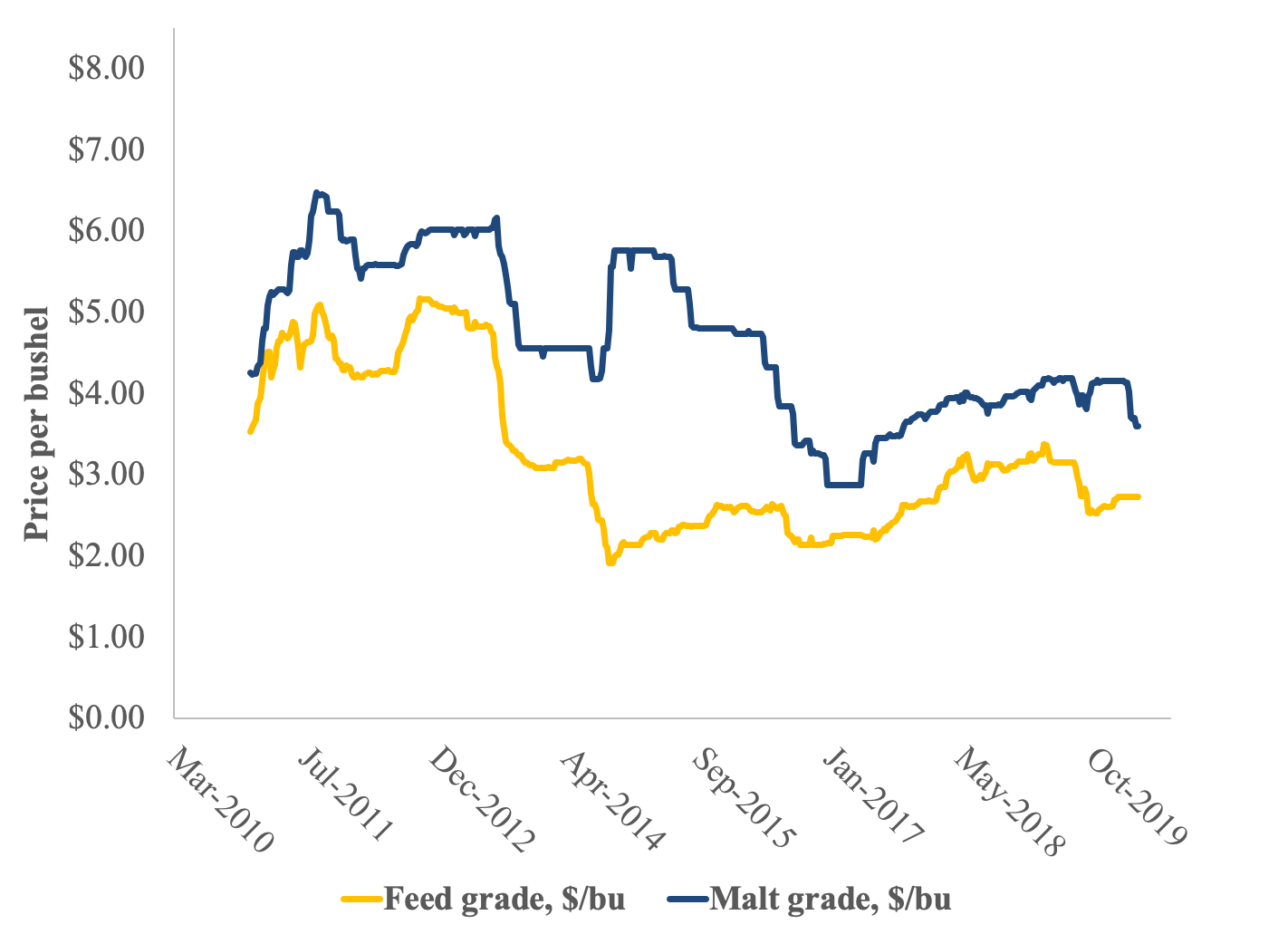

After several years of slow but consistent price growth, northern U.S. barley markets are exhibiting divergent price patterns in the wage of the COVID-19 public health emergency. The figure below shows the extent to which the northern U.S. barley markets have varied over the past decade.

Figure notes: Data from the USDA Agricultural Marketing Service. Prices represent average barley spot market bids in Montana.

