The Paycheck Protection Program (PPP) was launched by the Small Business Administration and Department of the Treasury on April 3, 2020 with $349 billion allocated to the program. This study is based on payroll data in the Statistics of US Businesses (SUSB) for 2017 and inflated by the increase in consumer price index (5%) from June 2017 to June 2019. This study considers how the PPP funds would be allocated across small businesses in Montana if all Montana small business were successful in applying for these funds.

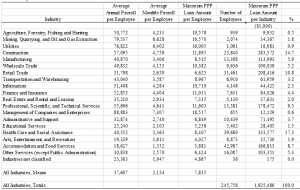

PPP is based on average monthly payroll expenditures. Table 1 summarizes average payroll paid to employees of small businesses in all industries. Employees in management of companies and enterprises ($88,883), mining, quarrying, and oil and gas extraction ($79,537), and utilities ($76,822), earn the highest salaries/wages. Employees working for accommodation and food services ($18,627) and arts and entertainment ($19,329) earn the lowest salaries.

Table 1 Average Payroll and Maximum Number of PPP Loans by Industry in Montana The maximum loan available under the PPP is based on the monthly average payroll of the small business. Table 1 computes the maximum loans available for each industry. For instance, let’s consider the accommodations and food service industry. The average annual payroll is $18,627 per employee; however, the PPP requires you to report the average monthly payroll over the past 12 months (or $18,627/12 = $1,552). The maximum loan is 2.5 times the average monthly payroll, or $3,881 per employee. Multiplying the monthly payroll ($3,881) times the number of employees in the industry (42,987) is the maximum loan available to the entire accommodations and food service industry is $166.8 million, or 8.7% of the loan funds available to all industries in Montana.

The maximum loan available under the PPP is based on the monthly average payroll of the small business. Table 1 computes the maximum loans available for each industry. For instance, let’s consider the accommodations and food service industry. The average annual payroll is $18,627 per employee; however, the PPP requires you to report the average monthly payroll over the past 12 months (or $18,627/12 = $1,552). The maximum loan is 2.5 times the average monthly payroll, or $3,881 per employee. Multiplying the monthly payroll ($3,881) times the number of employees in the industry (42,987) is the maximum loan available to the entire accommodations and food service industry is $166.8 million, or 8.7% of the loan funds available to all industries in Montana.

If all small business competed for this PPP funding, health care and social assistance (17.3%), construction (14.7%), and professional, scientific, and technical services (9.3%) would capture over 40% of the total funds (Table 2). Those small business impacted the most severely by the corona virus pandemic (accommodations and food services, retail trade, and arts, entertainment and recreation) would capture nearly 22% of the total funds.

The PPP is a unique opportunity for small businesses to obtain grant funding. If the small business maintains their workforce and doesn’t lower payroll expenses over the 8 weeks of this program, then the loan is forgiven. In most small businesses, about 75% to 80% of the funds will be used for payroll and 25% used for rent, mortgage interest, and utilities.

Other small businesses, such as farmers and ranchers, have many grant programs available to them for disaster assistance, such as the price loss coverage and agricultural risk coverage programs for crop producers and the livestock forage program and livestock indemnity program for livestock producers. However, similar programs have never been offered to small business owners. The PPP provides an excellent opportunity for small business owners to receive disaster support in the form of a grant, rather than loan. If your small business has been damaged by corona virus pandemic, it’s time to apply.

(