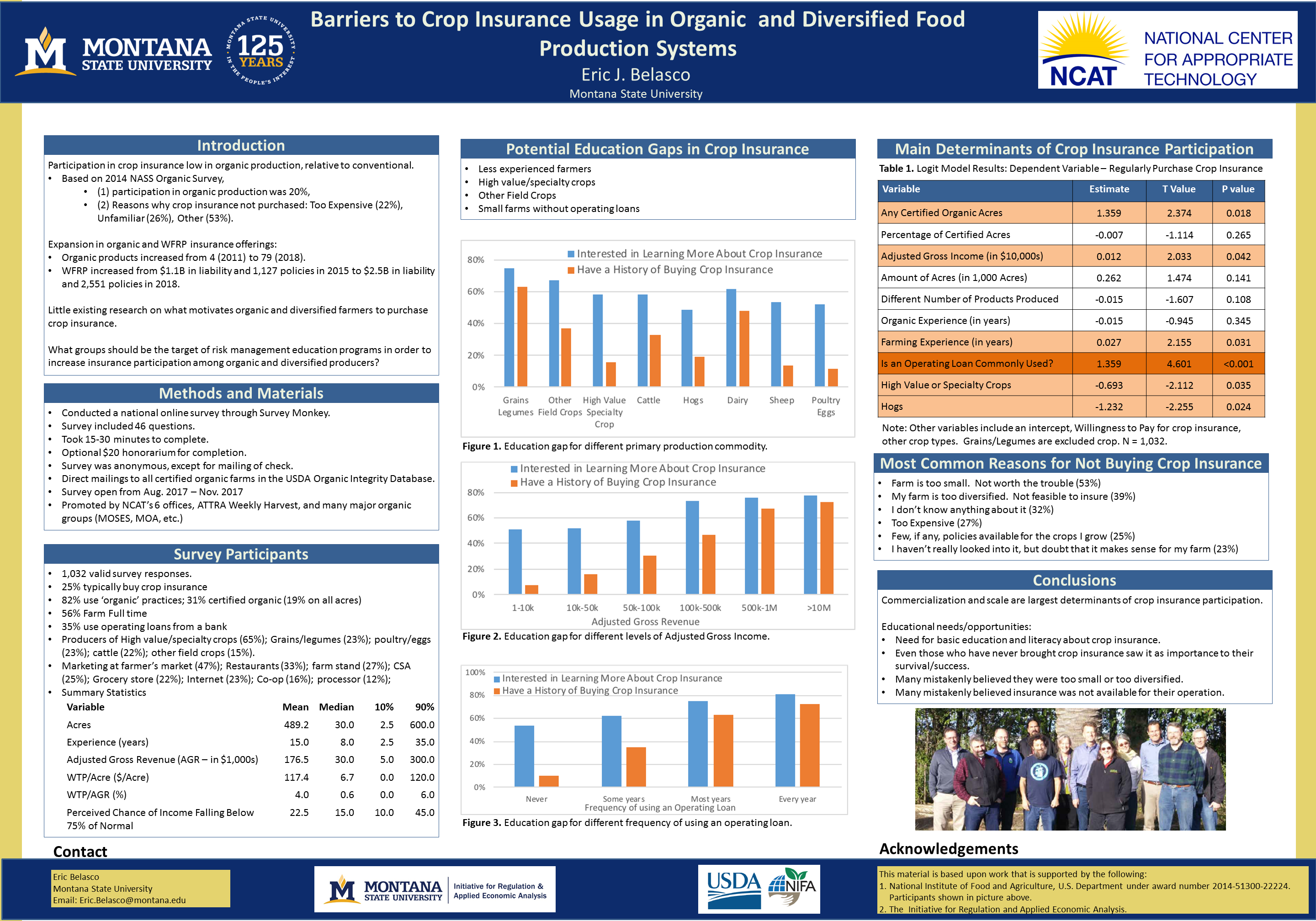

Last week at the annual AAEA meeting in Washington D.C., I presented a poster that summarized many of the findings from a 4-year study funded by the Organic Agriculture Research and Education Initiative. As part of this study, we surveyed 1,032 producers mostly focusing on organic and diversified operations. Below are some of the main findings.

