2020 has already been a pretty bizarre year, for a number of reasons. With crop acreage information now in, and seemingly so much canola blooming in the Gallatin Valley over the last month, I have been wondering how and if planting decisions have been affected across the state. Planted acres for this year are now in, so here are a few highlights.

- Canola. I’ve been spending a fair amount of time this summer on the Bridger Ridge, hanging out with mountain goats and trying to hone my terrible trail running skills. Also doing research, of course! From that vantage point, blooming canola fields really pop and this photo totally does not really do it justice. Canola acreage in Montana has expanded over the past five years as producers have sought to diversify production. This year, numbers are actually relatively in line with last, just up slightly.

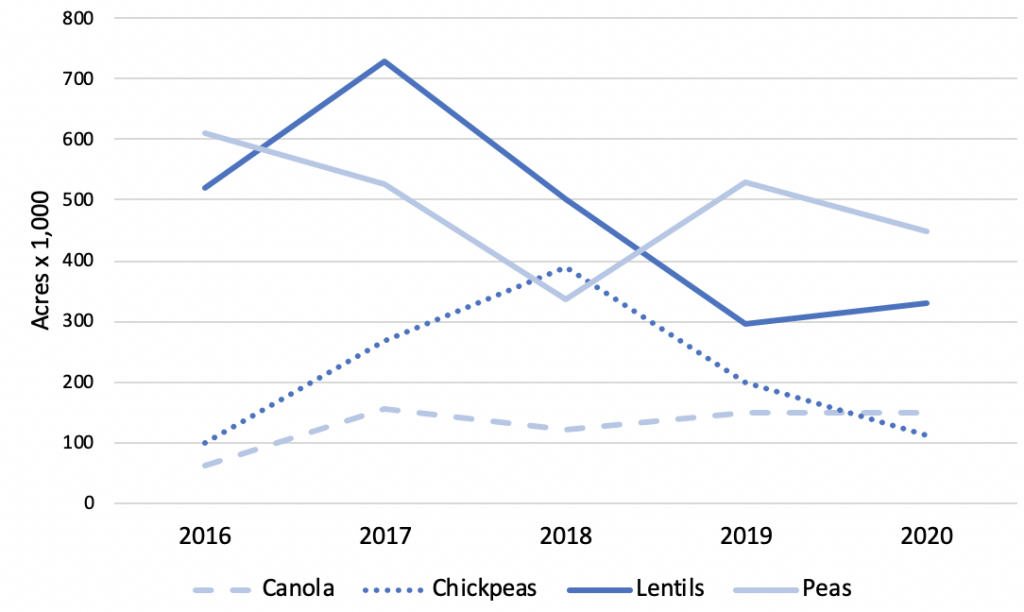

- Chickpeas, lentils, and dry peas. Pulse markets, once a bright spot among in dismal grain prices, have seen strong headwinds as trade tensions have developed, and really haven’t let up for several years. Chickpeas, which saw some of the highest pulse crop prices a few years back, no longer see those high returns. Acreage this year reflects that. Dry pea acreage has increased slightly; prices have not fallen to the extent that other pulses have. Lentils have seen a real drop off as prices have fallen. (Aside: while we export the bulk of pulses produced, these challenges are separate from our ongoing trade strife with China. Some pulse production does end up in China, but the bulk typically has gone to India and other southeast Asian countries.)

- Wheat and barley. Total acreage is relatively steady for these two major crops. We’ll be delving into those more deeply once we wrap up this year’s Montana Wheat and Barley Committee Variety Survey.

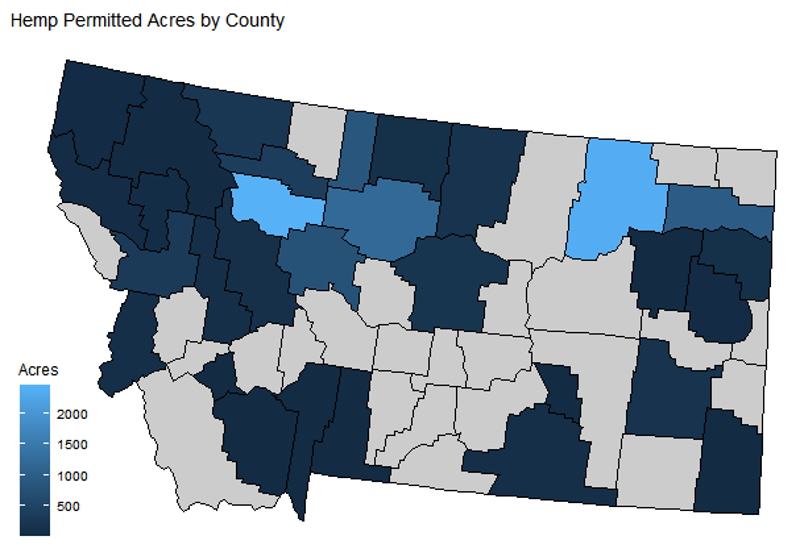

- Hemp acreage, which exploded here last year to be the most of any state in the country with over 40,000 acres, has really plummeted this year. Using data on permitted acres from the Montana Department of Agriculture (thank you, Andy Gray!) we estimate 2020 acreage to be roughly a quarter of that, although actual planted acreage information is not yet available. Much of the drop is likely due to CBD prices really declining over the last year. Back in September Texas A&M budgets predicted a return over variable costs (ROVC) of over $5,000 per acre for production destined for the CBD market. That same budget for this month (July) predicted an over $9,000 loss per acre in ROVC. (Thank you, Justin Benavidez!) Permitted acres are now showing up less as a giant block straight across the Montana highline and more scattered across the state and in the northwest.

This post was written with assistance from MSU DAEE MS student Rebecca Kaiser.

This post was written with assistance from MSU DAEE MS student Rebecca Kaiser.