The price data suggest indicate that markets for feed grade barley declined by approximately 20% at the time of the 2019 harvest, but have since slightly recovered and have remained relatively steady around $2.75 per bushel. However, malt barley prices had remained relatively strong after the 2019 harvest, before declining by approximately 13% since late-February.

While the stability of feed barley prices is somewhat surprising given the drop in the prices of other feed grains such as corn and soybeans, the lower malt barley price can most likely be linked to the declining consumer demand prompted by the shelter-in-place and adverse economic impacts of the COVID-19 pandemic. As restaurants and bars are ordered to be closed, unemployment numbers have soared, and general economic uncertainty is abound, consumers are less likely to purchase such luxury goods as beer, wine, and other alcoholic beverage products. It’s likely that the extent to which this demand-driven decline continues to affect the malt barley market will depend on the length to which the public health emergency continues to affect the economy and consumers’ confidence in the economy.

While any forecasts for barley markets should be interpreted with some caution due to the uncertainty of COVID-19 impacts on the economy, there could be some insights from these forecasts if there is a relatively rapid recovery from the pandemic. Several recent forecasts for barley prices (made prior to the COIVD-19 outbreak in the United States)—shown in the table below—reflect relatively stable, albeit slightly weakening, markets. The most recent estimates from the August 2019 Food and Agricultural Policy Research Institute (FAPRI), March 2020 Agri-food Canada (Ag-Can, adjusted for U.S. dollars per bushel and for malt quality), and February 2020 USDA World Agricultural Supply and Demand Estimates (USDA) reports show that malt barley spot prices for the remainder of the 2019/20 marketing year are expected to be between $4.62 and $5.75 per bushel. For the 2020/21 marketing year, there is a consensus that prices are likely to moderate downward.

| Marketing year | FAPRI (malt) | USDA (malt) | Ag-Can (malt) |

| 2019/20 | $4.62 | $4.65 | $5.04–$5.75 |

| 2020/21 | $4.42 | $4.30 | $4.79–$5.50 |

| 2021/22 | $4.41 | $4.30 |

Table notes: FAPRI is the August 2019 FAPRI Baseline Update Report, and USDA is the February 2020 USDA World Agricultural Supply and Demand Estimates, Ag-Can is Agri-Food Canada March 2020 Outlook for Principal Field Crops report. Ag-Can feed barley prices were converted to malt prices using the average feed grade discount in Montana between 2000 and 2019, which has been 64.5%.

