I’ve been putting off thinking about it for awhile, but may others have not. Discussion surrounding the next farm bill is definitely building. When that bill will be constructed, when it will pass, and what will be in it are still in the realm of guesswork. Instead of making predictions about the next bill, I’ve been spending a bit of time with the one we currently have–the 2014 farm bill.

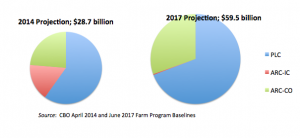

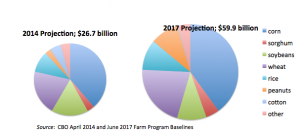

The Congressional Budget Office (CBO) released an update on spending projections for that bill at the end of June. I’ve been wondering how the current projections stack up against those in 2014. (Note that these CBO scores don’t get into any of the nutrition programs that make up more than half of projected spending).

For one thing, the 2014 score compares projections from 2014-2014, the 2017 update projects 10 years into the future from today (so 2017-2027). So we aren’t exactly comparing apples to apples, but there are a few other key differences as well. The current projections are a lot more detailed and include spending and prices for crops that aren’t in the 2014 Baseline. Another big difference is that in 2014, no one had elected which farm bill program they would choose, so a lot more guesswork was required in the CBO’s projection. Here are some highlights from the comparison.

- Spending over the 10-year window CBO looks at is expected to be much higher –roughly double–now than it was in 2014.

- PLC is projected to pay a lot more than expected. The 2014-2024 expectation was $15.9 billion; 2017-2027: $41.2 billion. (Aside: Montana farmers by and large chose PLC over other options.)

- ARC-Individual payments, were much less than expected. That’s true both in absolute terms and as a proportion of total expenditure. ARC-Individual payment calculations are based on producers’ individual farms, rather than county averages. It received a lot of attention but few actually chose it. The 2014-2024 expected ARC-IC payment was $4.4 billion. 2017-2027 projection: approximately $200 million. This isn’t a huge shock—ARC-IC paid on a much lower proportion of a farmer’s base acres than the alternatives.

- Wheat is expected to trigger a PLC payment every year for the next 10 years. What that means: wheat prices are expected to stay low. (Although, note that the wheat price used in farm bill calculations is the “all wheat” price—an average of currently high spring wheat and very low winter wheat prices. See Anton’s earlier post about that.

What other exciting news have I been reading? The USDA Acreage Report also came out before the holiday weekend. There were some “fireworks” for corn and soybeans. But there weren’t any big big departures from the March 31 Prospective Plantings Report for wheat, barley, or pulse crops. One interesting item of note is that canola acreage, while still small relative to other crops, more than doubled to 130,000 acres in Montana. That’s more than doublle for a record high for Montana. The U.S. is also at a record high at 2.2 million acres. Why the increase? Some of it may be moves away from the drama and depression of the wheat market (or just diversification). Another potential explanation is an increase in using canola as a cover crop.

As an aside–I took a break from writing this post to go for a run up Pete’s Hill on the edge of Bozeman, where I took the photo up top of campus with some very yellow fields nearby. After interrupting Joe Janzen from something likely much more important to discuss, I have concluded that it is “probably canola.”

2 Comments

I can confirm that it’s canola.

Thank you for weighing in on this important matter from vacation!