Harvest of small grains and pulses crops has largely wrapped up across Montana. Crop yields ranged from average to catastrophic, with the ongoing drought to blame for major yield losses. With bushels that were harvested, farmers must now decide whether to sell or store. Many farmers will have enough on-farm storage to hold this year’s crop and understand the strong seasonal pattern that exists in local cash grain prices. Prices are usually lowest at harvest, and higher in the spring. For this reason, many grain marketing experts are hesitant to recommend off-the-combine sales at harvest (For example, see the last section of this blog post.)

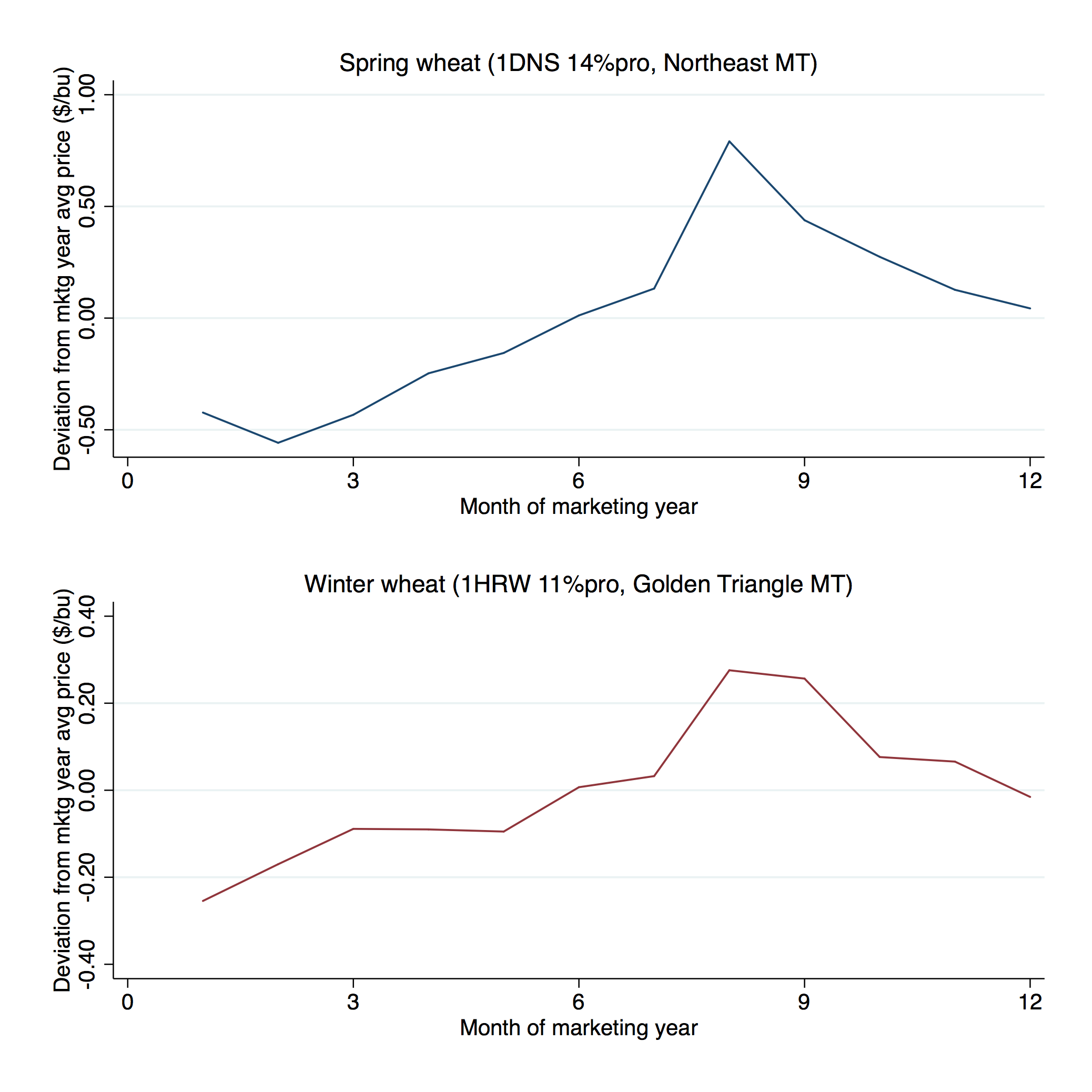

Montana cash wheat prices exhibit to strong seasonality. The graph below shows the average difference between the cash price in a given month of the marketing year and the annual average price for spring wheat in Northeast Montana and winter wheat in the Golden Triangle over the period from 2005-2016. The marketing year in this graph runs from July to June. For spring wheat, cash sales at the seasonal low in August would be approximately $1.25/bu lower than prices at the seasonal high in February. Similarly for winter wheat, cash sales at the seasonal low in July would be about $0.45/bu lower than seasonal highs in February and March.

Why sell today if you know market conditions are likely to get better in the future? First, the graph only shows average price differences over this period. In some years, farmers storing grain would earn higher returns than shown. In others, they would have earned higher prices selling off the combine in July and August.

Storage costs make current and future prices like apples and oranges

More importantly, comparing cash prices throughout the year isn’t an apples-to-apples comparison. The sell or store decision is more complicated because storage isn’t free. There are costs to moving grain (hauling and augering) and maintaining grain quality (aeration and drying). Even grain stored in ideal conditions will experience some shrinkage and quality deterioration. These physical costs of storage will vary from farm to farm and year to year, but may be conservatively estimated at approximately $0.10/bushel. This physical cost is often far below the difference in harvest and springtime prices, so storage still appears to be a sound marketing strategy.

