I was recently invited to be part of a panel at the 2019 Montana Organic Association’s annual meeting. The panel was focused on better understanding the challenges and opportunities for resilience of Montana’s organic producers in light of uncertain climatic and market conditions, and I was asked to provide the economics / social science perspective.

As I thought about the trends I’ve observed in Montana and the research associated with agricultural and food production and markets, there were eight areas that became apparent in representing the opportunities and challenges faced by Montana’s organic industry.

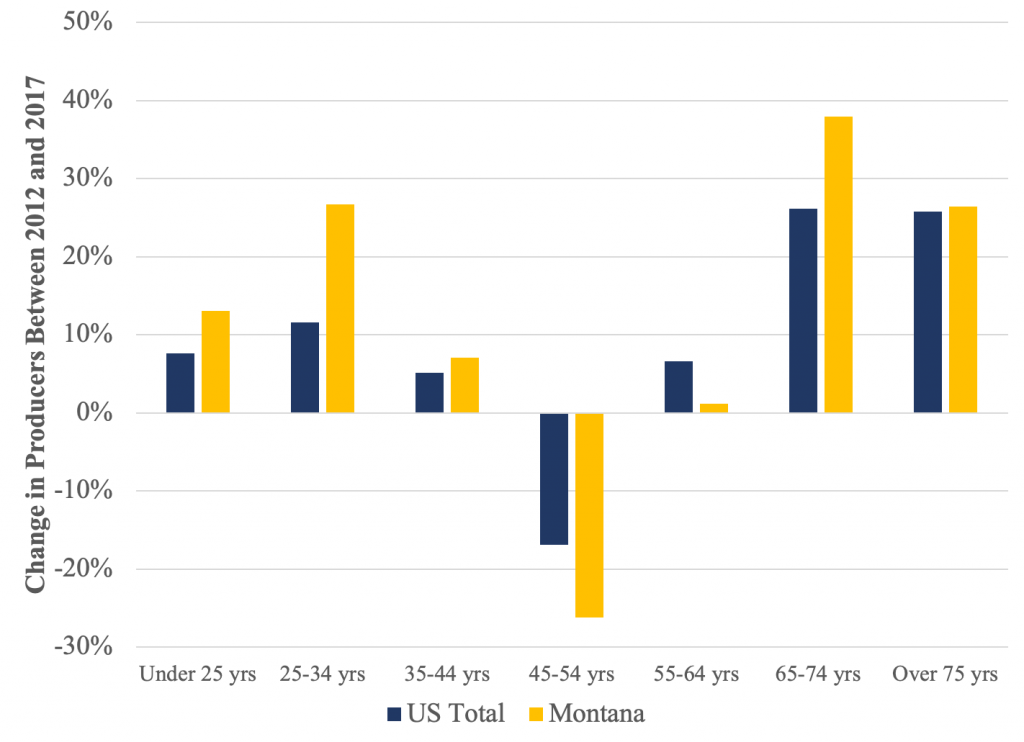

1. Montana is outpacing the United States in the number of young producers entering the food and agriculture industry.

The graph below shows the changes in agricultural producers across different age brackets, in the United States and in Montana between 2012 and 2017 (i.e., the two years when the Census of Agriculture was conducted). The data indicate that in Montana, producers who are under 25 and those between 25 and 34 increased by 13% and 26%, respectively. This is approximately twice as much as the average increase in young producers across the United States.

Notes: Data from the US Census of Agriculture, 2012 and 2017

Younger food producers have been repeatedly shown to be more likely to adopt organic production practices and adopt new production and management technologies. This could represent a significant opportunity for Montana’s organic industry to grow at a faster pace than in other U.S. regions.

