Key insights:

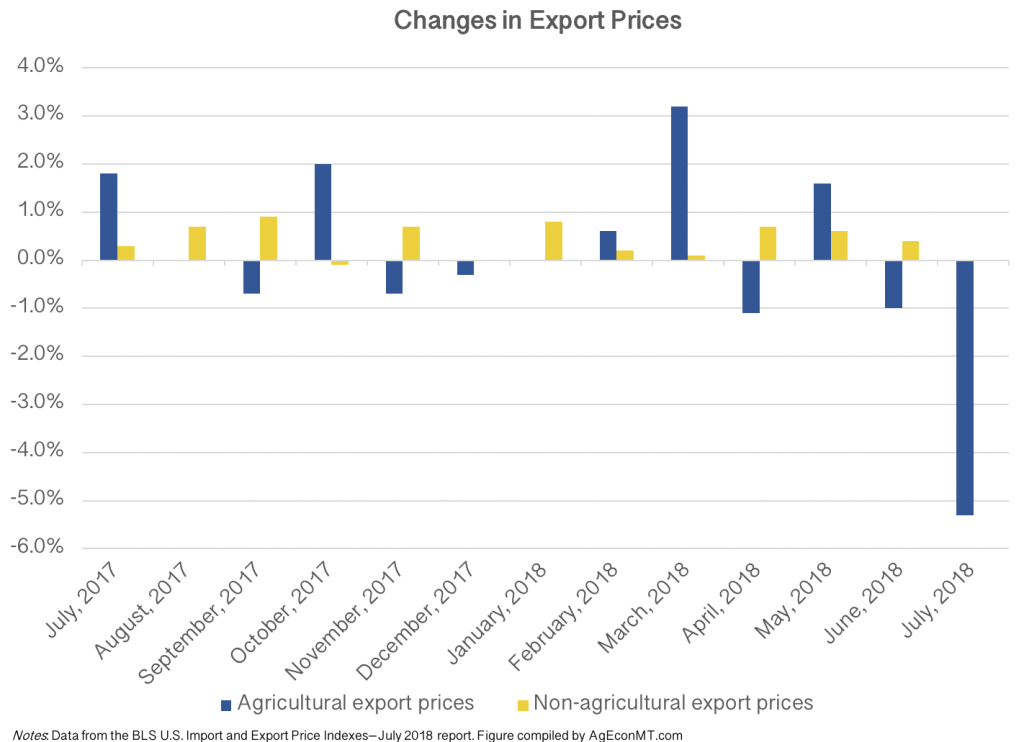

- The July 2018 Bureau of Labor Statistics report on U.S. Import and Export Prices indicated that export prices for agricultural prices fell 5.3%.

- The price decrease is precisely what economic theory indicates as a result of tariffs on U.S. exports. China, Canada, Mexico, the European Union, among other nations instituted numerous retaliatory tariffs against the United States.

- The drastic drop in agricultural export prices is an important signal that the ramifications of the ongoing trade dispute are serious, especially in the face of increased 2018 production reported by the USDA.

On August 14, 2018, the Bureau of Labor Statistics published its July 2018 report of U.S. Import and Export Prices. The report provided some drastic insights about the emerging tangible consequences of the ongoing trade disputes with which the United States is currently involved. As the figure below shows, agricultural export prices declined by 5.3% in July 2018, while export prices for all other goods did not change.

While undoubtedly this price drop is adding to the anxiety of the U.S. production agriculture sector, it represents an outcome that most economists have warned about since the White House has indicated its international trade strategies last year. Here is a brief overview of why these warning signals have been ringing.

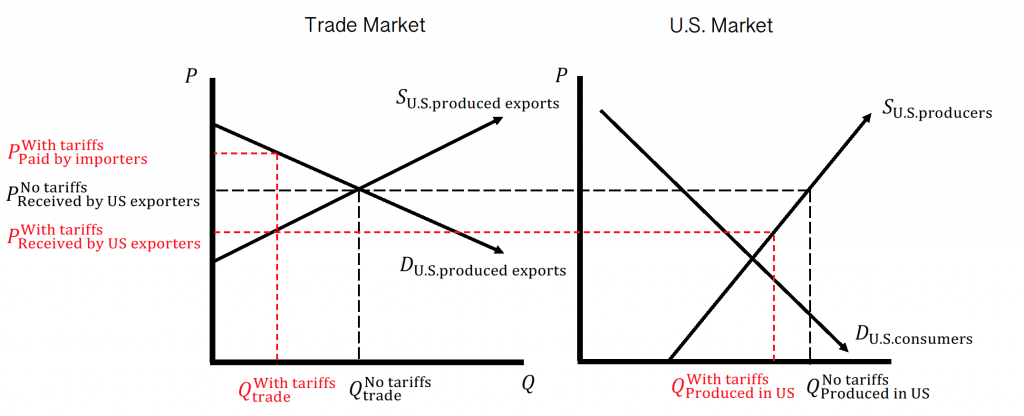

The figure below shows a basic characterization between the U.S. market for goods (let’s assume it’s the agricultural industry) and the global market for trade. Without trade restrictions, the quantity of goods traded and the price that U.S. producers receive is determined by the intersection of the supply and demand for U.S. exported products in the trade market. At this intersection, the price received by U.S. producers is higher than the price they would receive if they were to sell all of their products exclusively to U.S. consumers (which occurs at the intersection of the supply and demand curves in the U.S. market).

However, what happens during a trade dispute? Let’s assume that the importers of U.S. agricultural products (e.g., China) imposes a retaliatory tariff, which would essentially raise the prices that those importers must pay for U.S. products. This price increase for importers (indicated in red on the graph above) would have two consequences (both shown in red): (1) it would decrease the quantity of U.S. products demanded and (2) it would lower the prices received by U.S. exporters. A double-whammy for the U.S. agricultural industry.

An additional concern in the time of decreasing prices and quantities demanded and uncertainty about short- and long-term implications of the trade dispute is the news in the latest (August 10, 2018) USDA World Agricultural Supply and Demand Estimates report that both corn and soybeans are projected to have higher production and higher inventory stocks. The report also notes that wheat production is likely to not be as poor as projected earlier in the year. These factors have put additional downward pressures on commodity prices.