In a recent post, I discussed several ways to think about whether conditions in wheat markets are likely to get worse or improve next year. Today, I want to share a fairly recent (and recently discovered by me) joint project between the agricultural economics department at Purdue University and the CME Group: the Ag Economy Barometer.

The Ag Economy Barometer project is based on a monthly survey of over 400 large producers from across the United States about their sentiment of numerous measures of the agricultural economy. While the project began in October 2015 and there is a somewhat limited scope of comparison, it does provide several year-on-year indicators as well as sentiment about the future.

You can look at all of the available statistics on the Ag Economy Barometer project website, but I will discuss a few here that I think provide some key insights.

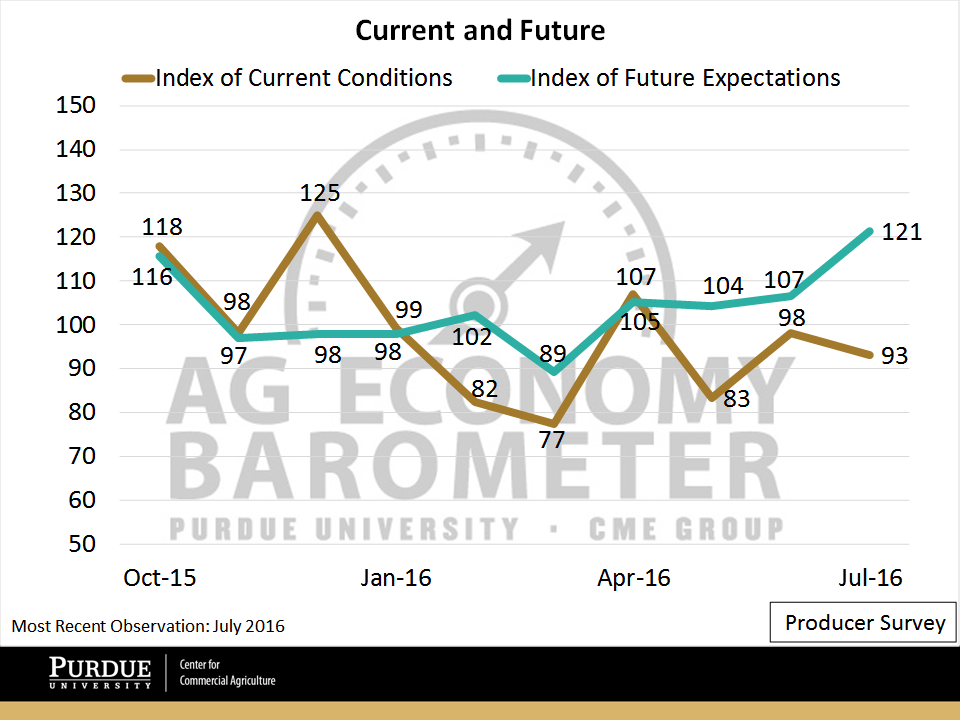

First, here is a general index of the sentiment about current and future expectations of the ag economy. To interpret the indices, consider that the base period is October 2015 through March 2016, at which the index is 100. Therefore, any value above 100 means that the sentiment is better than it was in the October through March period, and values below 100 imply a less optimistic sentiment than the base period.

The index of current conditions (brown) shows that the most recent sentiment about current ag economy conditions is that conditions are somewhat worse (93) than they were between October 2015 and March 2016. However, the expectation sentiment (green) is that of optimism—that future ag economic conditions will be substantially better than they were last year.

