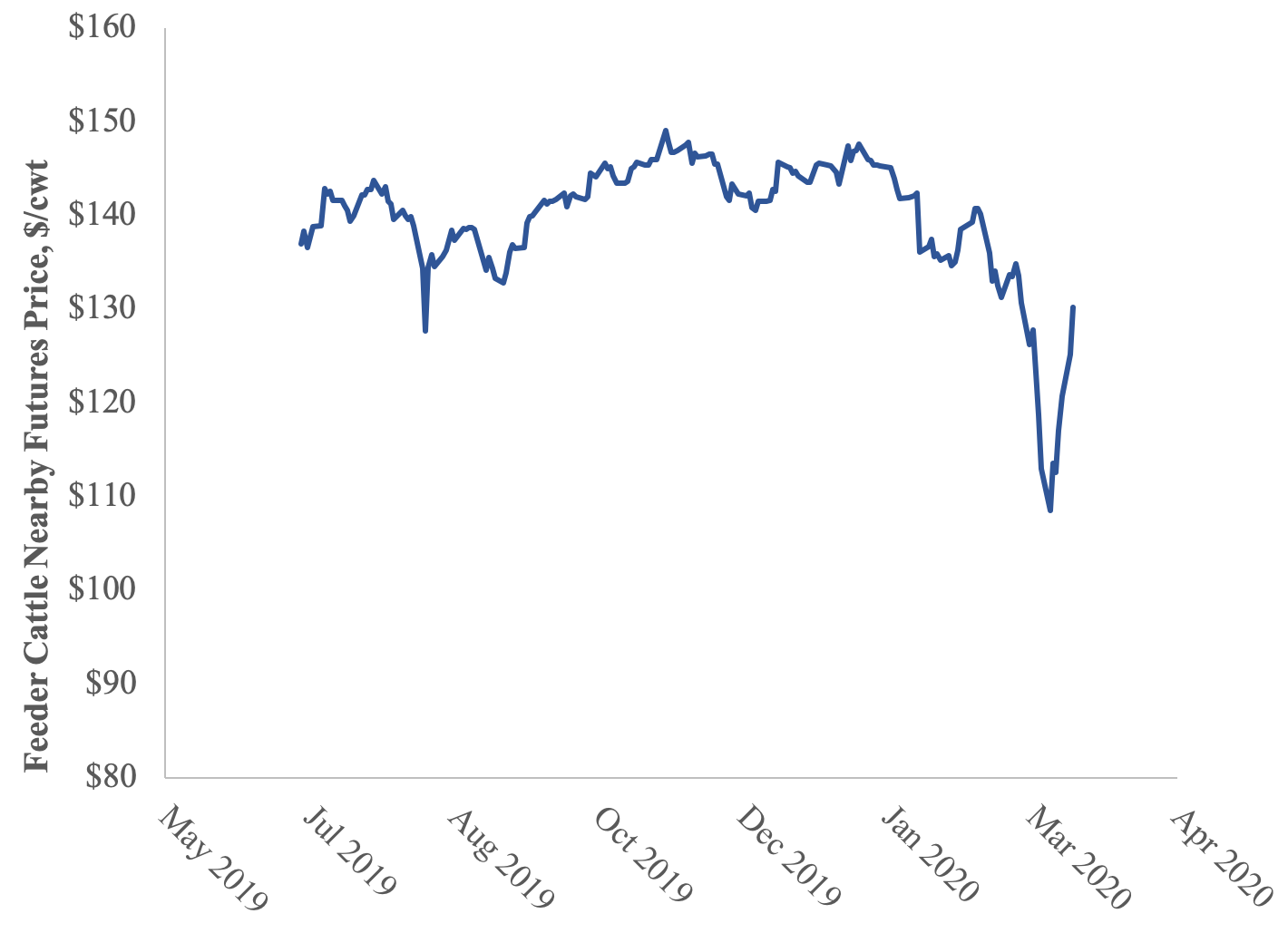

The past several weeks have been unusual and uncertain, to put it mildly. The COVID-19 public health emergency has affected economies across the globe, and are continuing to be a major factor in slowing down the U.S. economy and increasing volatility in the production agriculture sector. The figure below shows just how much volatility the feeder cattle market has endured over the past several weeks, with prices dropping by $25-$30 per hundredweight before bouncing back by the approximately the same amount over a span of 4-5 weeks.

