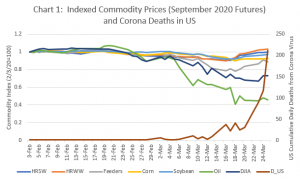

This analysis examines changes in September 2020 agricultural commodity futures prices (hard red spring wheat, hard red winter wheat, feeder cattle, corn, and soybeans), current oil prices, and current Dow Jones Industrial Average (DJIA) prices from February 3 through March 25 (see Chart 1). All futures and current prices are indexed to February 3; hence, this analysis examines changes in prices since February 3.

The US had no COVID-19 deaths reported until March 2, even though worldwide deaths exceeded 3,000 deaths by early March. Since March 2, corona virus related deaths in the US have increased from 6 to over 200 per day (See Chart 1 – red line).

By March 2, agricultural commodities prices had declined by less than 3%, while the DJIA and oil prices had declined by 6%. On March 2, Saudi Arabia announced their plans to increase oil production causing a rapid decline in oil prices. By March 10, agricultural commodity prices had declined by 5%, while oil prices had declined by 31% and the DJIA was down 12%. While commodity futures prices for wheat, corn, and soybeans trended somewhat lower; feeder cattle futures prices (down by 16%) followed dramatic declines in oil (down 55%) and the DJIA (down 32%) by March 20. By March 25, prices for winter and spring wheat were stable to slightly higher, soybean prices were 3% lower, feeder cattle prices were down by 11%, and corn prices were down 7%. While agricultural commodity prices had realized price declines of 11% or less; oil prices had declined by over 54% and the DJIA was down by 27%.

The downward pressure on commodity prices has been most pronounced for feeder cattle and corn prices. Since February 3, feeder cattle futures prices have dropped by 11%. Feeder cattle futures prices have moved lower partially based on fears the coronavirus will curb U.S. beef consumption by keeping consumers from eating away from home. In addition, there is some concern that meat packing facilities may face labor shortages due to the COVID-19. Corn prices have been pressured by lower demand for ethanol as gasoline consumption is expected to decline in the near term. Although, lower cattle and corn prices should translate in higher export sales over the next few weeks.

Help may be on the way! Agricultural producers will likely benefit directly from the stimulus package. The stimulus package would hike the annual borrowing authority for the Commodity Credit Corporation from $30 to $50 billion, which was the source of funds for the Market Facilitation Program.

CME Group was the source for commodity price data.

Wall Street Journal was the source for the Dow Jones Industrial Average.

Oil Prices Live was the source for light sweet crude oil prices.

Johns Hopkins Coronavirus Resource Center was the source for confirmations and deaths.