Education Gaps Persist in the Crop Insurance Participation

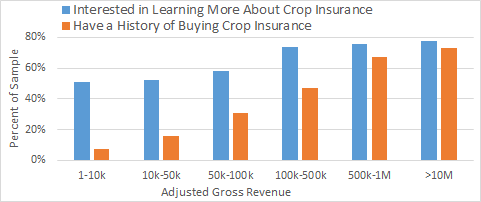

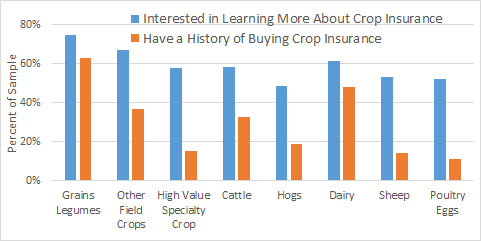

In 2018, the RMA intends to spend $4.16 million to fund partnerships that focus on education programs geared to federal crop insurance programs. This commitment is part of an ongoing effort that recognizes the importance of education in increasing the use of crop insurance as part of an effective risk management strategy. Gaps in utilization, defined as the difference between interest in learning more about crop insurance and actually using crop insurance in the past, may help carve out areas of future emphasis for programs like this.

The first gap we identified includes less experienced and small farms without operating loans. One rationale may be in the maintenance of farm records. Maintenance of good farm records becomes even more complicated as diversification increases and as the number of marketing channels increases. The use of an operating loan may also be an indicator of good record keeping, as most bankers will want to work through your balance sheet before determine operating lines of credit. Alternatively, as the commercialization of a farm increases, good record keeping plays a more important role. While this gap does not necessarily indicate that these farmers are likely to buy corp insurance, it does indicate that they have an interest in learning more about it.

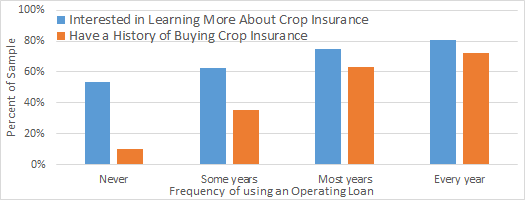

A second gap persists among other field crops (e.g.,cotton, peanuts, potatoes, sunflowers, hay, etc.), high value specialty crops (e.g., fruits, vegetables, melons, tree nuts, etc.), and some livestock (cattle, hogs, sheep, poultry/eggs). While many of these commodities have single policies, they are typically newer than some of the more established crop insurance policies, including corn, soybeans, and wheat.

Main Determinants of Crop Insurance Participation

I should start by mentioning that this surveyed group does not accurately represent major conventional field crops farmers. This survey focused on diversified and organic farms, many of whom sell to farmer’s markets, restaurants, and farm stands. This is substantially different from many past studies on this topic, including Coble et al. (1996); Goodwin (1993); and more recently Woodard and Yi (2018). That being said, we found the largest determinant of crop insurance participation among this group was the use of an operating loan, followed by income level, experience, organic certification, and commodity effects. It is notable that there is a positive relationship between a farmer having any amount of certified acres and using crop insurance. For those who have gone through the process of certifying organic acres, the process often provides a quick lesson in record keeping. For this reason, the process of organic certification may be compatible with the record-keeping demands for crop insurance. On the other hand, for those who sell through farmer’s markets, restaurants, and other channels where the certification process may not hold as much value, those record keeping demands may not be as high.

Why Producer’s Don’t Buy Crop insurance

In the survey, we solicited the reason producers did not purchase crop insurance. In our sample, 774 out of 1,032 (75%) stated that they do not “typically” buy crop insurance. The main reasons (respondents could indicate up to four responses) they provided are below:

“Farm is too small. Not worth the trouble.” (53%)

“My farm is too diversified. Not feasible to insure.” (39%)

“I don’t know anything about it.” (32%)

“Too expensive.” (27%)

“Few, if any policies available for the crops I grow.” (25%)

“I haven’t really looked into it, but doubt that it makes sense for my farm.” (23%)

A few thoughts come to mind following the above reasons. First, more diversification increases the cost of record keeping and may discourage crop insurance purchases. This flies in the face of Whole Farm Revenue Protection (WFRP), which is a product that was developed with diversified farms in mind. Second, there are likely many producers who are unfamiliar with new products in the RMA portfolio that insure products they grow. These producers tended to be younger, have smaller operations, and a higher number of commodities grown and should be the focus of future education programs.

The poster I presented is below. Any suggestions or comments are welcome. Thoughts?