Feeder Cattle Futures Prices, June 2019–March 2020

Despite the recent volatility and market uncertainty, there is generally a consensus that the U.S. and, most likely, global economies are headed for a recession, if they’re not already there. So what would be the potential impact on U.S. cattle markets?

The simple answer is: I don’t know and don’t believe anyone who is confident enough to say that they do. There are currently way too many unknowns to know how long the public health emergency is going to last, to what extent public policy will continue to limit social and economic activity, what will be the size of the economic impact, and how long will the recession last? But, despite these many unknowns, we can at least look at recent history to provide some clues and lessons about the possible impacts.

The last major recession occurred in 2008, known as the Great Recession. There are different ways to potentially assess what happened to U.S. cattle markets during this recession. One approach is to look at prices in the markets. However, prices reflect dynamics in both supply and demand components, making it difficult to understand recession impacts on consumers’ behaviors, which are going to be the primary drivers of market changes during broad economic downturns.

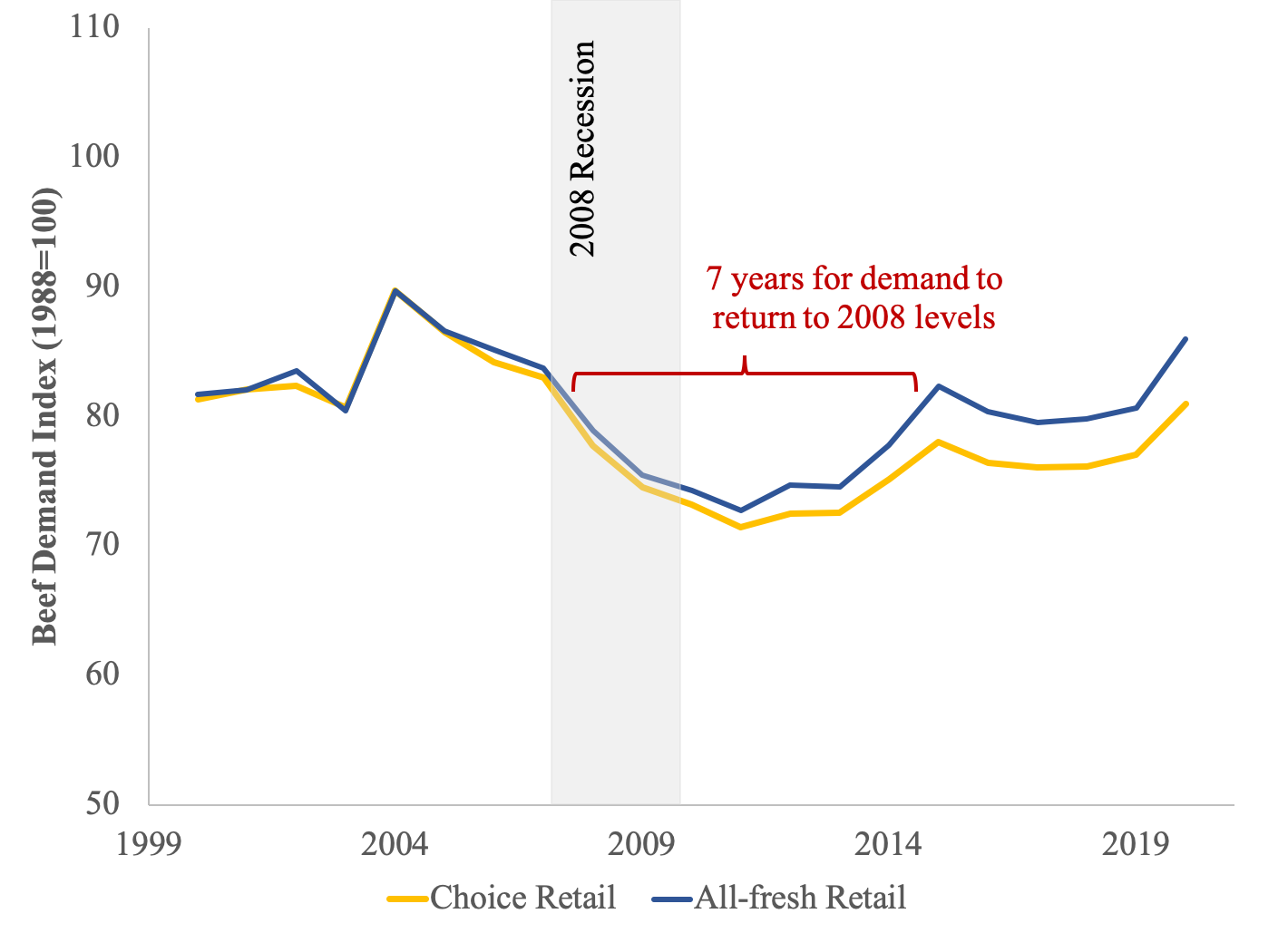

An alternative approach is to use demand indices, which attempt to separate demand-related changes from contemporaneous supply dynamics (my colleagues Dr. Gary Brester and Dr. Glynn Tonsor and I published a paper describing the methodology a few years ago). The figure below shows domestic retail demand indices for all fresh beef products and choice (higher quality) products between 2000 and 2020.

U.S. Beef Retail Demand Indices, 2000–2020

The figure shows that during and after the 2008 recession (which lasted about 18 months), both retail demand indices trended down for approximately 24-36 months, before beginning an upward trend in 2011. Additionally, it took approximately seven years before the all-fresh retail demand index recovered to its 2008 (pre-recession) level, and longer for the choice retail demand. The indices also provide some evidence that the recession had a relatively greater adverse impact on reducing demand for choice beef products.