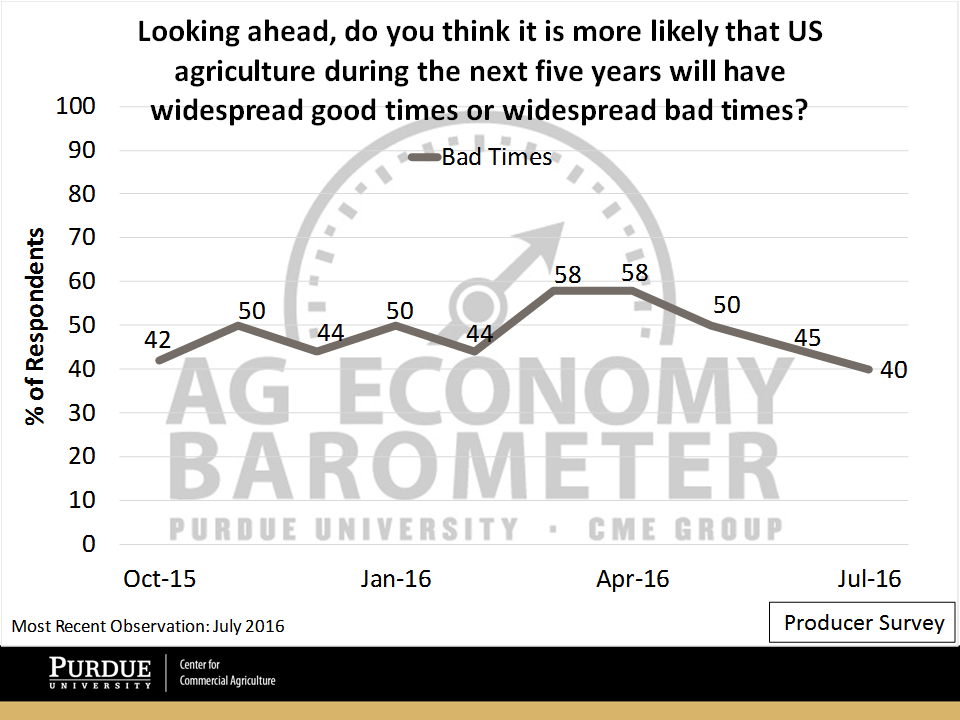

The second indicator is based on the question of whether agriculture will enjoy widespread good times or widespread bad times over the next five years.

The indicator shows that in the most recent survey of July 2016, only 40% of respondents were pessimistic about the agricultural economy in the next five years. This is in contrast to the sentiment in the first part of 2016 when more than half of respondents were pessimistic.

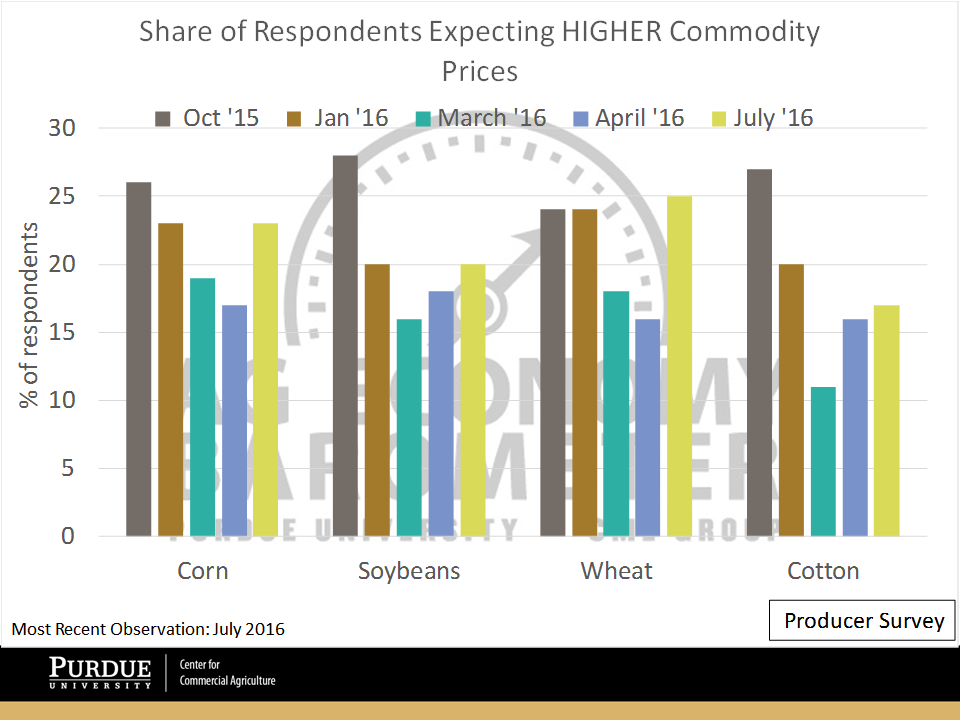

Lastly, I want to show the results of the question regarding the sentiment about commodity prices.

Similar to the optimism signaled by the charts above, there appears to be a growing optimism that prices of all four major commodities produced in the United States will rise. For wheat, the greatest pessimism about prices occurred in April 2016, when just over 15% of respondents expected prices to be higher than in the past. Now, as I’ve discussed in a previous post, there seems to be a signal of acknowledgement that prices have likely bottomed out and will begin to rise.

In general, there appears to be optimism for the performance of the U.S. agricultural economy and the Ag Economy Barometer is a good tool to keep track of future sentiment changes.