Meghan Brence, recent graduate of Montana State University’s Agricultural Business program, contributed to this post.

This post is part two of the series that focuses on how US Department of Transportation’s hours of service (HOS) and electronic logging device (ELD) provisions could lead to unequal economic impacts on feeder cattle producers across the United States. The first post describes the underlying mechanism (the “how“) hours of service (HOS) and ELD rules can differentially impact ranching operations. This post provides an overview of our preliminary data analysis that seeks to offer some insights about the potential quantitative impacts (the “how much“) of the provisions.

Why can’t we measure HOS/ELD impacts directly and what’s our approach?

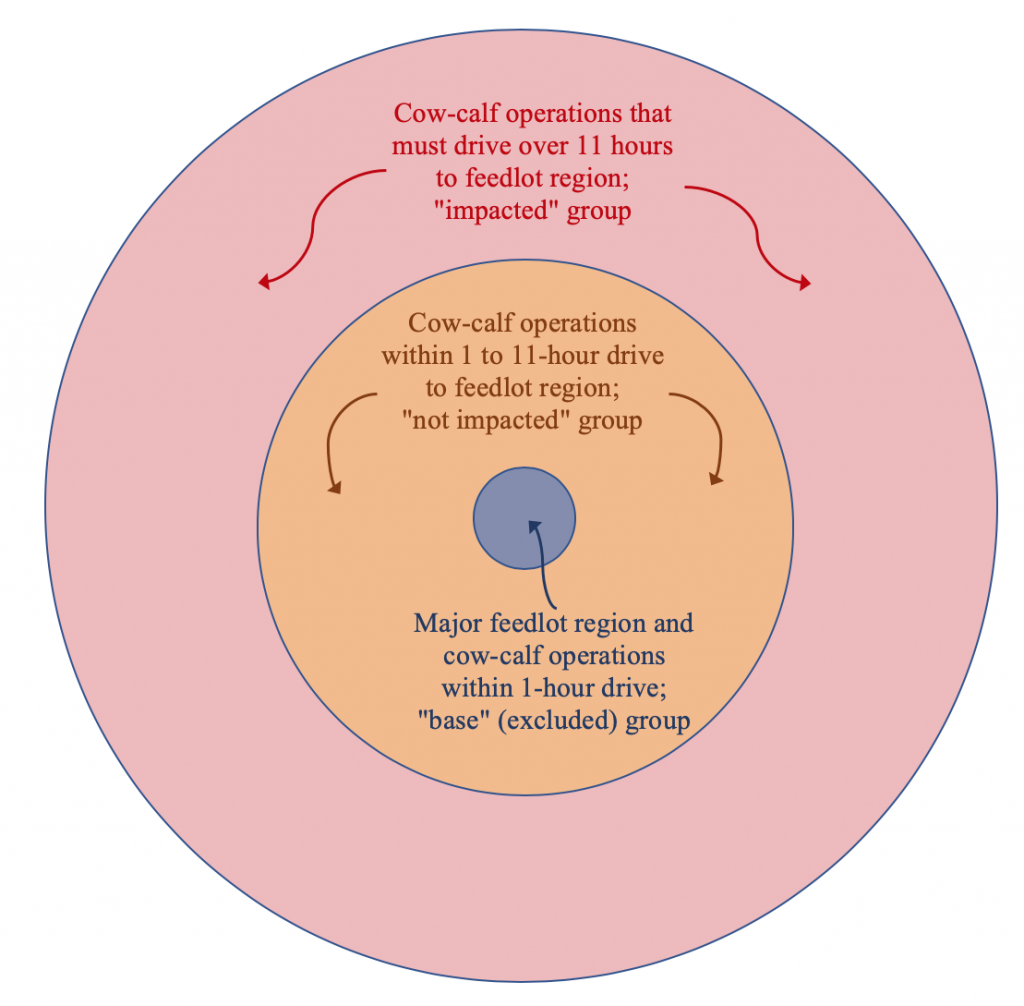

As I discussed in the first post, one of the ways to consider the impacts of the HOS/LED provisions is to assess differences in feeder cattle prices in regions that would not be impacted by the regulations (those that are within 11 hours of driving to major feedlot locations) and those regions where producers would be impacted (must transport cattle for more than the 11-hours). Because the HOS/LED regulations would essentially represent higher transportation costs, the expected impact would be a reduction in feeder cattle prices in impacted locations, but only trivial (if any) effects for locations that are within 11 hours of major feedlot regions.

Ideally, we would assess how feeder cattle prices in the “impacted” locations and prices in the “not impacted” locations changed after the HOS/ELD provisions became implemented. However, legislators have continued to make efforts to delay the enforcement of these statutes for those transporting livestock. As such, the ideal approach is not yet possible.

As a second-best alternative, we instead use data describing diesel prices as a proxy for additional transportation costs that could result from the HOS/ELD implementation. In other words, we ask: When transportation costs increase (as measured by higher diesel prices), do feeder cattle prices in “impacted” locations change to a greater degree than feeder cattle prices in “not impacted” locations? And if they do, how much is that additional effect?

We collect monthly price information for steers sold at 143 cattle auction facilities across 19 states in the Midwest, Great Plains, and Mountain West regions between January 2004 and March 2018. We then define three location groups: “base locations,” “not impacted,” and “impacted.” Base locations are facilities that are located less than 1 hour of driving from one of the six major feedlot regions: Greeley, CO; Kearney, NE; Sioux City, IA; Dodge City, KS; Guyman, OK; and Amarillo, TX. These “base locations” are excluded from the analysis to ensure that they do not potentially bias the results. Locations that are in the “not impacted” group are those that are between 1 and 11 average hours of driving to the six locations. And locations that are in the “impacted” group are those are more than 11 hours of driving.

Finally, after accounting for potential confounding factors such as each auction facility’s state, the year in which prices were measured, and intra-year seasonality, we estimate the potential differential impacts on “impacted” and “not impacted” locations associated with changes in diesel prices.

What do the data indicate?

The estimation results provide two sets of insights. First, the data show that, on average, producers in the “impacted” region (outside the 11-hour driving radius) receive approximately $5.00–$6.00 per hundredweight less than prices at auction facilities within the “not impacted” region. This is a fairly expected result, because longer driving distances and, thus, higher transportation costs that are associated with lower prices relative to locations that are closer to feedlots.

| Average price difference in “impacted” group, relative to “not impacted” group | –$5.64/cwt |

| Average impact on price in “not impacted” group from a $1.00/gallon increase of diesel price | –$0.42/cwt |

| Average impact on price in “impacted” group from a $1.00/gallon increase of diesel price | –$1.53/cwt |

The second set of results show the impacts of changes in diesel prices. The data indicate that, on average, when diesel prices increase by $1.00/gallon, feeder cattle prices in the “not impacted” region decrease by approximately $0.42/cwt. However, in the “impacted” region, the resulting decrease is about $1.50/cwt. That is, increases in transportation costs disproportionately affect feeder cattle markets that are farther away from major feedlot regions.

The second set of results provides at least suggestive evidence of the differential impacts that transportation costs have on regions that would be impacted by the HOS/ELD provisions. And while this analysis does not directly assess impact of the regulations (this type of analysis is simply not possible before the provisions are actually implemented), these results do show that the implementation of those regulations could skew the feeder cattle marketing landscape.

As with all preliminary economic assessments, additional work is needed to further refine the analysis and provide a more detailed investigation of potential HOS/ELD regulations. This initial empirical exercise provides the motivation for doing so.

(Photo by citizen for boysenberry jam is licensed under CC BY 4.0)