Key Insights:

- The most recent 10% tariffs placed on $200 billion worth of Chinese goods include items frequently purchased by U.S. consumers.

- The tariffs will increase U.S. companies’ costs of acquiring and marketing these products. However, some portion of these costs will be passed on to consumers in the form of higher prices.

- The extent to which prices rise depends on numerous factors, including the number of consumers in a market and the number of retail outlets.

- In rural communities—especially in the northern Great Plains—where population densities are low and the number of stores are limited, firms are much more likely to pass through additional tariff costs by charging higher prices.

- These impacts may be exacerbated by the fact that median disposable incomes also tend to be lower in rural communities than in more urban locations.

This past Monday, September 17, 2018, the Trump administration announced that it will impose an additional $200 billion worth of tariffs on imported Chinese goods. While this announcement represents a further escalation of the on-going trade dispute with the Asian country, the policy is unique to previous trade restrictions in that it imposes a 10% tariff on many final consumer goods. This tariff is set to rise to 25% at the beginning of 2019.

The products included on the tariff list range from various seafood items; prepared vegetables and fruits; nuts; pastas; soaps, shampoos, make up, and hairspray; rain jackets; machinery belts; particleboard; yarns and fabrics; saw blades, hammers, and wrenches; manure spreaders; air conditioners; engines, gear boxes, and radiators; spark plugs; televisions; to mattresses and lamps. Here’s a full list from the U.S. Trade Representative office.

While the tariffs will directly impact only the companies that import and sell these items (by increasing their costs), it is almost certain that the actual incidence of the cost increase will be partially passed on to consumers in the form of higher retail prices. What is important to note, however, is that the amount of the additional costs that will be passed on to consumers depends a lot on where those retailers operate. And rural communities are likely to experience a higher pass-through of these costs. Here are at least two reasons.

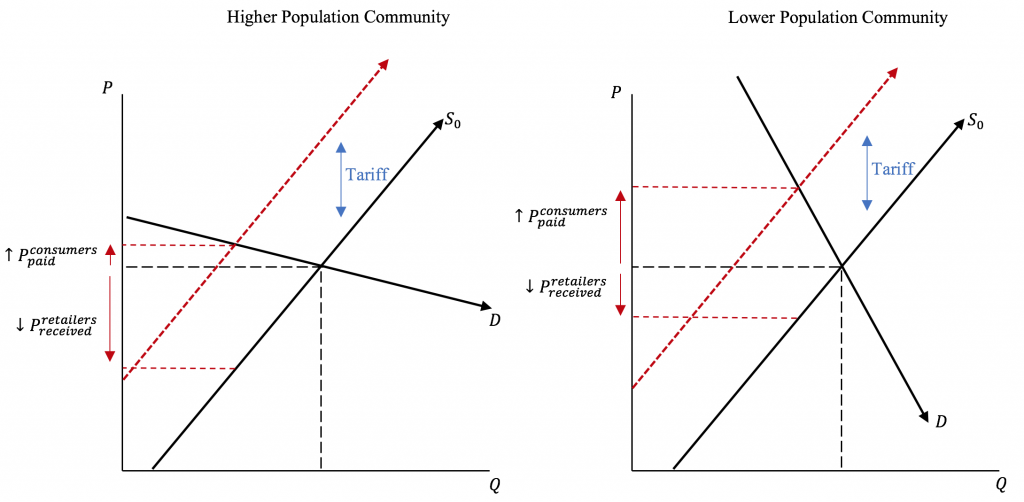

First, the ability of retailers to pass through costs and raise prices depends on the population size of the community within which the retailer operates. In locations with larger populations, tastes and preferences tend to be more diverse and the choice of products available to consumers is also greater. Therefore, as the figure below shows, retailers pass through a smaller proportion of their cost increases to consumers in these more densely populated locations. In smaller communities, a larger portion of 10% tariff is likely to be borne by consumers.

As the figure shows, even though the size of the tariff is the same in both types of communities—higher and lower population—the changes in the actual prices paid by consumers and those received by producers is different. In the higher-population communities, retailers have a more limited ability to pass through the tariff costs to consumers, resulting in a smaller change in consumer prices. However, in lower-population communities, the pass-through is significantly higher, with the consumers taking on the greater burden of the trade restriction.

A second, somewhat related factor that’s likely to create more pronounced impacts on smaller, rural communities is the fact that in these communities, there may be many fewer retailers who compete against one another. When there are more companies that are competing with each for customers, consumers typically benefit because the competition leads to lower prices.

However, in many smaller, rural communities, there may be only one or very few retailers. In this case, these retailers have the ability to pass through a greater percentage of their cost increases to consumers in the form of higher prices. In the most extreme cases when a retailer is essentially a monopolist within a community (e.g., a similar retailer in another location is so far away that it may be too costly to drive there, especially in the case of smaller items such as shampoos or spark plugs), the retailer can pass through 50% or more of the cost increase. (It is important to acknowledge the caveat that long-run reputation and good-will effects exist, and retailers in smaller communities may limit the extent to which they pass through their costs, even if these businesses have substantial market power.)

Lastly, the extent to which these price increases are “felt” by consumers also depends on their income and the proportion of their income that is spent on everyday items for their household and business. For example, the USDA Economic Research Service noted that rural household income is approximately 20–25% less than in urban areas. This implies that even a small increase in prices is likely to have a relatively greater economic effect on a household in a rural community.

And unlike the policies implemented to counteract economic losses from retaliatory tariffs on specific agricultural commodities, it will be much more difficult to isolate the impacts of trade constraints on final consumer goods and even harder (likely impossible) to equitably compensate consumers.

Have you felt the impacts of the 2017–18 trade dispute at your local stores? Have you noticed differences when shopping in your community retailers or those in larger cities? Let us know.

(Photo by QuoteInspector is licensed under CC BY 4.0)