I always look forward to seeing all the participants at our annual outlook conference and it’s an honor to share my thoughts as part of the conference. This year I focused on the long run trends in cattle markets (full presentation). Below is a summary of those thoughts.

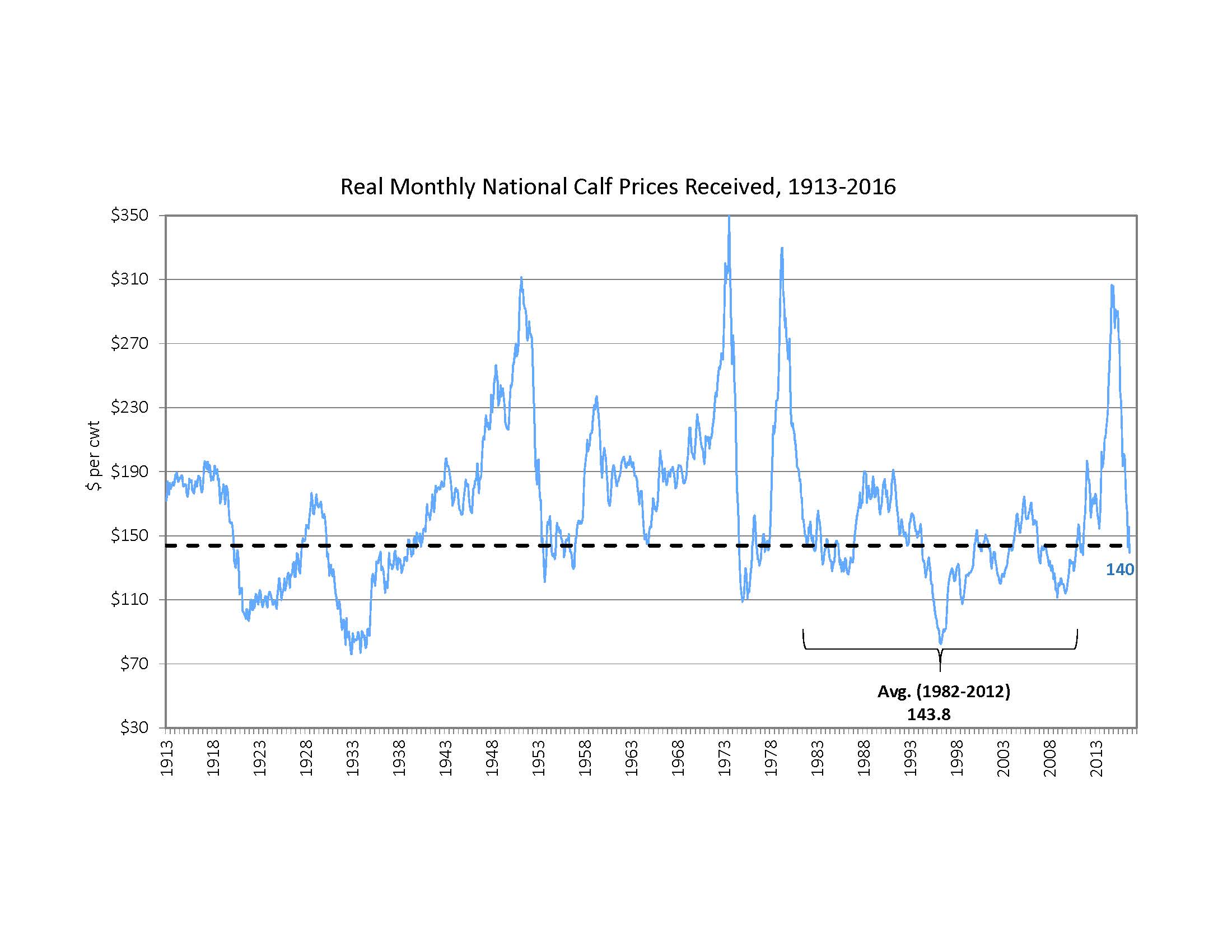

Real calf prices have been flat over the last 100 years.