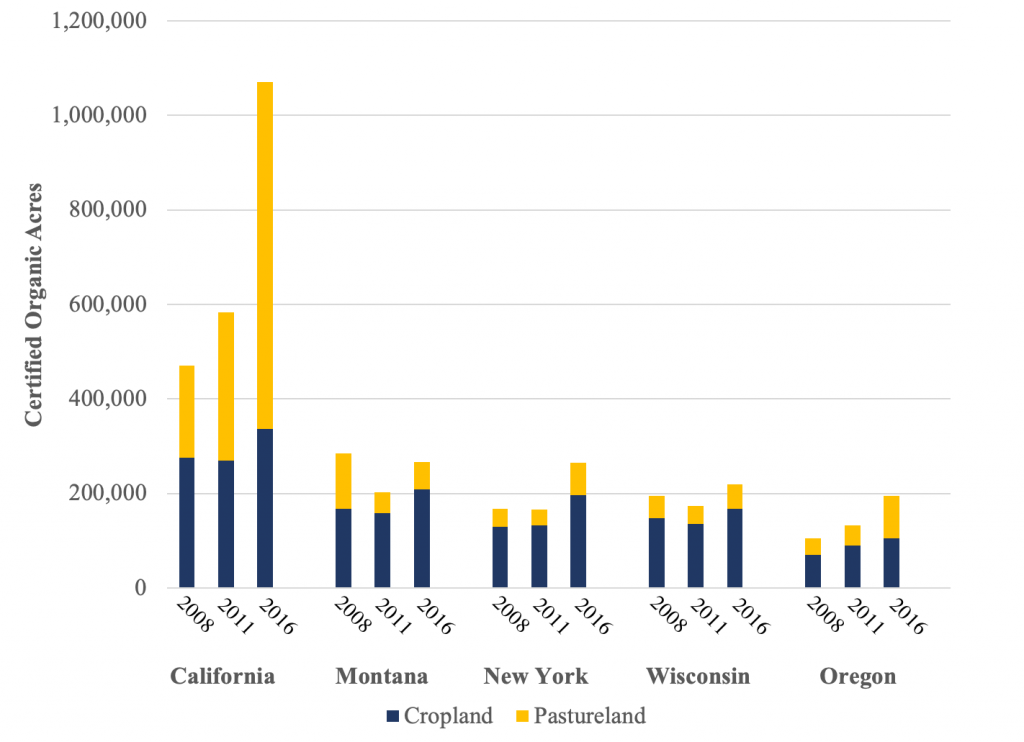

2. Montana has a higher-than-average land and human capital infrastructure for organic production.

Montana has traditionally been one of the leaders in the total acres allocated to organic production. In fact, Montana remains as the state with the second largest number of organic production acres in the United States. Perhaps more importantly than having a large existing base of certified-organic land is the fact that there are a critical mass of producers who understand and have knowledge about how to transition and be successful in organic production. As new producers potentially look to organic production and existing producers consider diversifying their management portfolio, this existing knowledge base can be particularly beneficial to leveraging peer networking and learning opportunities among existing and new producers.

Notes: Data from the USDA National Agricultural Statistics Service.