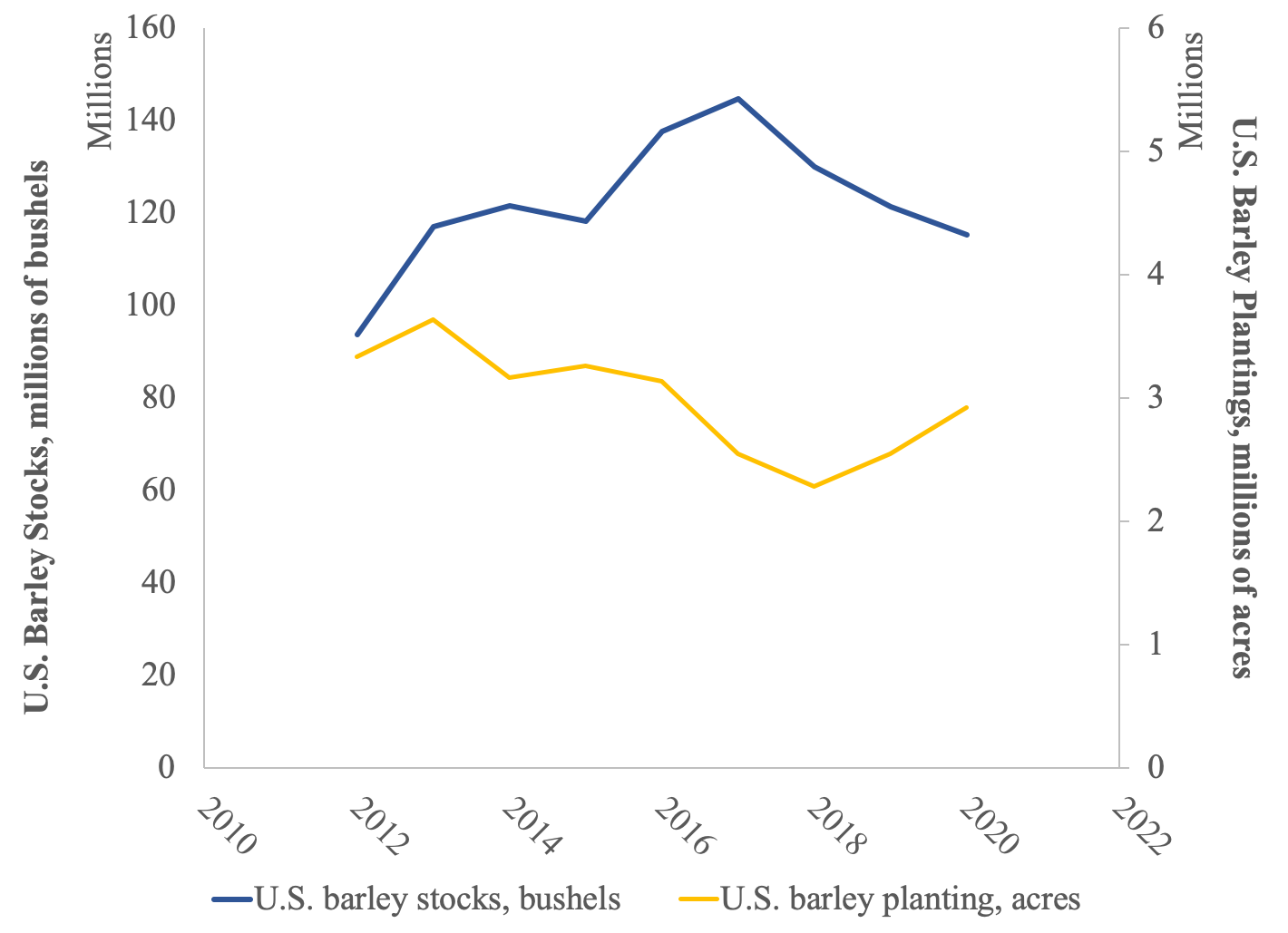

The continued climb in barley prices over the past two years has been primarily due to lower plantings and continued high inventories in the barley market. The figure below shows that March 2018 inventories represented the highest barley stocks in decades, resulting in low prices during the 2017/18 marketing year. Since then, as stocks continued to be depleted and planted acres dropped below 3 million for three years in a row, barley prices have slowly but steadily crept up. In 2020, barley acres are projected to be approximately 2.91 million in the United States, the closest they’ve been to hitting the 3-million mark since 2016.

Figure notes: Data from the USDA National Agricultural Statistical Service.