This trend is in contrast to the downward trend experienced in major grains, as pointed out by Joseph Janzen at the conference. Technology gains and lower cost of production in wheat have led to a long run reduction in real price. While it is clear that we have a more productive beef production system than 50 years ago, these gains have been offset (in terms of lower real prices) by reduced inventory and growing demand. Thus, the 20-year national average real calf price prior to the recent run-up (1982-2012) is around $1.43 per pound. Current calf prices are lower than the long run average.

Current calf prices are lower than the long run average.

Assuming a 25 cent basis adjustment from CME feeder cattle contracts, the expected price for next October for Montana calves was around 1.38 (at the time of the presentation). Futures prices have increased about 6 cents since then, placing the expected calf price to be $1.44 next fall. This seems low relative to the last few years, but is largely in-line with the long run average real price. Without any significant market shocks (when does that ever happen??), this is around where we would expect calf prices to converge in the long run.

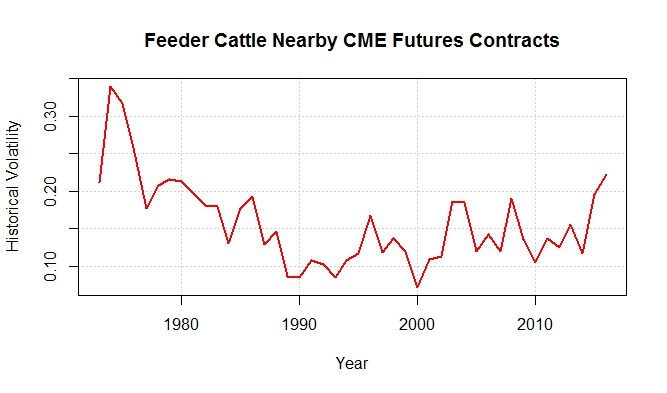

Cattle price volatility is elevated, but this isn’t surprising.

Historical volatility is a measure of how much the futures price moves within a given amount of time. Since most contracts are based on the futures market or other nearby cash markets, this volatility should also inform local price volatility. So far this year, annual historic volatility is around 23%, which is a level that is consistent with the volatility following the price spikes experienced in 1973 and 1979. Volatility is measured as a percent of the price, which implies that actual deviations (in dollar terms) are larger this year. MCOOL is not to blame for the fall in cattle prices.

MCOOL is not to blame for the fall in cattle prices.

It is tempting to blame the repeal of MCOOL for the falling cattle prices. While it is true that the repeal of MCOOL occurred at the peak of cattle prices, there are fundamental reasons why cattle prices were expected to fall without any MCOOL repeal. A recent report prepared for the USDA Chief Economist showed that MCOOL has adversely impacted beef producers and consumers. Further, another recent study showed that the implementation of MCOOL failed to shift demand in any significant way. A nice review of these issues as they relate to MCOOL was provided by our keynote speaker, Jayson Lusk.

Prices for ranchers are more sensitive than other segments of the beef supply chain.

Savy ranchers have noticed that beef prices haven’t fallen nearly as much as calf prices. While it is tempting to think that this is due to market concentration and price manipulation in the meat processing sector, there are some basic economic concepts at work. A nice overview of these concepts were provided in a recent post by Anton Bekkerman). Essentially, as prices move, producers respond with changes in inventory. For example, as beef prices increase, the price given to ranchers increases and those ranchers are likely to respond by increasing their supply. By the way, this happened in 2014-2015. If ranchers can’t increase their supply fast enough (economists call this inelastic supply), then they will be subject to larger price movements. Since consumers have a relatively elastic demand for beef (they can also buy chicken and pork) and processors are able to adapt their supply quicker than ranchers, the prices that ranchers receive tends to be more volatility than other segments of the beef sector.