Key Insights:

- Understanding markets’ valuation of wheat protein content levels can be an important aspect for making marketing decisions, especially for hard red wheats.

- While futures markets do not provide this information directly, the difference between the prices of the Minneapolis Grain Exchange (MGEX) hard red spring wheat futures contract and the Kansas City Board of Trade (KCBT) hard red winter wheat futures contract can be used to indirectly gain insights about protein valuation.

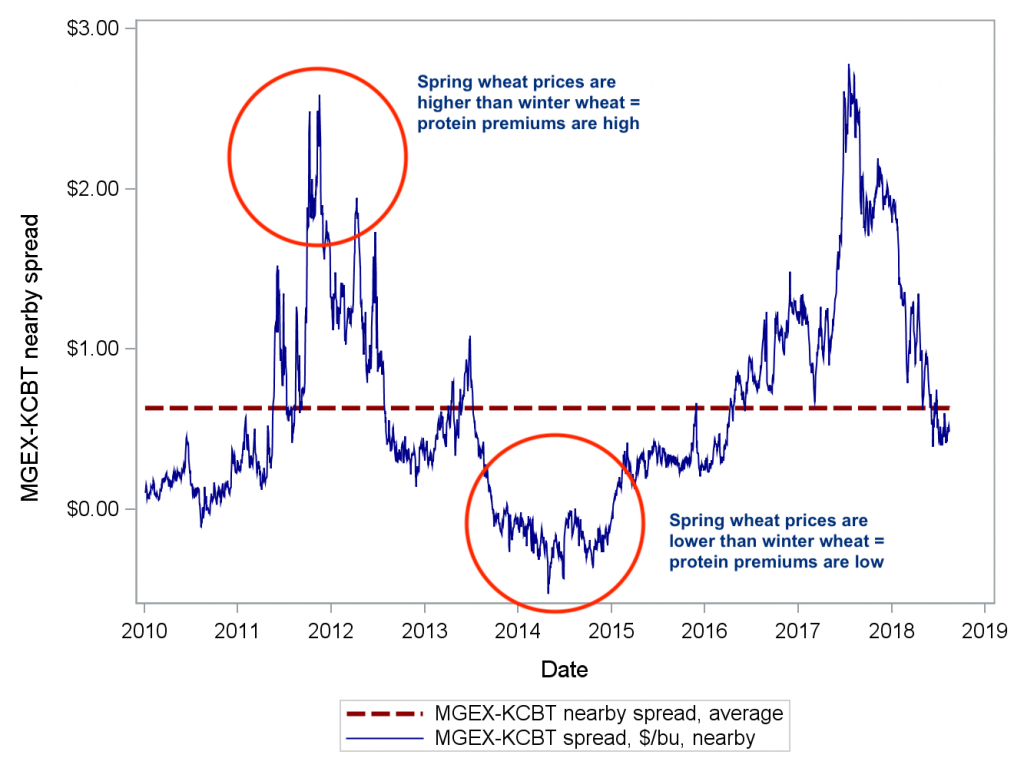

- Historically, the MGEX-KCBT price spread has been, on average, approximately $0.63 per bushel. When the spread is higher than the average, protein premiums/discounts are likely to be higher; when the MGEX-KCBT spread falls below $0.63 per bushel, premiums/discounts at local elevators are likely to be smaller.

Similar to other grains, wheat is assessed based on a number of quality characteristics and the final net price received by a farm business depends on the extent to which a buyer offers a premium or applies a discount due to the different qualities of delivered grain. For hard red wheats produced primarily in the central and northern Great Plains regions of the United States, one of the most prominent quality characteristics is the grain’s protein content level. However, while price premiums and discounts for many other grain quality characteristics are often not well publicized or may not vary significantly across marketing years, price schedules across protein content levels are much more widely available and can increase or decrease dramatically based on prevailing supply and demand conditions.

The uncertainty and volatility of wheat protein premiums and discounts certainly adds to the marketing risks faced by farm and agribusinesses who buy and sell wheat. This is especially the case when transactions will occur in the future, and despite what economists and meteorologists will attempt to claim, it’s rather difficult to predict the future.

However, there are at least some market-based tools that are available to gain some insights about what markets believe (given existing and available information) will happen to protein premiums and discounts in the future. One such tool is futures contract prices, which broadly represent the aggregation of information about national (and increasingly global) supply and demand conditions.

Now, you might be thinking: “There are no futures contracts or prices for wheat protein. How can futures markets be useful?” You’re right. Futures contracts only exist for commodities rather than specific quality characteristics of those commodities. However, the structure of two futures contracts—the hard red spring wheat contract (traded on the Minneapolis Grain Exchange; MGEX) and the hard red winter wheat contract (currently traded on the Chicago Mercantile Exchange but still widely known by the acronym KCBT from when they were traded on the Kansas City Board of Trade)—provides an opportunity to indirectly gauge the broad supply and demand characteristics in the wheat protein market.

Here’s the idea: The MGEX futures contract is priced for hard red spring wheat with a 13.5% protein content level. The KCBT futures contract is priced for hard red winter wheat with a 11% protein content. Therefore, the difference (spread) between the MGEX and KCBT contract prices represents that additional premium that markets are willing to pay to obtain 13.5% protein content wheat rather than 11% protein wheat.

Therefore, the MGEX-KCBT price spread provides information about how much more (if the spread is wider) or less (if the spread is narrower) markets value higher protein wheat relative to lower protein wheat. If the MGEX-KCBT spread is wider, then this suggests that elevators are likely to value (and offer higher premiums) for higher-protein level wheat. Conversely, a narrower MGEX- KCBT spread suggests that markets are less likely to offer high protein level premiums.

How would you know whether markets are currently valuing protein premiums to be higher or lower than average? Below is a graph of MGEX-KCBT spreads since 2010. The dashed line indicates the long-run average spread of approximately $0.63 per bushel (or approximately $0.25 per bushel per 1 percentage point protein level).

In the past two years, when high-protein wheat was a major deficit in the United States and the world, the MGEX-KCBT spread has reached as high as approximately $2.75 per bushel ($1.10 per bushel per percentage point). This was a signal to producers and elevators that the demand for higher-protein wheat significantly exceeded the available quantities supplied, and there was significant incentive to market higher-protein wheat as soon as possible. In the 2018/19 marketing year, however, the MGEX-KCBT spread has dropped below the long-run average, sending a signal that markets have a sufficient amounts of higher-protein wheat. If storage space is available, a farm business may consider storing their higher-protein wheat until a period when the MGEX-KCBT spread begins to rise again.

What’s the current MGEX-KCBT spread? You can take a look for yourself by visiting a new website that Kate Fuller and I developed for collecting wheat price data: www.montana.edu/basis. The website contains a ten-year archive of the spread and updates with new information on a daily basis.

How do you make decisions about marketing wheat with different protein levels? How do you manage the price risks? Leave a comment and let us know.

(Photo by Brad Higham is licensed under CC BY 4.0)