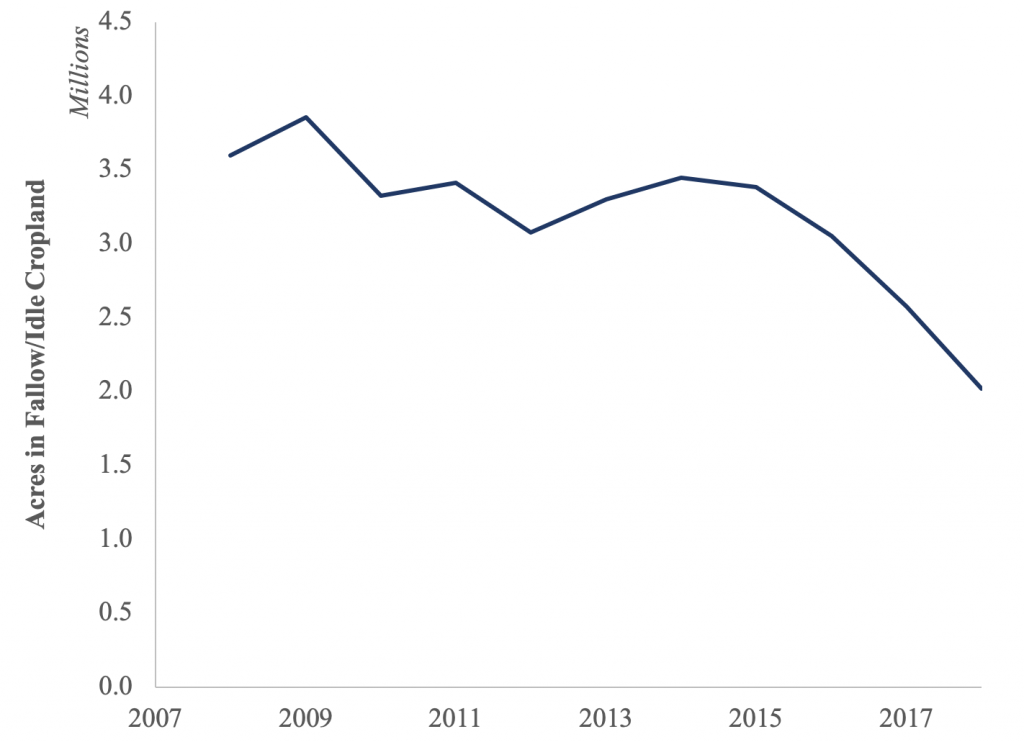

3. Montana producers have increasingly become more diversified and production-intensive.

As the graph below shows, the number of fallow and idle cropland acres in Montana has consistently dropped over the past decade, and is rapidly nearing being 50% lower than in 2007. This is one of the many indicators that Montana producers have increasingly altered their cropping systems to be more intensive. Producers have also increased their portfolio of crops. While 10 or 20 years ago, the wheat–fallow rotation could have described the vast majority of dryland farmers in Montana, it isn’t the case today. Peas, lentils, chickpeas, canola, hemp, flax, among other pulse and oilseed crops have rapidly replaced fallow and are not likely to go away.

Notes: Data from the USDA National Agricultural Statistics Service Cropland Data Layer.

Producers’ who have recently adopted more diverse and intensive production systems are much more likely to have the skills, confidence, and willingness to consider further diversification, such as organic production.