Lower demand at the retail level ultimately trickles down to the processors, fed cattle, and feeder cattle markets, resulting in lower prices and decreased sales for producers. The impact on U.S. cattle markets recession sparked by the COVID-19 outbreak could have similar impacts as the 2008 recession, but the details and actual effects are unlikely to be known for a while. However, knowing how the U.S. beef markets were affected a decade ago is important to prepare cattle producers for a potentially extended period of depressed markets.

What are some strategies to manage these market risks? Again, given the market volatility and the many uncertainties, there’s no single right or wrong answer. However, here are some possible considerations.

- The Classic, Timeless Advise: Aggressive Information Tracking: knowing and revisiting the details of your production’s costs and breakeven scenarios is absolutely critical to understanding risk exposure. Additionally, because output markets have been so volatile and market dynamics so fluid, aggressively following market opportunities and taking advantage of them can mean the difference between being in the black or in the red.

- Using Futures or Options Markets: this is a market-based approach to locking in a price in order to ensure revenues that do not fall below a certain level. It’s important to note, however, that cattle markets have been getting thinner, with fewer contracts being traded. This can potentially increase volatility in those markets, leading to possibly higher and more unexpected margin calls (for futures contracts) and/or higher premiums for put or call options that are out-of-the-money. If an operation would like to pursue this management option, options may be the better choice, but knowing your operation’s breakeven cost is critical to lock in the optimal price and assess the trade-offs in paying option premiums relative to the benefit of protecting downside price risk.

- Livestock Risk Protection Insurance: the LRP is a subsidized market price risk management product that can provide downside risk protection for feeder cattle producers. Price guarantees are based on underlying futures prices and producers can elect coverage between 70 and 100%. Subsidy rates were increased a few years ago from 13% to 20–35% based on producers’ elected coverage levels. Producers can use LRP to insure up to 6,000 head of cattle per year.

What are you seeing in your neck of the woods? What risk management strategies are you considering and how are you evaluating trade offs of using one alternative to another?