Pasture, Rangeland, and Forage Insurance Program 101

Note: Today we are taking a break from COVID content to bring you this guest post written by MSU Applied Economics MS program soon-to-be-graduate Molly DelCurto, whose thesis is on the topic of Pasture, Rangeland, and Forage Insurance.

Droughts have become more frequent in the western United States in the last two decades and have led to significant consequences for those working in the agriculture industry. Farmers are often thought of when a drought occurs as they can have devastating impacts on crop yields. However, livestock producers are also hit hard when droughts occur. Livestock producers who depend on range forage as a primary feed source can see substantial depletions to their available forage and reductions in forage quality during drought. Financially, this can cause pretty severe consequences as ranchers may need to source additional acreage/supplementation, change their grazing rotations, or liquidate part of their herd. To help livestock producers with the potential financial burden of low precipitation conditions, the United States Department of Agriculture (USDA) Risk Management Agency (RMA) created the Pasture, Rangeland, and Forage (PRF) insurance program.

The PRF program insures livestock producers’ forages that are solely used for livestock feed against low precipitation conditions. Unlike many other agriculture insurance products that evaluate each person’s individual production loss, the PRF insurance program uses a rainfall index to trigger indemnities (amount paid to the insurance purchaser to cover losses) when the precipitation falls below a predetermined historical average for a grid area. This is referred to as area-based insurance as it splits insured areas into grids (17×17 miles at the equator) and uses rainfall indexes within each grid to determine both the 70-year historical average and current precipitation levels. Insurance programs that use indexes have the advantage of being relatively easy and lower cost to implement, which in turn usually makes the programs more affordable for ranchers to insure in. However, these insurance programs also have the potential downfall of not being completely representative of a rancher’s actual loss. For example, a rancher could have experienced no losses, but their insured area shows lower than average rainfall, triggering an indemnity payment or vice versa.

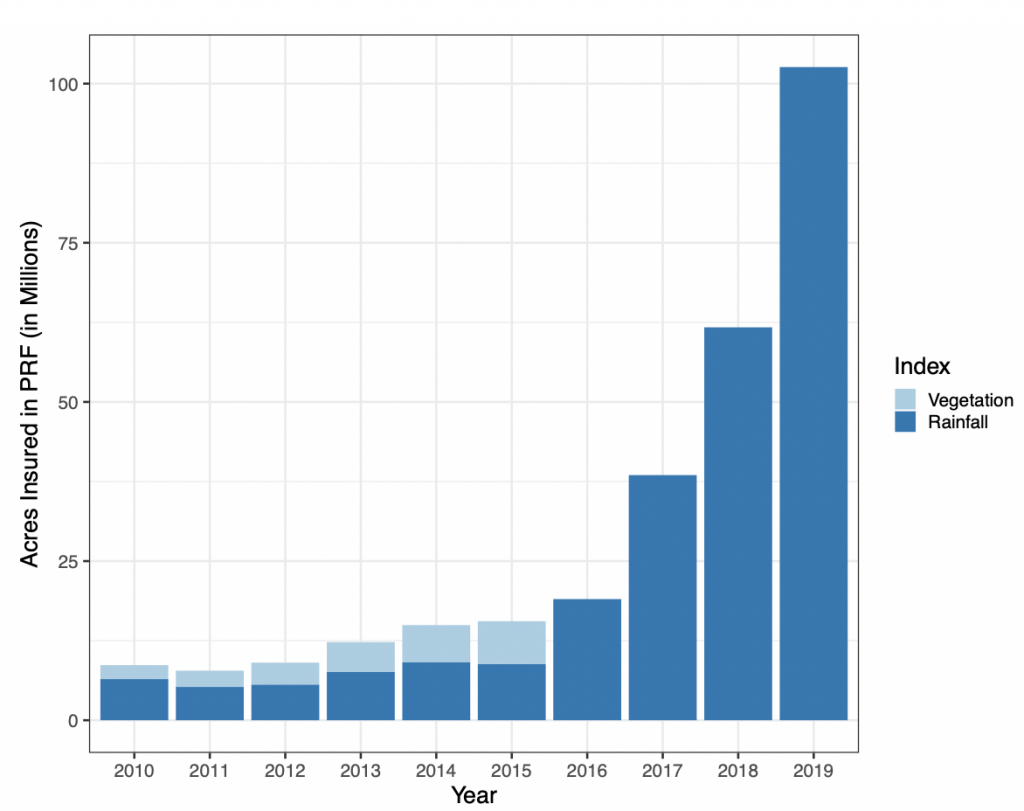

Even so, this program has seen a rapid increase in acreage enrollment in the last four years. PRF has especially become popular in southwestern states such as Arizona, Texas, Nevada, and New Mexico, which have the highest acreage enrollments as of 2019. However, PRF has seen steady increases in most states, suggesting that it may be a useful risk mitigation tool elsewhere.

Figure notes: Data contributed from the USDA-RMA Summary of Business. This figure only includes acres enrolled in the western United States.

To enroll, a rancher must purchase coverage from their local insurance provider. When purchasing PRF insurance protection there are a few choices a rancher must make. First, they must select the month intervals they will insure in. PRF does not provide coverage for an entire year. Instead a rancher must select at least two non-consecutive two-month intervals that are the most critical to their operation. Second, they must select a productivity factor between 60% and 150%. The RMA estimates a base land productivity value for the county, also referred to as the county base value, reported as $/acre. This value is used to determine both the size of the premium (cost to insure in the program) and the potential indemnity. If a rancher feels this estimate is not representative of their actual land’s productivity value they can adjust with the productivity factor. Finally, they must select a coverage level between 70% and 90%, in 5% increments. The coverage level determines at what percent of the historical average an indemnity will be triggered. For example, if a rancher selects the 85% coverage level and actual rainfall is less than 85% of the historical average, an indemnity will be triggered.

This program might not be the best fit for all ranching operations, but it is a another risk management tool to consider. To find out more about the program visit the USDA-RMA webpage. To find out if this program is a good fit for your operation, please contact your local insurance provider.