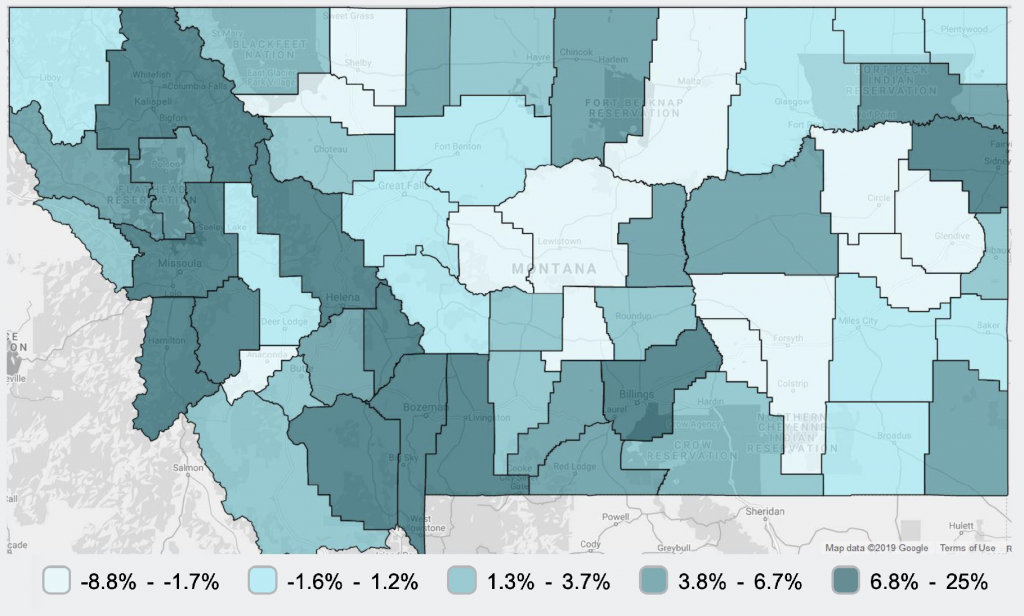

4. Changing Montana demographics and potential for local market development.

If you’ve lived in Montana during the past 5-10 years, you’ve probably noticed the rapid influx of new residents. The map below from the U.S. Census Bureau shows that between 2000 and 2018, much of this in-migration is concentrated in the western and southwestern parts of the state. Additionally, data from the Internal Revenue Service indicate that Montana has the third-highest rate of in-migration by individuals earning more than $200,000 annually.

Notes: Map courtesy of the US Census Bureau.

The combination of an increase in population and, in particular, individuals with a relatively high disposable income offers some potential that there is likely to be a higher demand for organic foods in local markets (since organic products typically have a price premium).

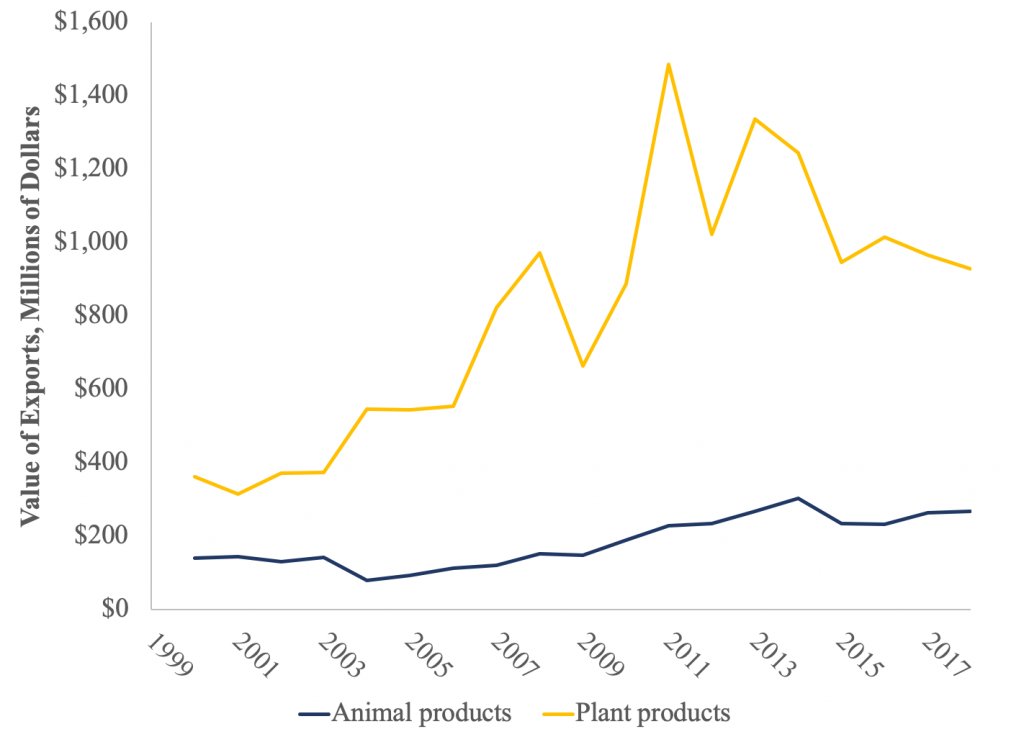

5. Strong existing export infrastructure for agricultural products.

The vast majority of Montana agriculture is exported outside of the state. Small grains and pulse crops in particular are exported to international destinations, although as shown in the figure below, the value of international animal product exports has also risen over the past twenty years. This existing export infrastructure and existing trade relationships with international partners could be leveraged to incorporate organic exports. Montana agricultural producers have historically focused on the production of high-quality grains and livestock, and this rapport and reputation could be beneficial for making in-roads for marketing high-quality organic products.