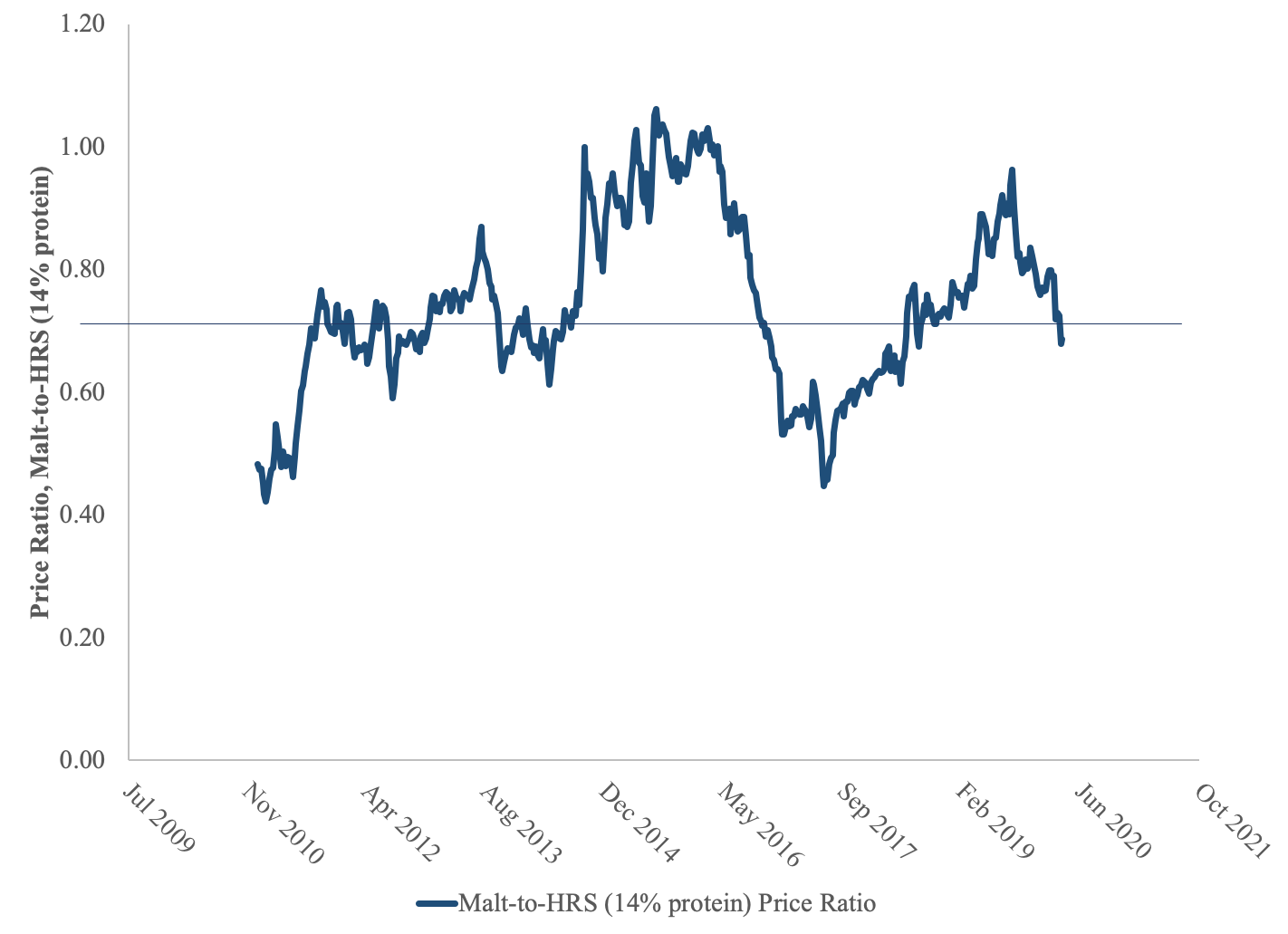

Another market signal that can be used to evaluate the extent to which markets value barley relative to other crops is the price ratio. Crops in northern U.S. dryland and irrigated rotations are often rotated with spring wheat. The graph below shows ratios of malt barley price to current hard red spring wheat (14% protein content) prices. Relative to the ten-year average, recent price ratios trends indicate a weakening trend of markets’ valuation of barley relative to spring wheat. This suggests that while barley acres increased in 2020, producers may have chosen to plant less barley than they may have planted if those decisions were made a few months ago.

Figure notes: Horizontal line represents ten-year averages.

Figure notes: Horizontal line represents ten-year averages.

Lastly, it is important to consider barley production costs. Malt barley cost estimates from North Dakota State University indicate that 2020 production costs are expected to be just over $200 per acre. These costs are 3.5% higher to those estimated for 2019, suggesting that most operations are likely to also experience similar or slightly higher expenditures in 2020 relative to those in 2018.

| Costs per acre | |||

| Region | Direct | Indirect | Total |

| N. Dakota, Northwest region | $128.03 | $76.10 | $204.13 |

| N. Dakota, Southwest region | $132.34 | $75.49 | $207.83 |

Table notes: NDSU Projected 2020 Crop Budgets for the Northwest and Southwest agricultural statistical regions.

What factors do you consider important in evaluating upcoming barley markets?

(Photo by Mustafa Khayat is licensed under CC BY 4.0)

1 Comment

Nice article.

I do have some questions about what you consider Direct Costs and Indirect costs?

North and South Dakota numbers do not fit well with an irrigated malt barley crop here in Montana, but may align more with dryland production in Montana.

Just as an FYI; I figure my COP for irrigated malt barley in North Central Montana to be around $425-$450/ac. Usually expecting about a 115 bu/ac yield.

Thanks,