Not so fast. There is an additional, hidden cost to storage. Farmers who sell today get paid today. Farmers who store aren’t paid until the grain is delivered at some point in the future. For the farmer considering delivery now in September or storing until next May, he or she needs to adjust prices for the fact that receiving a given amount of money in May is not the same as receiving the same amount today. This is the economic concept of time value of money.

Interest rates measure of the time value of money and allow us to make prices for future delivery comparable to prices today. To discount the expected price for delivery next May we divide it by (1 + r) where r is the interest rate over the eight months between now and May. Similarly, to compare the current September price to the expected future price, we multiply the September price by (1+r). (To convert an annual interest rate to a September-to-May rate, we multiply the annual interest rate by the proportion of the year we expect to store, or 8/12 for the September to May period.)

What interest rate should be used to compare today’s price to the expected May price? The relevant interest rate likely varies from farmer to farmer. If there are bills that must be paid and selling grain is the only way to generate the cash needed to pay those bills, the effective interest rate is very high. For many farmers, a useful benchmark is the interest rate paid on operating loans or other debt. Every dollar earned from the sale of cash grain today can be used to offset the interest paid on these loans. The current average farm operating loan rate according to the Federal Reserve Bank of Kansas City is approximately 6% (annualized).

How to make apples-to-apples price comparisons

As of this writing, the cash price for No. 1 Hard Red Winter Wheat with 11% protein in Great Falls was about $3.98/bushel. Adding storage costs to this price gives us the minimum price we need to receive in May to make storage profitable:

Breakeven price for stored grain = price today x (1 + interest rate) + physical storage costs

= 3.98 x (1 + 0.06 x (8/12)) + 0.10 = 4.24

Therefore, sales in May need to made at $4.24/bu or better to make storing grain over this period profitable.

Bottom line: Before making the sell or store decision, estimate both interest and physical storage costs to make apples-to-apples comparisons of current and expected future prices. In forthcoming posts, I’ll discuss two additional components of the sell or store decision: forming expectations about prices for future delivery and dealing with post-harvest price changes.

(Photo by UnitedSoybeanBoard is licensed under CC BY 4.0)