Notes: Data from the USDA Economic Research Service.

Notes: Data from the USDA Economic Research Service.

6. Montana does not have the same productivity as other U.S. regions.

While agricultural production remains one of Montana’s primary industries and Montana has been a leader in organic production over the past 10-15 years, northern Great Plains producers may be at a competitive disadvantage if (when) farmers and ranchers in other, more productive regions take on more organic production. As the map below shows, the average value of agricultural production in Montana is right around average, relative to other parts of the United States.

Notes: Map generated using the 2017 Census of Agriculture data.

There are multiple reasons for this—including land productivity, precipitation and weather variability, proximity to processors, proximity to final producers, expansiveness of transportation infrastructures, among others—but the outcome is the same: if producers in regions where agricultural production has been historically more valuable decide to enter organic production, Montana’s organic industry is likely to be adversely affected.

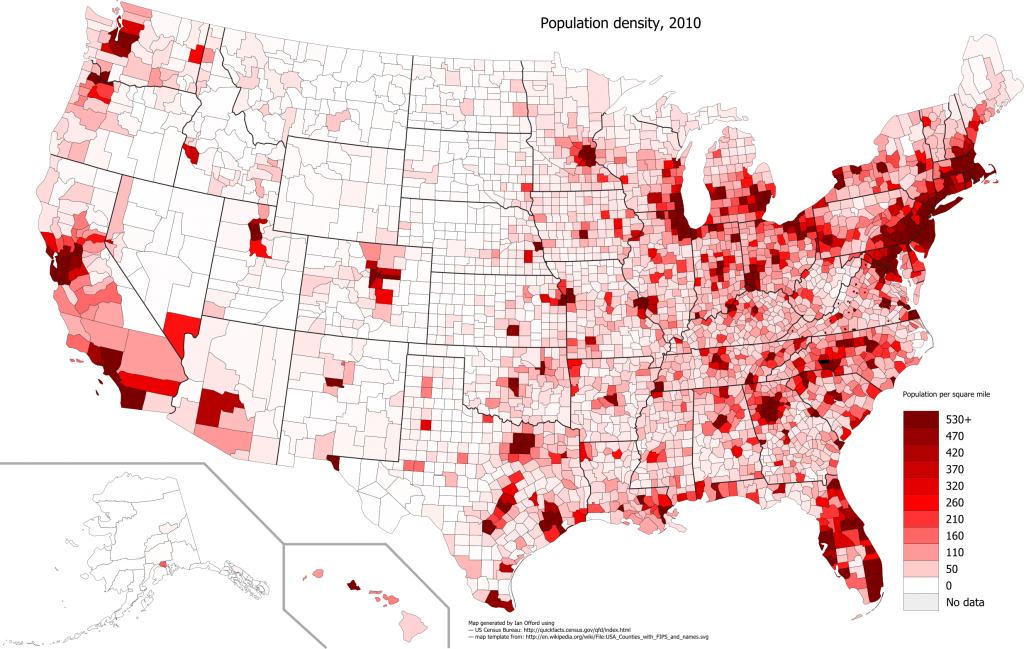

7. Montana is simply not very close to densely populated U.S. consumer locations.

Montana only crossed the million mark for population in the early-2010s, and it also is home to the most remote city in the United States. There is a definite charm and appeal to living in a state that’s so expansive and yet so sparsely populated. However, when it comes to marketing opportunities, Montana’s remoteness does create a number of challenges.

The map below shows that population density by county from the most recent U.S. Census. The majority of the most densely populated U.S. cities are nowhere near Montana. When in comes to marketing organic food products, this is a problem because the additional costs for transporting organic products from Montana to major consumer centers could price these products above what individuals are willing to pay (especially because organic products already have a significant price premium relative to conventionally produced foods). This can be exacerbated if producers in other states—which are closer to major population locations—enter organic production.

