Earlier this year, there was much talk about the pulse crop boom in the Northern Great Plains. Lentil prices were at record highs on the strength of strong export demand, especially to India. Farmers planted record acres of lentils in 2016, including more than 500,000 here in Montana. Merchants opened and expanded processing facilities to take in the increase in pulse crop production.

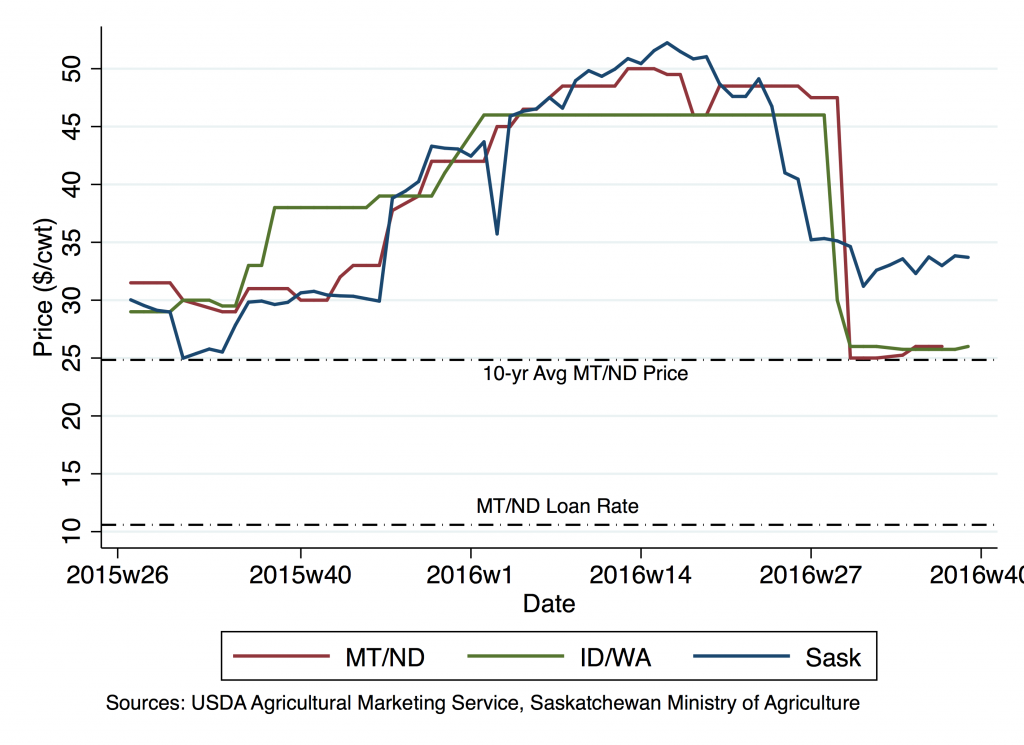

As the pulse crop harvest is wrapping up in Montana, it’s worth revisiting the lentil market situation. What’s happened to prices since the spring of 2016 and where might they be headed in 2017? To see, I’ve collected weekly reported medium green lentil prices for current delivery from July 2015 to present in the graph below. The three series represent prices for major North American growing areas of Montana/North Dakota, Idaho/Washington, and Saskatchewan. All prices are converted to US dollars per hundredweight (cwt).

Lentil prices fell dramatically in June and July in expectation of the 2016 harvest. This decline was in some ways expected. While cash prices in the spring were $45 to $50/cwt, as much as double today’s price, forward contract prices available to growers for harvest delivery were much closer to current cash prices. This is part of the natural seasonal pattern in crop prices – prices are generally lowest at harvest when supplies are relatively abundant. Lentil prices in each of the production regions appear strongly correlated, although Canadian bids appear slightly stronger at present when measured in US dollars.

Current lentil prices in Montana and North Dakota are close to the long-run (ten-year) average of approximately $25/cwt and well-above the price floor established by the Loan Deficiency Payment program loan rate of $10.59/cwt. The price decrease since spring has been dramatic, but the overall price level remains relatively high. Consider the wheat market, where demand is sluggish and prices are at ten-year lows. The size of the lentil price decrease in June and July reflected the market’s estimate of increases in North American acreage and production relative to demand. Even with record acres and average to above-average yields, lentil prices are fairly strong.

Indian production key to future price moves

Whether lentils remain a relative bright spot for Montana growers depends in large part on events outside the state. One major piece of upcoming market news concerns pulse production in India. The success of the summer or kharif pulse harvest and the expectation of an even bigger winter or rabi season pulse crop may lead to further price decreases in North America. Needed rainfall and government support have spurred acreage gains, leading some analysts to suggest India could reap a “monster crop” after two years of drought-induced shortfall.

We’ll have a better idea of the exact size of the Indian pulse crop in the coming months as India harvests its rabi pulses in about February. In the meantime, growers should be aware of the potential for further price declines and market remaining 2016 production accordingly. Prices are highly unlikely to return to their springtime highs in the near term. Growers should consider sales now to at the very least pay the bills for 2016 production costs.