Notes: Map courtesy of the US Census Bureau.

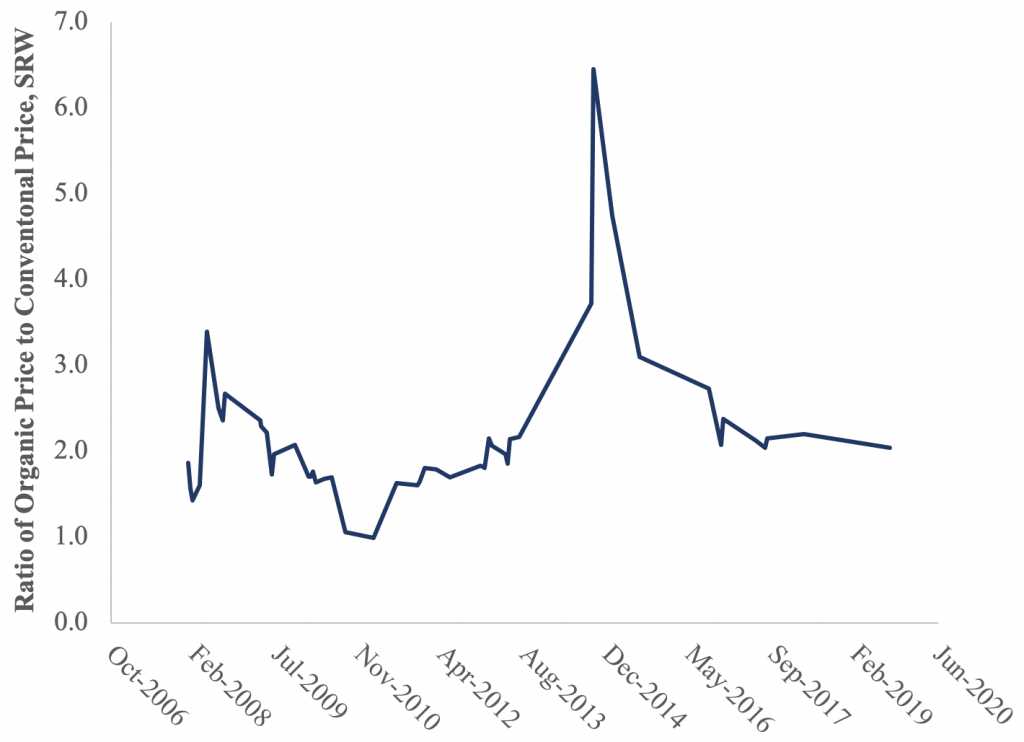

8. Relative organic-to-conventional prices fluctuate and may limit entry (or create exit) for organic producers.

For many producers—and perhaps more so for farmers and ranchers who currently use conventional production methods—one of the critical decision factors in entering organic production is the relative price of organic commodities to conventional commodities. That is, many want to know: Is it worth incurring additional time and money costs for producing organically relative to my existing opportunities for producing conventionally?

The figure below shows that this organic-to-conventional price ratio (the figure shows the relationship for soft red winter wheat between 2006 and 2019) is on average approximately 2-to-1, but can vary significantly. Historically, when the price ratio exceeds 2.0, there have been more organic acres entering production. However, when the price ratio fell below 2.0—especially for an extended period, such as 2009-2012—many fewer organic acres entered and in Montana, there were numerous organic farmers who transitioned all of their organic land back to conventional practices.

Notes: Data from the USDA Agricultural Marketing Service.

Over the past 2-3 years, the organic-to-conventional price ratio has been relatively stable at its historical average. But, how it changes in the future is, well, uncertain.

What factors are influencing your decisions to enter or not enter organic production? Do you see Montana as becoming an even greater factor in U.S. organic production?

(Photo by Tim Psych is licensed under CC BY 4.0)